14 Sites with Unpaid Daegum, 12 Sites Changing Payment Methods

Subcontractors with Weak Financial Structures Face Bankruptcy Risk if Cash Flow is Blocked

Subcontractor Payment Guarantees Show Low Effectiveness Despite Increased Performance

20 Small and Medium Construction Companies Reported Closure This Year

According to the workout of Taeyoung Construction, direct and indirect damages to partner companies have increased. In addition to Taeyoung Construction and its partners, the real estate project financing (PF) crisis has spread throughout the construction industry, leading to a surge in closure reports from small and medium-sized construction companies facing liquidity crises.

On the 24th, according to the Korea Specialty Contractors Association, an emergency damage survey was conducted targeting member companies performing subcontracted work after Taeyoung Construction filed for workout. Among the 104 sites that responded, 92 sites reported direct or indirect damages. There are 581 partner companies affected by Taeyoung Construction's workout, with 1,096 subcontract contracts.

92 Sites Suffer Delays in Payment and Changes in Payment Methods

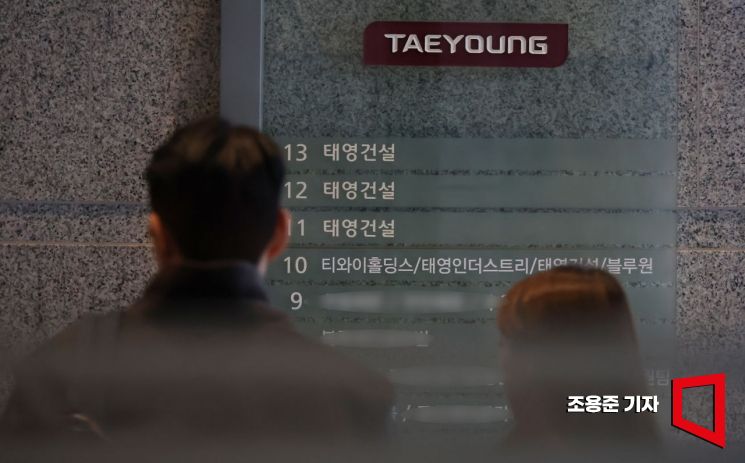

On the 11th, when the fate of Taeyoung Construction, which applied for a workout (corporate restructuring) after failing to repay real estate project financing (PF) loans worth about 9 trillion won, is decided, employees are arriving at Taeyoung Construction in Yeongdeungpo-gu, Seoul. Photo by Jo Yongjun jun21@

On the 11th, when the fate of Taeyoung Construction, which applied for a workout (corporate restructuring) after failing to repay real estate project financing (PF) loans worth about 9 trillion won, is decided, employees are arriving at Taeyoung Construction in Yeongdeungpo-gu, Seoul. Photo by Jo Yongjun jun21@

There were 14 sites where Taeyoung Construction did not pay the fees. The payment deadline for accounts receivable secured loans was extended from 60 days to 90 days at 50 sites. Twelve sites changed their payment methods to promissory notes or accounts receivable secured loans (ARS loans), and two sites switched to direct debit. Additionally, there were 14 other cases, such as sites where promissory note discounting was not possible. Subcontractors have weak financial structures, and if funds are not properly circulated for several months, they inevitably face bankruptcy.

The insolvency of large construction companies affects not only subcontractors but also material suppliers, equipment companies, and workers. Although the use of the "payment guarantee" system to protect subcontractors is increasing, differences in terms and ambiguous criteria among guarantee institutions may cause damages.

The performance of "subcontract payment guarantees" has increased significantly compared to three years ago. This is largely due to the abolition of exemption reasons for payment guarantees in 2020. The payment guarantee performance rose from KRW 6.3821 trillion in 2020 to KRW 43.7395 trillion in 2022, a 6.8-fold increase. The payment guarantee system is a system where the primary contractor guarantees payment of subcontract fees to subcontractors during the construction period. If the debt is not fulfilled, organizations such as the Construction Mutual Aid Association pay the guarantee amount.

Due to the low effectiveness of the subcontract payment guarantee system, contractors need to respond according to the timing of guarantee claims. The Korea Institute of Construction Policy explained, "If the principal contractor applies for the start of management procedures, the guarantee payment can be withheld for 30 days, so it is necessary to request guarantee payment or agree on direct debit before the start of management procedures. If the payment method for subcontract fees changes or the payment deadline is extended, it may be recognized as a significant change in the guarantee contract terms, so prior confirmation with the guarantee institution is required."

Guarantee creditors must inquire whether the workout constitutes a "guarantee accident," notify the fact within 15 days from the date of the guarantee accident, and claim guarantee debt fulfillment. After a guarantee accident occurs, construction costs incurred by the guarantee creditor continuing construction are not recognized as guarantee amounts, so construction must be stopped.

Dark Clouds Brought by the PF Crisis

Taeyoung Construction, which is experiencing a liquidity crisis due to real estate project financing (PF), has applied for a workout, and on the 5th, the construction site of Taeyoung Construction's Seongsu-dong development project located in Seongdong-gu, Seoul, has come to a halt. Photo by Jinhyung Kang aymsdream@

Taeyoung Construction, which is experiencing a liquidity crisis due to real estate project financing (PF), has applied for a workout, and on the 5th, the construction site of Taeyoung Construction's Seongsu-dong development project located in Seongdong-gu, Seoul, has come to a halt. Photo by Jinhyung Kang aymsdream@

The risk of PF insolvency, combined with interest rate hikes and rising raw material prices, is increasing cases of construction company closures and bankruptcies.

According to the Construction Industry Knowledge Information System on the 24th, 20 general construction companies have reported closures this year citing "business abandonment." Among them, Sion General Construction, based in Seoul, reported closure due to company bankruptcy. Last year, a total of 21 construction companies went bankrupt, a 50% increase of 7 companies compared to 2022. The number of construction industry closure reports increased by 23% to a total of 2,347 cases.

Not only Taeyoung Construction but also top construction companies are experiencing deteriorating financial soundness as net borrowings increase. The net borrowings/EBITA ratio, which measures the scale of net borrowings of the top 13 construction companies, rose from 0.2 times at the end of 2021 to 3.1 times in the third quarter of 2023. Cash flow in construction companies has declined, and net borrowing burdens have increased.

With housing market demand shrinking, supply is also being hit. Permitted construction volumes have sharply decreased, and projects such as sales are not progressing smoothly. As of November last year, housing permits decreased by 36.9% year-on-year, and in provincial areas, by 41.8%. Total construction orders from January to November last year amounted to KRW 154.7447 trillion, a 23% decrease compared to the same period the previous year (KRW 201.2031 trillion).

Cases of canceling sales have also emerged. Shimwoo Construction, an affiliate of Woomi Construction, canceled the project for "Incheon Gajeong 2 District B2 Block Woomirin," which had conducted pre-sale subscriptions in 2022. Although scheduled for occupancy in November next year, the main subscription has been repeatedly delayed, and the principal and interest have not been repaid to financial institutions.

Since last year, unsold housing units in provincial areas have exceeded 60,000, and subscription shortfalls are occurring frequently. From the 15th to 17th, only 24 people applied for 168 units at Gangneung U-Bless Recent, which held first and second priority subscriptions. From the 19th to 23rd, only 63 people applied for 134 units at Gwangju Eodeungsan Jinarichae Riverfield.

The Korea Institute of Construction Policy stated, "If guarantee accidents increase due to restructuring of large construction companies, the payment rate of construction-related mutual aid associations will rise, worsening the management of mutual aid associations and increasing guarantee fees, thereby expanding the financial cost burden across construction companies. To prevent capable subcontractors from going bankrupt despite profitability due to real estate PF insolvency, proactive responses from the government, related institutions, and construction companies are urgently required."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)