Taeyoung Construction Subcontract Payment Date Delayed from 60 to 90 Days

Cash Conversion Not Possible Before Maturity... Material Suppliers Face Liquidity Shortage

Suppliers of materials to Taeyoung Construction are facing a 'cash flow paralysis' crisis due to unpaid subcontracting payments. Taeyoung Construction, which has been paying subcontracting fees through accounts receivable secured loans (external receivables loans, or "oedamdae") instead of the usual electronic promissory notes, recently unilaterally extended the loan maturity dates and issued accounts receivable that cannot be discounted, pushing suppliers toward a liquidity cliff. In particular, unlike the current law that requires the primary contractor to pay subcontracting fees within 60 days, Taeyoung Construction has delayed payments up to 90 days. Since Taeyoung Construction’s suppliers also provide materials to other construction sites, there are growing concerns that the liquidity crisis could spread throughout the construction industry.

"Taeyoung Construction's oedamdae cannot be cashed... Worries over material costs and labor wages"

The construction site of youth housing in Sangbong-dong, Jungnang-gu, Seoul, where the framing process was halted due to wage arrears issues at Taeyoung Construction. / Photo by Yonhap News

The construction site of youth housing in Sangbong-dong, Jungnang-gu, Seoul, where the framing process was halted due to wage arrears issues at Taeyoung Construction. / Photo by Yonhap News

According to the construction industry on the 24th, Company A, which supplies materials to one of Taeyoung Construction’s sites, has not received about 500 million KRW in payments for November and December last year. Among these, the November oedamdae maturity schedule was extended by Taeyoung Construction from the original 60 days to 90 days based on the tax invoice date. As a result, Company A cannot cash the loan before maturity and must hold the receivables without securing funds until the end of next month.

An oedamdae is a payment method where a subcontractor borrows from a bank by using accounts receivable issued by the primary contractor as collateral (cashing it) to cover material costs, labor wages, and so on. The primary contractor pays the bank on the loan maturity date, and if the payment is delayed, it is treated as a loan delinquency. In cases where the oedamdae has a repayment claim, the bank can demand payment from the subcontractor. In other words, the subcontractor must repay the loan instead of the primary contractor. This differs from electronic promissory notes, which are treated as defaults if the primary contractor fails to meet the maturity date.

The representative of Company A said, "Usually, we receive oedamdae the month after delivery and discount it to cash it before maturity. But now, Taeyoung Construction is issuing oedamdae that cannot be discounted and has extended the maturity." He added, "To cash the November oedamdae, we have no choice but to wait until the end of February." He also said, "It will be the same for December. The oedamdae maturity will likely be set for March." He trailed off, saying, "While wage arrears for construction site workers are a problem, subcontractors supplying materials also have many families to support. Even if we manage January, from February onwards..." He said it was fortunate that the oedamdae does not have a repayment claim.

Taeyoung Construction has already experienced confusion such as wage arrears due to liquidity problems. Regarding this, a Taeyoung Group official said, "The wage issue for workers at the youth housing in Seongdong-gu, Seoul, occurred during the oedamdae payment process," and added, "If a workout is initiated, it will be prioritized for repayment."

Concerns over non-repayment of oedamdae... "Taeyoung must take primary responsibility"

Because Taeyoung Construction shifted the oedamdae to financial claims that only require payment of overdue interest, subcontractors are engulfed in disappointment and anxiety. If oedamdae were classified as commercial claims, payment would be immediate, but since they have been converted to financial claims, subcontractors must wait for negotiations between Taeyoung Construction and creditors. However, industry insiders agree that if subcontracting payments are delayed, it is the small subcontractors, not Taeyoung Construction, who face liquidity crises. Since Taeyoung Construction’s material suppliers also supply other construction companies, there is a high possibility that the liquidity crisis could spread to other sites. On December 29 last year, Taeyoung Construction failed to repay 45.1 billion KRW of oedamdae out of 148.5 billion KRW in commercial claims that matured.

Although subcontractors can receive payments later through the Construction Guarantee Association’s subcontracting payment guarantees, it is difficult for them to wait until then. The Guarantee Association emphasized that Taeyoung Construction must take responsibility and resolve the oedamdae issue before the second creditors’ meeting scheduled for April. An official said, "Taeyoung Construction must repay the oedamdae primarily. To achieve a successful workout, Taeyoung Construction must show efforts."

There are also claims that Taeyoung Construction violated the 'Subcontracting Act,' which requires primary contractors to pay subcontracting fees within 60 days. Since Taeyoung Construction extended the oedamdae maturity from 60 to 90 days, it is accused of violating 'fair trade.' Large construction companies mainly use electronic promissory notes with enforced payment, making their subcontracting payment systems safer, while Taeyoung Construction is criticized for arbitrarily using oedamdae. In fact, a representative of a major construction company said, "We have always dealt with subcontractors using electronic promissory notes. We have never used oedamdae."

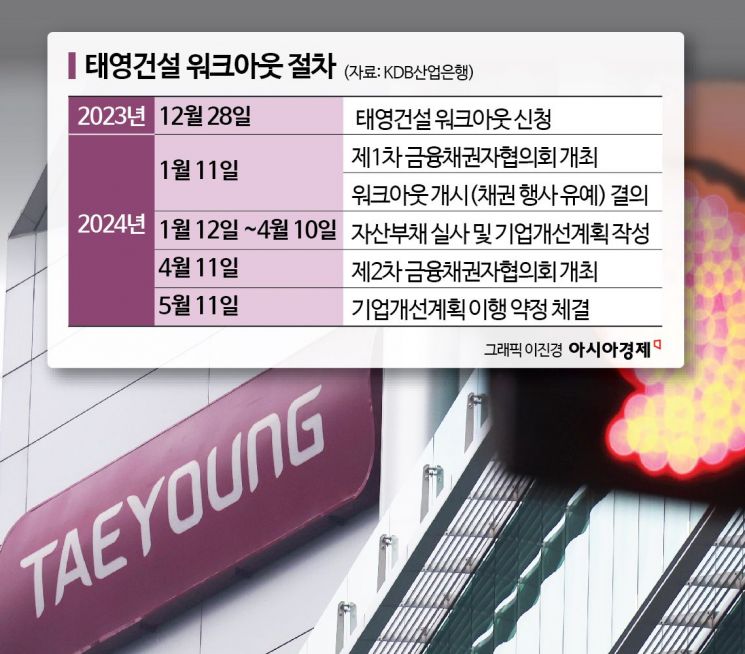

Meanwhile, KDB Industrial Bank, the main creditor bank, began due diligence on Taeyoung Construction’s assets through Samil Accounting Corporation on the 22nd. The due diligence team of about 30 people will inspect individual business sites over three months and then decide whether to maintain or liquidate the company. If it is concluded that Taeyoung Construction’s going concern value is low, the workout will be halted, and Taeyoung Construction may be liquidated or declared bankrupt.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.