Securing Liquidity Using Held Assets... Woori Bank Provides Support

Utilizing Alternative Funding Methods Amid Expansion of Corporate and Investment Finance Defaults

M Capital, facing difficulties in financing due to project financing (PF) defaults, has securitized loan and lease assets worth 150 billion KRW to secure cash. Woori Bank is expected to facilitate the financing by providing credit support.

According to the investment banking (IB) industry on the 24th, M Capital decided to securitize its assets with Hi Investment & Securities and KB Securities as lead managers. To this end, it sold 4,159 lease and installment receivables worth 150 billion KRW to a trust managed by Woori Bank. Woori Bank plans to issue trust beneficiary certificates to a special purpose company (SPC) and then reissue securitized securities backed by these assets. In this process, Woori Bank provided credit support up to 15 billion KRW. If bond repayments fail, Woori Bank will support the repayment of securitized securities within the credit support limit.

The securitized securities are divided into senior securities worth 100 billion KRW and subordinated securities worth 46 billion KRW according to repayment priority. The senior securities will be sold to institutional investors, while M Capital is expected to acquire the subordinated securities worth 46 billion KRW. When individual debtors who purchased medical devices, automobiles, etc., through leases or installments repay their debts to M Capital, these repayments will be primarily used as funds to repay the securitized securities.

M Capital is pursuing asset securitization in this way because financing through capital bonds has become difficult due to concerns over PF defaults. Credit rating agencies downgraded the credit outlooks of M Capital (credit rating A-) as well as OK Capital (BBB+) and DB Capital (BBB) at the end of last year and early this year. M Capital and DB Capital’s outlooks were changed from ‘positive’ to ‘stable,’ while OK Capital’s was changed from ‘stable’ to ‘negative.’

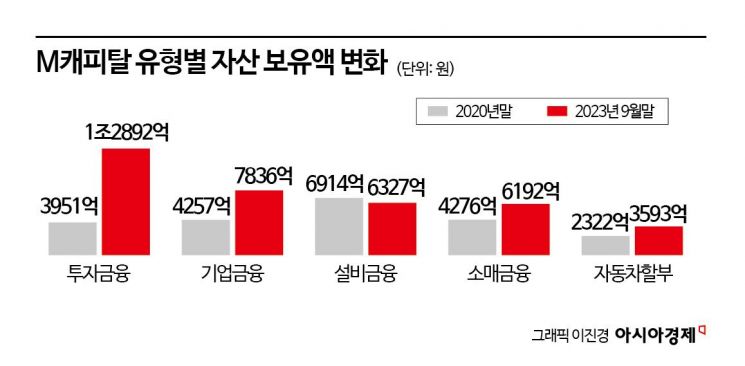

These capital companies share common characteristics of having many PF and corporate finance assets and increasing concerns about defaults. After being acquired by a private equity fund (PEF) invested by Saemaeul Geumgo, M Capital significantly increased its investment finance assets, including PF. Investment finance assets rose from 395.1 billion KRW at the end of 2020 to 1.2892 trillion KRW by the end of September last year, and corporate finance assets increased from 425.7 billion KRW to 783.6 billion KRW during the same period.

In particular, the likelihood of PF defaults is increasing. As of the end of September last year, M Capital’s real estate finance totaled 691.7 billion KRW, accounting for 18.5% of total operating assets. Among these, PF loans, including bridge loans of 131.1 billion KRW provided for construction development projects, reached 595.9 billion KRW. Including about 100 billion KRW of bridge loans classified as secured loans, total bridge loans increase to 231.1 billion KRW.

The non-performing loan (NPL) ratio for loans overdue more than three months is 1.7%, which is not high. The sale of the troubled Huland Industrial Development site and recovery of other bad debts have been made. However, as of the end of September last year, the ratio of loans overdue between one and three months increased to 21.6%. This is due to delayed repayments by developers of projects such as the 41 billion KRW bridge loan for a mixed-use complex in Cheongdam-dong, Seoul, and the 25.9 billion KRW PF for a mixed-use complex in Dong-gu, Busan. As the delinquency period lengthens, the ratio of bad debts is likely to increase.

Because of this, M Capital’s financing ability has weakened. M Capital has not issued capital bonds through public offerings this year. Earlier this year, it issued 20 billion KRW of private bonds with Kyobo Securities as the lead manager. An IB industry official said, "Due to concerns over expanding PF defaults, public financing is difficult. It is necessary to secure operating funds or debt repayment funds by using alternative financing methods such as asset sales or securitization." The official added, "As PF defaults increase in the financial sector, this type of financing is increasing and is expected to continue to grow."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)