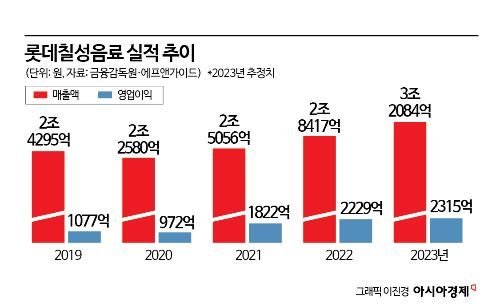

Last Year's Sales Expected at 3.2084 Trillion Won

Zero-Calorie Drinks and Soju Drive Performance Together

Beer Slump Remains a Challenge... Interest Grows in 'Crush' Results

Lotte Chilsung Beverage is expected to join the 3 trillion KRW sales club for the first time in the domestic beverage industry, thanks to the strong performance of 'Zero' and 'Saero'. With new products such as 'Milkis Zero' being launched one after another, surpassing half of the zero-calorie beverage market share, the zero-sugar soju 'Saero', which marked its first anniversary, also continued its smooth progress, adding strength.

According to financial information company FnGuide on the 24th, Lotte Chilsung Beverage's sales last year are estimated to have increased by 12.9% to 3.2084 trillion KRW from 2.8417 trillion KRW a year earlier. Operating profit during the same period is expected to rise 3.9% to 231.5 billion KRW.

Last year, Lotte Chilsung reportedly maintained a favorable growth trend in both beverage and liquor businesses. In the beverage business, it led the 'zero-calorie' market. Having officially entered the zero beverage market in 2021 with the launch of 'Chilsung Cider Zero' and 'Pepsi Cola Zero', Lotte Chilsung expanded its zero lineup in 2022 with 'Toms Zero', 'Hot6 Zero', and 'Ceylon Tea Zero', and introduced various new products such as Milkis Zero last year.

With the expansion of the zero-sugar product lineup and strong sales, Lotte Chilsung's zero products exceeded 200 billion KRW in sales by the third quarter, raising the market share to over 50%. In particular, Milkis Zero achieved cumulative sales of 26 million cans within five months of its launch, exceeding expectations and laying the foundation for 'Milkis' to grow into a single brand with annual sales of 100 billion KRW for the first time in 34 years since its launch in 1989.

In the liquor business, the remarkable progress of Saero soju made with the 'zero sugar' method stood out. Saero, launched in September 2022, achieved cumulative sales of 100 million bottles in seven months and surpassed 100 billion KRW in cumulative sales within a year, smoothly landing in the market. As a result, Lotte Chilsung's domestic soju market share, which was around 16% at the beginning of 2022, rose by about 5 percentage points to 21% as of the third quarter last year. Thanks to Saero's success, soju business sales also increased by 27.9% year-on-year to 254.6 billion KRW by the third quarter.

However, the sluggish beer business is a disappointing point. 'Kloud' has struggled for years to make a presence amid the duopoly of OB Beer and Hite Jinro in the domestic beer market. Last year, cumulative sales until the third quarter amounted to only 60 billion KRW, down 22.7% from the same period the previous year, and the manufacturer's share in the retail market was only 4.5%. During the same period, Kloud ranked behind 'Cass', 'Terra', and even 'Asahi' in brand sales rankings.

In November last year, Lotte Chilsung launched a new beer product, 'Crush', for the first time in about three years since 'Kloud Saeng Draft', signaling a counterattack. Despite aggressive marketing efforts to promote Crush, early results have been generally considered below expectations. When doubts were raised about the initial performance, Lotte Chilsung quickly decided to expand the lineup with a 330ml can product. They believe that relying solely on the 500ml bottle product, mainly consumed in entertainment channels, limits brand awareness and sales expansion, so they plan to compete with can products preferred in the home-use channel.

With attention focused on whether Crush will settle in the market, the liquor business division is expected to continue leading Lotte Chilsung's growth this year by improving profitability. Soju prices were raised this month (Chum-Churum by 6.8%, Saero by 8.9%), and since Crush's price is set higher than the existing Kloud products, it is expected to enjoy the effect of a real price increase.

The beverage business is also expected to drive division growth as zero-calorie carbonated drinks increase their market share. Lee Kyung-shin, a researcher at Hi Investment & Securities, said, "Lotte Chilsung is proactively expanding the zero beverage market by adding new products in carbonated drinks, energy drinks, and teas," and predicted, "This year, external growth based on the expansion of zero products' market dominance will continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)