Companies Temporarily Halting IPOs Reduce Losses

Knocking on the Door of Listing Again Based on Improved Performance

E-commerce companies that pursued initial public offerings (IPOs) significantly improved their profitability last year. This improvement is attributed to tightening their belts by abandoning expansion efforts and cutting unnecessary expenses. Going forward, these companies are expected to knock on the door of the stock market again based on their improved performance.

Stopping Expansion... Companies Strengthening Fundamentals

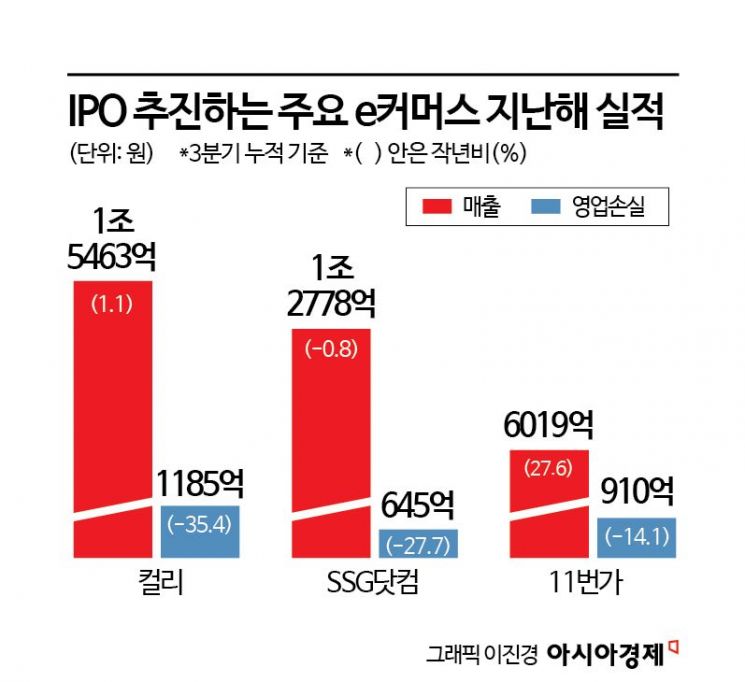

According to the industry on the 24th, Curly's cumulative operating loss for the first three quarters of last year was 118.5 billion KRW, down 35.4% from 183.6 billion KRW in the same period the previous year. In December last year, for the first time in nine years since the company's establishment, it achieved positive earnings before interest, taxes, depreciation, and amortization (EBITDA). Accordingly, the operating loss for the fourth quarter is also expected to shrink significantly. Curly explained that this is the result of structural cost improvements, meaning they have started to generate money through operating activities.

SSG.com also saw its cumulative operating loss during the same period decrease by 27.7% to 64.5 billion KRW from 89.3 billion KRW the previous year. While the market expects SSG.com's fourth-quarter results to show a larger deficit than the previous year, the dominant view is that the annual operating loss ratio will improve. SSG.com evaluates this as "a result reflecting a balanced growth strategy encompassing both growth and profitability."

11st is also gradually reducing its losses by actively working on improving its deficit structure. Its operating loss until the third quarter last year was 91 billion KRW, down 14.1% (15 billion KRW) from the same period the previous year. 11st expects record-high sales in the fourth quarter, following the 'Grand 11th Day,' the largest shopping event of the year held in November, and an increase in the use of its next-day delivery service, Shooting Delivery.

These companies had continued to expand their size as the e-commerce market grew during the COVID-19 period. However, they are now focusing on strengthening their fundamentals ahead of going public. In fact, Curly focused on reducing various costs such as marketing and selling expenses last year, and SSG.com also shifted its strategy from sales growth to profitability improvement. The negative sales growth last year is analyzed as a result of this strategic shift.

Ahn Jung-eun, CEO of 11st. On the 11th, CEO Ahn declared the "first year of performance turnaround" at this year's first town hall meeting held at the 11st headquarters located in Seoul Square, Jung-gu, Seoul.

Ahn Jung-eun, CEO of 11st. On the 11th, CEO Ahn declared the "first year of performance turnaround" at this year's first town hall meeting held at the 11st headquarters located in Seoul Square, Jung-gu, Seoul. [Photo by 11st]

Resumption of IPO Moves Expected to Gain Momentum

The industry expects this profitability-centered management approach to continue for the time being. As the growth of the e-commerce market has somewhat slowed recently, investors are placing more importance on profitability rather than sales. This aligns with the declaration by An Jung, CEO of 11st, at this year's first town hall meeting, calling it the "first year of performance turnaround."

The postponed IPO procedures are also expected to be concretized again. These companies had been reluctant to pursue IPOs, citing that their corporate value was not properly evaluated due to high interest rates and economic downturns. However, with clear improvements such as reduced deficits and turning profitable, it is anticipated that IPO moves will accelerate.

Previously, Curly filed for preliminary review for listing on the Korea Exchange in March 2022 and passed the review in August of the same year but temporarily halted its listing efforts in January last year. SSG.com officially announced its IPO plans in the first half of 2022 after selecting Mirae Asset Securities and Citigroup Global Markets Securities as IPO underwriters in October 2021 but later withdrew. An industry insider said, "Going public is one of the top goals for these companies," adding, "They are focusing on stabilizing profits while monitoring the IPO market situation."

11st, which is undergoing forced sale procedures, is also looking for opportunities to resume its IPO. When the financial investor (FI) Nile Holdings consortium invested in 11st in 2018, they set a condition to complete an IPO within five years. Failure to do so has left 11st in a difficult position. A 11st official stated, "Apart from the forced sale, pursuing an IPO is a long-term goal we are working on," and emphasized, "There are no plans to withdraw."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.