January Semiconductor ETF Fund Inflows Surpass Last Year's Monthly Record

Optimism Grows on Industry Improvement and AI Momentum

Despite the sluggish stock market this year, money has been flowing into semiconductor-related stocks and funds. With ongoing expectations for an improvement in the semiconductor industry this year, recent positive issues such as TSMC's strong earnings and artificial intelligence (AI) optimism have attracted investors to semiconductors.

According to the Korea Exchange on the 24th, semiconductor-related ETFs dominated the list of estimated fund inflows among exchange-traded funds (ETFs) up to the 22nd of this year. Estimated fund inflow refers to the sum of the daily number of shares issued multiplied by the previous day's net asset value (NAV) of the respective ETF during the period. TIGER Fn Semiconductor TOP10 saw an inflow of 182.36211 billion KRW, TIGER U.S. Philadelphia Semiconductor Nasdaq 38.94503 billion KRW, TIGER Semiconductor 33.99610 billion KRW, SOL Semiconductor Materials Fn 33.39810 billion KRW, HANARO Fn K-Semiconductor 32.29223 billion KRW, and KODEX AI Semiconductor Core Equipment 31.62361 billion KRW, all ranking high in estimated fund inflows.

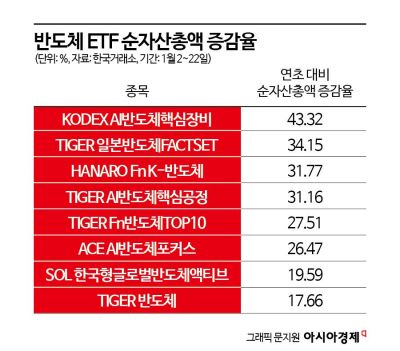

The total net assets of semiconductor ETFs also increased. As of the 22nd, KODEX AI Semiconductor Core Equipment's total net assets rose 43.32% compared to the beginning of the year, TIGER Japan Semiconductor FACTSET increased by 34.15%, HANARO Fn K-Semiconductor by 31.77%, TIGER AI Semiconductor Core Process by 31.16%, and TIGER Fn Semiconductor TOP10 by 27.51%.

Although January is not over yet, the monthly fund inflow scale for semiconductor-related ETFs this month has already surpassed last year's monthly maximum level. Kim Hoo-jung, a researcher at Yuanta Securities, said, "As of the 19th, the fund inflow into semiconductor-related funds reached 351.2 billion KRW," adding, "The three-week figure already exceeds last year's maximum monthly fund inflow for semiconductor-related ETFs."

Researcher Kwon Byung-jae of Hanwha Investment & Securities said, "While the domestic stock market showed weakness due to diminished expectations for U.S. interest rate cuts, stock ETFs saw fund inflows centered on semiconductors," and added, "Fund inflows into semiconductor ETFs will continue due to expectations for AI chip demand."

Foreigners and individuals have also been buying in the stock market. Up to the 22nd of this year, both foreigners and individuals ranked Samsung Electronics as their most net-purchased stock. Foreigners net-purchased Samsung Electronics worth 2.0213 trillion KRW, and individuals bought 1.2104 trillion KRW. Individuals also net-purchased SK Hynix worth 193.6 billion KRW.

The fund inflow into semiconductors appears to be driven by TSMC's strong earnings announcement and AI optimism. TSMC announced its Q4 earnings for last year on the 18th, with sales and net profit exceeding market expectations. Along with strong earnings, TSMC forecasted a 20% increase in sales this year due to AI demand, boosting expectations for industry improvement. Researcher Kim said, "In the second half of last year, semiconductor-related funds actively launched ETFs focused on materials, AI, and value chains, and since the beginning of the year, semiconductor ETFs have attracted great interest due to expectations for industry improvement and AI momentum."

As funds pour into semiconductor-related funds and stocks, attention is also focused on SK Hynix's Q4 earnings for last year, which will be announced on the 25th. The market expects SK Hynix to change the gloomy earnings season atmosphere as major companies have consecutively reported disappointing results. According to financial information provider FnGuide, the consensus for SK Hynix's Q4 earnings (average securities firm forecast) is sales of 10.4696 trillion KRW and an operating loss of 51.5 billion KRW, but there are expectations for a return to profitability. Kim Un-ho, a researcher at IBK Investment & Securities, said, "SK Hynix's Q4 sales are expected to increase 17.2% from the previous quarter to 10.6 trillion KRW, and operating profit is expected to turn positive to 298 billion KRW compared to the previous quarter," adding, "The improvement in operating profit is expected to continue this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.