Focus on reducing profits and expanding sales volume

Price cuts of up to around 10%

Increasing market share in global markets

A form of investment for SW development

There is an interpretation that Tesla's recent aggressive price reduction policy is a strategy to secure competitiveness in autonomous driving. The judgment is that lowering prices to increase sales volume, even at the expense of immediate profits, helps in acquiring extensive autonomous driving data. Tesla once surprised the automotive industry with an annual operating profit margin approaching 20%, but recently it has been focusing on expanding sales volume rather than increasing profits.

According to the industry on the 23rd, Tesla sold 1,808,581 electric vehicles worldwide last year. This is a 37% increase compared to 1.31 million units in 2022. Despite the recent slowdown in electric vehicle demand, Tesla's sales growth rate last year exceeded the global electric vehicle market growth rate of 26%.

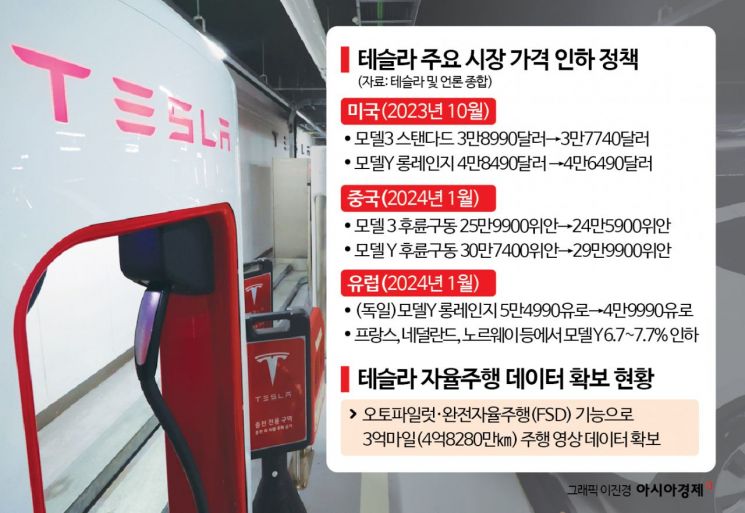

The secret to Tesla's sales growth of over 30% annually is price cuts. By lowering prices by as little as 3% and up to around 10%, Tesla increased its market share in various global markets. Since early last year, Tesla has implemented several price cuts in the US and China, and this year, starting with China, it has drastically lowered prices of major models in Europe, including Germany and France.

From a simple perspective, this strategy can be interpreted as a move to maintain the number one market share. It is a defensive strategy to counter the rapid rise of emerging competitors like China's BYD.

However, the interpretation changes when viewing Tesla not as a traditional automaker but as a software (SW) company. Tesla's price cuts are a form of investment in software development. Although the revenue from vehicle sales decreases due to lower prices, the reduced profits are equivalent to purchasing autonomous driving data. The more Tesla vehicles are on the road worldwide, the higher the completeness of its autonomous driving technology.

Tesla has already secured driving video data amounting to 300 million miles (482.8 million km) through its autonomous driving assistance software, Autopilot, and Full Self-Driving (FSD) features. Tesla vehicles send driving information to Tesla in real-time even when autonomous driving assistance features are turned off. The accumulated data is continuously stored and learned by an AI supercomputer called ‘Dojo’.

Traditional automakers such as Hyundai Motor Company & Kia, Toyota, GM, and Volkswagen, who have announced transitions to software-defined vehicles (SDV), are also investing heavily in software, which poses a challenge to Tesla. Hyundai Motor Company & Kia are developing a new SDV platform aimed at mass production in 2026. Once all models become SDVs in two years, over 7 million vehicles will simultaneously roam various parts of the world, collecting new data. This means a ‘quantum leap’ in data collection is possible. For this reason, Tesla is focusing on increasing sales volume to maintain the current gap in software development.

Another reason for Tesla's price reduction strategy is confidence that losses can be recovered at once by launching competitive software. Tesla can endure a temporary decline in profitability. The industry expects the official commercialization of Tesla’s latest FSD version, V12, to be imminent. V12, equipped with pure AI driving capabilities, allows AI to judge and drive through numerous variables on the road.

Samsung Securities estimates the development cost of Tesla FSD at only $2,675 (approximately 3.6 million KRW). However, the option sales price reaches $12,000 (approximately 16 million KRW). The gross profit margin relative to sales is 78%. The structure is such that profits increase exponentially as sales occur. Researcher Im Eun-young of Samsung Securities said, "Once FSD V12 is commercialized, licensing revenue can also be expected by supplying software to other automakers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)