Increase in Overseas Orders Amid Construction Market Slump

As of Q3 Last Year, Annual Orders in 2021 and 2022 Far Surpassed

Last Year's Middle East and North Africa Orders Hit Highest Since 2017

Concerns Over Low-Price Orders Nightmare from MB Government Era as Construction Costs Rise

As the domestic construction industry faces a severe downturn, major construction companies are expanding their overseas territories. Hyundai Engineering & Construction, Hyundai Engineering, Samsung C&T, and Daewoo Engineering & Construction are standing out in overseas oil and gas fields and plant markets, with forecasts suggesting they will achieve record-breaking order volumes this year. However, there are warnings that the worsening domestic construction market could negatively impact overseas orders or lead to low-price bids due to cutthroat competition.

Plant, Gas Field, and Infrastructure Orders Ahead

According to industry sources on the 23rd, domestic construction companies are scrambling to secure their first overseas orders. Daewoo Engineering & Construction is on the verge of securing an ammonia and urea plant order worth 3 trillion won in Turkmenistan, Central Asia. A Daewoo E&C official said, "Only the cabinet approval process remains," adding, "This single project is larger than Daewoo E&C's total overseas orders last year."

Hyundai Engineering & Construction is highly optimistic about securing a large-scale gas field order in the Middle East during the first quarter of this year. A Hyundai E&C official stated, "We have bid for the contract to build onshore infrastructure worth $3.6 billion (approximately 4.82 trillion won) at the Safaniya oil field, commissioned by Saudi Arabia's state-owned oil company Aramco, and are awaiting the results." The Saudi Ruwais liquefied natural gas (LNG) project, valued at $4.5 billion (about 6.03 trillion won), will also announce its bidding results in the first quarter.

Samsung C&T may secure orders not only for Middle Eastern plants but also for the Saudi Neom City project. Lee Sang-heon, a researcher at Hi Investment & Securities, explained in a report on the 22nd, "Samsung C&T is currently working on the underground tunnel construction in Neom City, handling 28 km out of the total 170 km of tunnels," adding, "The remaining 150 km section is expected to be ordered soon, so infrastructure-related orders for Neom City will accelerate starting this year." The researcher also suggested that Samsung C&T might secure large-scale modular housing orders in Neom City and Riyadh, the capital of Saudi Arabia.

This Year’s Overseas Order Performance Expected to Surpass Last Year’s

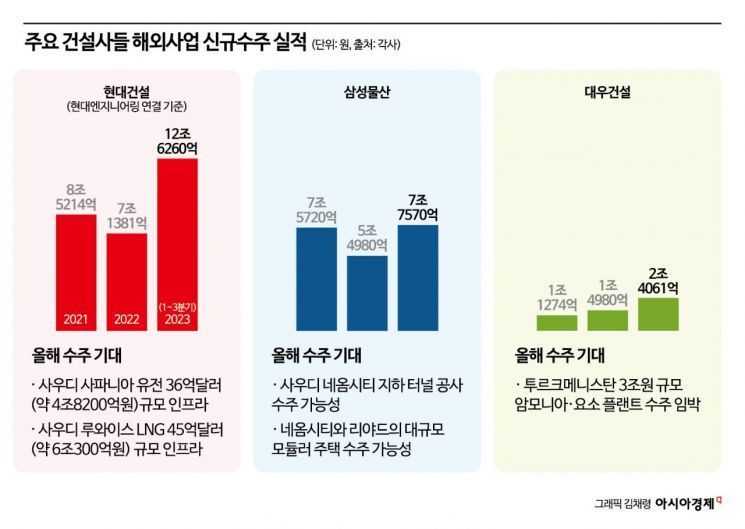

Recently, overseas construction order volumes have shown gradual improvement. The overseas business order volume from the first to third quarters last year far exceeded the annual order volumes of the previous two years. Hyundai Engineering & Construction's order volume was recorded at 12.626 trillion won by the third quarter of last year, significantly surpassing 7.1381 trillion won in 2022 and 8.5214 trillion won in 2021. Samsung C&T also recorded 7.757 trillion won, exceeding 5.498 trillion won in 2022 and 7.572 trillion won in 2021. Daewoo E&C's order volume from the first to third quarters last year was 2.4061 trillion won, greatly surpassing 1.7745 trillion won in 2022 and 1.1274 trillion won in 2021.

An industry insider said, "The proportion of overseas business in total sales reached about 50% for Samsung C&T and 40% for Hyundai Engineering & Construction last year," adding, "As the domestic construction market stagnates, the share of overseas business is increasing."

There is also analysis that Korean companies’ orders in the Middle East and North Africa reached $22.6 billion last year, the highest since 2017. Park Sera, a researcher at Shin Young Securities, said, "Last year, Korean companies’ order volume in the Middle East and North Africa was the highest since $24 billion in 2014," adding, "The scale of projects scheduled for bidding in this region this year is $270 billion, up from $230 billion last year, so Korean construction companies are expected to set new records in order volumes this year."

However, some voices caution against low-price overseas orders. A representative from a major construction company said, "During the Lee Myung-bak administration, as the domestic construction market weakened, many companies expanded overseas and Korean construction firms swept up petrochemical plant orders in the Middle East," adding, "However, the cost burden of these orders became enormous, leading construction companies to take big bath accounting (a method of recognizing large losses in a specific quarter)." Since it takes time to determine whether orders are low-priced, it is advised to be cautious about losses when entering bids or negotiating contracts.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)