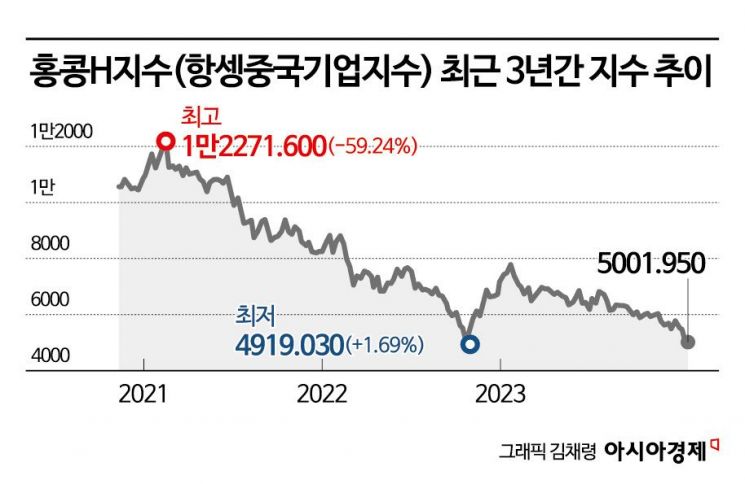

Massive Issuance of Hong Kong H-Index ELS 3 Years Ago

Index Decline... 44% Compared to January 2021

Domestic Principal Loss Expected to Approach 6 Trillion in First Half of the Year

The Hong Kong H Index (Hang Seng China Enterprises Index) fell below the psychological threshold of 5000 during trading on the 22nd. As the maturity of equity-linked securities (ELS) products, which were massively issued three years ago based on this underlying asset, approaches like a time bomb, the total principal loss for investors in the first half of this year is expected to approach 6 trillion won.

The Hong Kong H Index closed at 5001.95, down 2.44% from the previous session. During the day, it dropped to a low of 4943.24, breaking below the 5000 level. The index is close to its lowest level since 2005. Bloomberg reported that foreign institutional investors who had bet on the Hong Kong H Index are adjusting their portfolios to other regions within Asia, including Japan. Shin Seung-woong, a China stock strategy analyst at Shinhan Investment Corp., explained, "The 5000 level corresponds to a price-to-book ratio (PBR) of 0.65, which acted as a support level during the record plunge at the 2022 Party Congress," adding, "It is a support line considering the worst-case scenario."

The market interprets this as the result of intertwined negative domestic and external factors. The Hong Kong stock market follows the trend of the Chinese stock market but reacts sensitively to external factors such as the US base interest rate, creating a unique structure. There are forecasts that China's growth rate will slow to around 4.4?4.7% amid the absence of government stimulus measures. Poor investment performance in the Chinese stock market compared to the US stock market, which competes for global liquidity, has also led to foreign investor outflows. On the 22nd (local time), the US Dow Jones Industrial Average broke through 38,000 for the first time, and the US S&P 500 index has been on a rising rally since the beginning of the year. Global credit rating agencies such as Moody's downgraded China's long-term sovereign bond rating outlook from 'stable' to 'negative' in December last year, which also had an impact. Sovereign bond ratings are essentially national credit ratings. Moody's pointed out excessive debt of Chinese local governments and state-owned enterprises.

The problem lies in the high exposure of domestic investors to ELS products based on the Hong Kong H Index. ELS are typically derivative-linked securities with a three-year maturity that seek returns based on the prices of one to three underlying assets. Most ELS products maturing as of January 2024 were issued in January 2021, three years ago. According to Yuanta Securities, the average Hong Kong H Index in January 2021 was 11,339. The current H Index is around 5000, which is 44% of the base price. This is much lower than the 65?70% maturity repayment barrier of the products, making principal loss at maturity inevitable. Due to the nature of ELS products where the principal loss rate is calculated based on the index difference, the principal loss rate is estimated to reach 56%. The structure means that the larger the decline in the Hong Kong H Index at the beginning of the year, the greater the principal loss. According to the Financial Supervisory Service, as of November 15 last year, the outstanding sales balance of Hong Kong H Index ELS was 19.3 trillion won, of which 80%, or 15.4 trillion won, will mature this year. About 10 trillion won worth of maturities will come due in the first half of this year. Applying the estimated 56% principal loss rate from January, a simple calculation suggests that principal losses exceeding 5.6 trillion won could occur. Since the peak of the Hong Kong H Index was 12,271.6 in February 2021, a similar situation is expected to continue next month unless the index rebounds.

By industry, banks, which actively sold ELS in the retail sector, are suffering the most damage. Based on ELS outstanding balances, the sales ratio between banks and securities firms is 80 to 20. The confirmed loss amount for investors in the five major banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?due to Hong Kong ELS is estimated to be close to 230 billion won. Securities firms such as Korea Investment & Securities and Mirae Asset Securities are also confirming loss rates. However, the securities industry explains that their scale is not as large as banks and that most sales were conducted online through mobile trading services (MTS) and home trading services (HTS). They are expected to be relatively free from controversies over incomplete sales compared to banks. The Financial Supervisory Service is conducting on-site inspections to determine whether there were any procedural issues such as incomplete sales across banks and securities firms. The inspection results are expected to be announced around February to March.

The market diagnosis is that a rebound in the Hong Kong stock market is a prerequisite. A representative from a major securities firm said, "Unless a clear rebound momentum in China is confirmed, securities firms find it difficult to confidently present a 'buy' house view," adding, "Typically, the US and Chinese stock prices move inversely, but since the US stock market continues to be positive, it is difficult to even estimate where the bottom of the Hong Kong stock market currently is."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)