Hankyung Research Survey, Next Month BSI Forecast 92.3

Business Sentiment Index Below 100 Indicates 'Negative'

All Sectors Below 17-Month Standard, 'Funding Conditions' Most Problematic

"Urgent Financial Support Needed" Voices

Domestic companies have been forecasting that the Korean economy will not improve for nearly two years. This is interpreted as a prolonged sense of economic recession due to poor corporate performance, leading to a pessimistic outlook on the future economy. Industry insiders and experts have pointed out the need for extraordinary financial support measures.

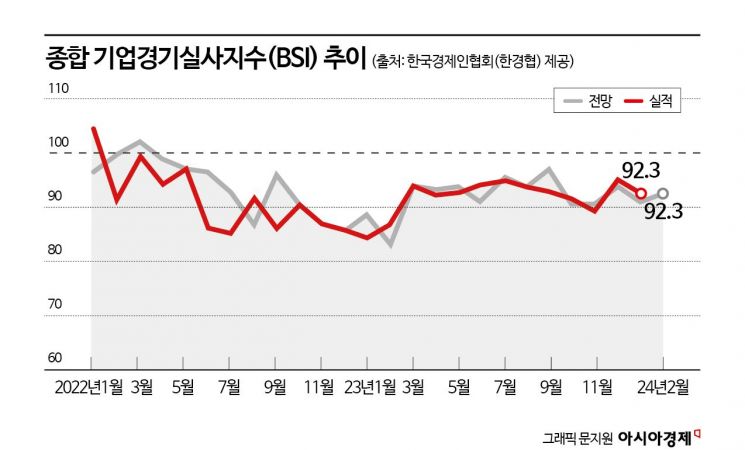

The Korea Economic Association (HanKyungHyup) conducted a Business Survey Index (BSI) targeting the top 600 companies by sales, and the BSI forecast for February 2024 recorded 92.3.

The BSI reflects the perceived economic condition by companies; a value below the baseline of 100 means more companies expect economic deterioration, while a value above 100 means more companies expect improvement.

The BSI forecast has not exceeded 100 for 1 year and 11 months since April 2022 (99.1). This is the longest record since February 2021. Previously, the BSI forecast was below the baseline of 100 for 33 consecutive months from June 2018 to February 2021. The actual BSI for this month also recorded 92.3, marking 24 consecutive months below 100 since February 2022 (91.5). This is analyzed as a sign that corporate performance deterioration is becoming prolonged.

Even when divided by industry, the BSI forecasts were all low. In the February BSI forecast, manufacturing was 91.7 and non-manufacturing was 92.9, both below 100. Non-manufacturing has declined for two consecutive months, recording 100.5 in December last year and 95.2 last month. Manufacturing has been below the baseline for 1 year and 11 months since April 2022 (94.8).

Among manufacturing sub-sectors, only non-metallic materials and products (110) were expected to show favorable conditions. In contrast, three sectors (food and beverages & tobacco, petroleum refining & chemicals, automobiles & other transportation equipment) hovered around the baseline of 100, while the remaining six sectors, including general & precision machinery and equipment, electronics & telecommunications equipment, forecasted sluggish business conditions.

Among the seven non-manufacturing sub-sectors, leisure, accommodation, and dining (114.3), which are expected to benefit from holiday demand, information and communications (105.9), and electricity, gas, and water supply (105.6) were forecasted positively. Wholesale & retail (94.4), transportation & warehousing (91.7), professional scientific & technical services and business support services (84.6), and construction (76.2) were below 100.

The forecast of recession across all sectors has continued for 17 consecutive months since October 2022. The BSI for all sectors was below 100. Many expected no improvement in finance conditions (92.3), domestic demand (92.8), exports (93.7), investment (94.8), profitability (95.3), and employment (95.9). Inventory was expected to be in an 'excess' state at 103.9. In particular, the finance condition BSI was the lowest, indicating that due to economic recession-related poor sales and inventory accumulation, companies are experiencing very difficult financial conditions, according to HanKyungHyup.

Lee Sang-ho, head of the Economic and Industrial Division at HanKyungHyup, emphasized, “Domestic companies have focused on securing liquidity through borrowing from financial institutions in response to poor performance, but with the continuation of high interest rates, interest burdens have greatly increased. Extraordinary financial support measures are needed, especially for sectors such as construction that are facing difficult financial conditions, and active efforts to boost domestic demand and export vitality are required.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.