Bithumb's 'Desperate Measure' to Give Up Main Income

Challenge of Turning Profitable Ahead of IPO

Upbit Focuses on Service Enhancement Instead of Direct Response

Bithumb, the second-largest player in the domestic virtual asset market, is fiercely chasing Upbit, the market leader, by leveraging aggressive events. This desperate measure to attract users even at the cost of immediate sales has shown some effect.

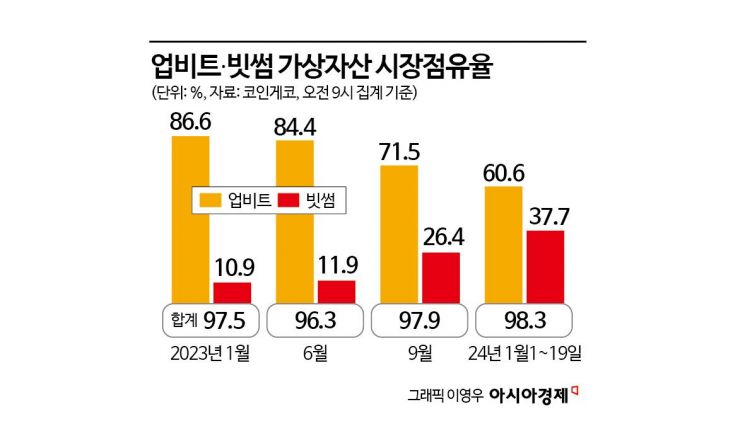

According to the virtual asset analysis platform CoinGecko on the 22nd, as of January this year (1st to 19th), Upbit's market share stood at 60.6%, showing a 22.9 percentage point gap with Bithumb's 37.7%. In January last year, the gap between the two exchanges was 75.7 percentage points, narrowing to less than one-third in a year.

This is interpreted as the result of marketing strategies such as Bithumb Korea's free fee events. On October 4th last year, Bithumb introduced a 0% trading fee policy as part of its 10th anniversary event. The previous fees ranged from 0.04% to 0.25%. This is a bold move to forgo trading fees, which are typically the main source of income for virtual asset exchanges. Lower-tier domestic exchanges like Korbit and Gopax also consecutively adopted free fee policies.

In addition to free fees, Bithumb Korea continues aggressive marketing by providing cash-like points. Last year, it offered virtual assets worth about 50,000 KRW randomly to customers trading over 100 million KRW monthly or provided points equivalent to 0.003% to 0.01% of the trading volume based on internal membership levels. Recently, as a new customer event, it decided to accumulate points equivalent to 10% annualized of the trading amount for customers trading with new net deposits. Points are accumulated based on the cumulative trading amount of new net deposits from the application date.

However, the strategy of giving up trading fees, the main source of income for exchanges, is unlikely to be sustainable in the long term. In the third quarter of last year, Bithumb Korea recorded an operating loss of 700 million KRW and a net loss of 10.6 billion KRW due to decreased sales from a slowdown in virtual asset trading. Bithumb Korea is also considering an initial public offering (IPO) in the second half of this year, making a turnaround to profitability urgent. This is because the importance of performance indicators has increased in the recent listing review by the Korea Exchange.

The re-listing issue of Wemade's virtual currency 'Wemix' also had an impact. Wemix, which was delisted due to incorrect circulation information and errors in explanatory materials, was re-listed on Bithumb in December last year, re-entering the four major KRW trading exchanges excluding Upbit. Bithumb also absorbed some liquidity from Wemix investors. Dunamu, the operator of Upbit, hesitated to re-list Wemix as CEO Lee Seok-woo clashed with Wemade CEO Jang Hyun-guk.

Upbit plans to focus on service advancement rather than directly countering Bithumb. Last year, it was the first domestic exchange to support multi-chain and offered various yield viewing features. It added the 'second candle' chart, a second-level chart, for the first time among domestic exchanges and provided a free service from October last year to January this year to recover virtual assets sent incorrectly by users. It also invested 10 billion KRW to advance its virtual asset matching engine.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.