<한은, 조사국 분석>

South Korea and US Near Full Employment

Rising Wage Levels May Fuel Inflation

Potential to Increase Financial Volatility

As the labor markets in South Korea and the United States show unusually strong performance, concerns are emerging that this could instead increase volatility in the financial markets. Analysts suggest that the strength in the labor market may reinforce downward wage rigidity and stimulate inflation.

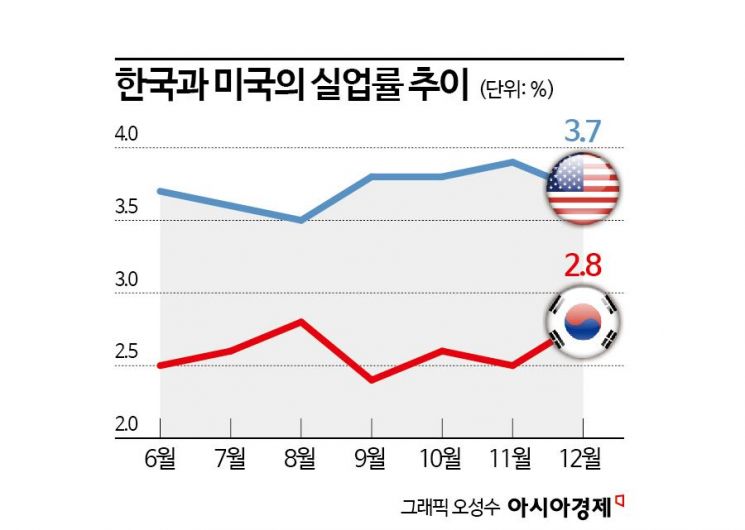

On the 19th, the Bank of Korea analyzed that the domestic unemployment rate has remained below 3% since 2022, which is unusually strong given the economic conditions. In particular, last year, despite the domestic economic slowdown, the unemployment rate hit a record low of 2.7%, effectively representing a state of full employment.

The Bank of Korea’s Employment Analysis Team explained that companies facing labor shortages due to difficulties in new hiring are responding to the economic slowdown by adjusting the working hours of existing employees instead of layoffs, which is a major factor contributing to the strong employment conditions.

On the 17th, job seekers are attending a job preparation lecture at the 2024 Public Institution Recruitment Information Fair held at the aT Center in Yangjae, Seoul. Photo by Heo Younghan younghan@

On the 17th, job seekers are attending a job preparation lecture at the 2024 Public Institution Recruitment Information Fair held at the aT Center in Yangjae, Seoul. Photo by Heo Younghan younghan@

Last year, while our GDP growth rate worsened, the unemployment rate remained low, indicating that companies are employing more workers relative to production output. In fact, in sectors like manufacturing, which are experiencing severe labor shortages, new unemployment (layoffs) has significantly decreased, while overtime hours have declined.

A Bank of Korea official stated, "The sharp decline in the unemployment rate during the pandemic recovery process was primarily due to increased labor demand centered on face-to-face service industries," adding, "However, companies’ labor hoarding behavior out of concern for labor shortages also contributed to maintaining the low unemployment rate."

The strength in the labor market is not limited to South Korea but is a global phenomenon. Last month, the U.S. unemployment rate fell by 0.2 percentage points from 3.9% in November to 3.7%, and the U.S. is also considered to be near full employment.

In December, the U.S. nonfarm payroll employment increased by 216,000, marking the third consecutive month of growth and recovering above the 200,000 mark. From 2010 to 2019, the average monthly increase was 183,000, and when this statistic exceeds 200,000, the labor market is considered strong.

Employment in Europe is also favorable. In November last year, the Eurozone unemployment rate was 6.4%, the second-lowest level since the Eurozone’s establishment in 1999. Despite the Eurozone’s economic conditions worsening, with GDP growth turning negative in the third quarter of last year, employment has shown improvement.

Such an unusually strong employment trend can ease concerns about a hard economic landing but, on the other hand, is pointed out as a factor that could increase volatility in financial markets.

The strength in the labor market raises wage growth, which can slow the pace of inflation deceleration. Last month in the U.S., wage growth increased by 4.1% year-over-year, higher than the 4.0% recorded the previous month.

Yoon Young-gyo, a researcher at KDB Future Strategy Research Institute, emphasized, "The rebound in U.S. wage growth last month suggests that the process leading to price stability may take a considerable amount of time."

In the U.S., concerns have been consistently raised that the strong employment following the pandemic could entrench high inflation and delay interest rate cuts. Federal Reserve Chair Jerome Powell has also stressed that cooling the overheated labor market must precede efforts to reduce inflation.

Researcher Yoon noted, "Employment is maintained mainly in the service sector, which is less sensitive to economic cycles, so the slowdown in the labor market and the resulting decline in wage growth will be gradual," adding, "Despite instability in employment in sectors like automobiles that led the economic recovery in 2023, downward wage rigidity in the manufacturing sector is also a factor burdening inflation."

However, there are also forecasts that the labor market will cool this year compared to last year. The Fed’s Beige Book report released on the 17th (local time) indicated signals of labor market cooling. It assessed that increases in job seekers waiting, decreases in turnover rates, selective hiring by companies, and easing wage pressures are occurring nationwide across the U.S.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.