Lim Jong-yoon, President of Hanmi Pharmaceutical, Builds Resentment After Being Excluded from Succession

Prepares for 'Management Rights Dispute' Through Shareholder Meeting Vote Battle

"Can Gather Friendly Shares," Claims, Industry Says "Not Easy"

The public backlash from the eldest son, Lim Jong-yoon, president of Hanmi Pharmaceutical, who was sidelined during the integration process with OCI, is intensifying. Lim Jong-yoon has secured friendly shares and announced a management dispute, vowing to overturn the decisions made by his mother, Song Young-sook, chairwoman of Hanmi Science, and his younger sister, Lim Joo-hyun, president of Hanmi Pharmaceutical, and cancel the integration of the two companies.

On the 17th, Lim Jong-yoon told Asia Economy, "I can secure funding from the securities market through my separately managed Cori Group and domestic companies." He also expressed to the media his intention to file an injunction to halt the integration of Hanmi Pharmaceutical and OCI. However, considering his position within the holding company Hanmi Science and the shareholding structure, it is difficult for Lim Jong-yoon to overturn this decision. Even if Hanmi Pharmaceutical merges with OCI, Lim Jong-yoon's stake in Hanmi Science will not change, so there is no financial disadvantage from the integration.

Nevertheless, those close to Hanmi Pharmaceutical interpret Lim Jong-yoon's strong opposition to this integration as an emotional conflict with his mother, who has long excluded him from company management and succession plans.

Seoul Songpa-gu Hanmi Pharm Headquarters Building Exterior

Seoul Songpa-gu Hanmi Pharm Headquarters Building Exterior

Lim Jong-yoon is currently an inside director of Hanmi Pharmaceutical but holds the symbolic position of 'Head of Future Strategy' rather than CEO. Industry insiders say he has no operational organization under his control within the company. However, Lim Jong-yoon was originally the most likely successor among the three siblings?his younger sister Lim Joo-hyun and younger brother Lim Jong-hoon, president of Hanmi Precision Chemical?to inherit management rights. He successfully established Beijing Hanmi Pharmaceutical after entering China in 2004 and became CEO of Hanmi Pharmaceutical in 2009. However, over time, the owner family began to doubt his management capabilities, and after Chairman Lim Sung-gi passed away in 2020, Song Young-sook, who took over as chairwoman of the Hanmi Pharmaceutical Group, promoted both of Lim Jong-yoon's younger siblings to president positions, changing the succession plan to a 'decision after verification of the three siblings.'

Earlier, in 2007, Lim Jong-yoon established a personal company called Cori Group in Hong Kong and has been managing vaccine development companies and others. In 2021, he invested in a British genetic diagnostics company and became a registered executive. An industry insider said, "Lim Jong-yoon's establishment of Cori Group was intended to create a diverse portfolio 'Pan-Hanmi' by adding a bio-focused Cori Group to Hanmi Pharmaceutical, which mainly focuses on synthetic drugs (chemicals)." However, since it is a separate company, he was also criticized for running a 'personal business.' According to industry sources, the top management of Hanmi Pharmaceutical even instructed executives not to provide any financial or operational support to Lim Jong-yoon's personal business.

Those close to Hanmi Pharmaceutical believe that Lim Jong-yoon's declaration of war against his mother and younger sister stems from long-standing resentment, so regardless of the chances of winning the management dispute, he is unlikely to back down easily. Lim Jong-yoon has indicated the possibility of a vote showdown at the regular shareholders' meeting in March, for which the support of his younger brother Lim Jong-hoon and Shin Dong-guk, chairman of Hanyang Precision Chemical, a major shareholder of Hanmi Science and a hometown junior of Chairman Lim, is essential.

Lim Jong-yoon is currently considering legal action. Although the term 'integration' is used, it is effectively a merger of the two companies, but no special resolution was passed at the shareholders' meeting, and in the context of a management dispute, the approval of a third-party allotment capital increase is illegal, among other legal issues. Therefore, he plans to take all possible actions, including filing an injunction. However, an industry insider said, "Legal action takes a long time, and Hanmi Pharmaceutical and OCI likely proceeded with the integration after legal review. Emphasizing the word 'integration' rather than 'sale' or 'merger' is also seen as a way to avoid such issues."

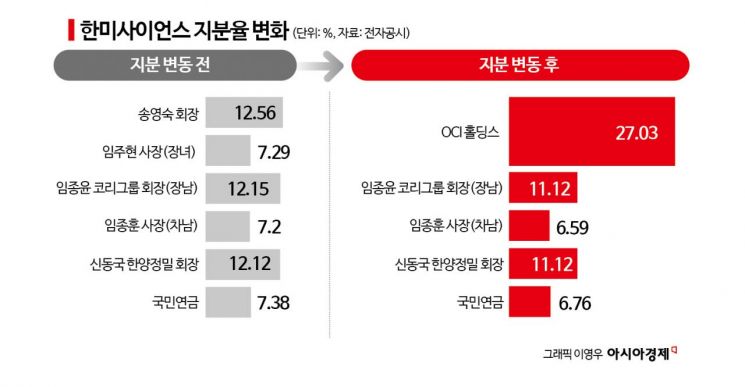

For this reason, some analysts say the only realistic opportunity for Lim Jong-yoon to reverse this deal is the regular shareholders' meeting in March. It is judged that Lim Jong-yoon can secure about 28.8% of Hanmi Science shares if his younger brother Lim Jong-hoon and Shin, the largest individual shareholder of Hanmi Pharmaceutical, join forces, which is similar to the 27.0% held by OCI and Hanmi. Additionally, he is considering further share purchases using Cori Group's resources. However, Shin is currently on an overseas business trip at the beginning of the year and has not yet expressed his position on the Hanmi Pharmaceutical and OCI integration, so both sides are only hoping that Shin will side with them.

Hanmi Pharmaceutical is also preparing for a shareholding battle with Lim Jong-yoon. On the 15th, Hanmi Science corrected its disclosure to state that the share sale entity changed from the two children of Chairwoman Song and Lim Joo-hyun to Chairwoman Song and the Gahyeon Cultural Foundation. The Gahyeon Cultural Foundation, chaired by Song, inherited shares after Chairman Lim's death and currently holds 4.9% of Hanmi Science shares. Since public interest corporations do not pay inheritance or gift tax on shares below 5%, this is seen as a tax reduction strategy. An industry insider said, "Public interest corporations have concerns about voting rights restrictions, and in an extreme vote showdown, there is a risk related to the '3% rule' for auditor appointments. The Gahyeon Cultural Foundation lowered its shares below 3% and preserved the shares of grandchildren who can freely exercise voting rights."

Hanmi Pharmaceutical believes it will be difficult for Lim Jong-yoon to form a shareholding alliance. A person familiar with Hanmi Pharmaceutical said, "Lim Jong-yoon considers his younger brother Lim Jong-hoon a friendly force, but in reality, that is unlikely. Lim Jong-yoon has focused on personal business for the past decade, but Lim Jong-hoon has worked closely with their sister Lim Joo-hyun within the Hanmi Pharmaceutical Group and currently serves as a president of an affiliate, so he is much closer to his sister."

Even if Lim Jong-yoon gains the upper hand in the management dispute, the ultimate key is financial mobilization. Since the reason for the Hanmi Pharmaceutical and OCI integration is to secure funds for inheritance tax payment, it is necessary to be able to pay the inheritance tax by replacing the funds coming from OCI. Lim Jong-yoon said, "There are institutions in the investment banking (IB) industry showing interest," and added, "I will reveal specific plans gradually."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)