16.3% Increase Compared to the Previous Year

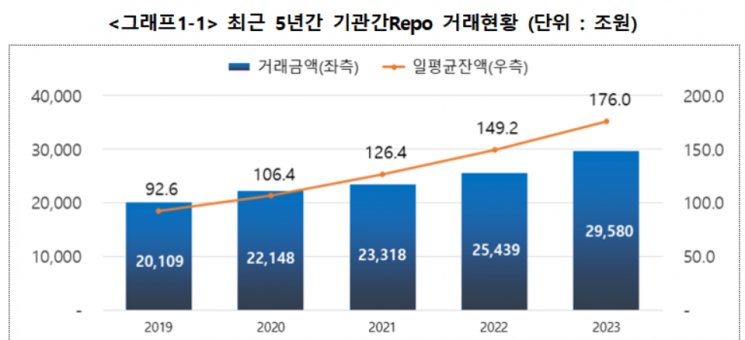

The Korea Securities Depository announced on the 16th that the amount of inter-institutional repurchase agreement (Repo) transactions last year (based on the opening transaction) reached 2,958 trillion won, an increase of 16.3% compared to the previous year.

A repo refers to a bond issued by financial companies with the condition that it will be repurchased after a certain period with added interest.

The balance of inter-institutional repos reached a record high of 208.4 trillion won as of December 28 last year. The average daily balance was 176 trillion won, up 18.0% from the previous year.

By industry, based on the average daily selling balance (fund borrowing), domestic securities companies accounted for the largest share at 79.7 trillion won (45.3%), followed by asset management companies at 45.9 trillion won (26.1%), and domestic securities company trust portions at 16.4 trillion won (9.3%).

Based on the average daily buying balance (fund lending), asset management companies led with 58.8 trillion won (33.4%), followed by domestic bank trust portions at 49.5 trillion won (28.1%), and non-residents at 18.1 trillion won (10.3%). The buying share of domestic banks decreased by 4.8 percentage points from the previous year to 8.5%.

The increase in both selling (6.9%) and buying balance shares of non-residents is believed to be due to recent regulatory improvements such as the financial authorities’ tax exemption on interest and capital gains from foreigner-held government bonds and Monetary Stabilization Bonds, and reforms in the foreign investment system, which have led to increased foreign investment in the domestic capital market.

The average daily balance by transaction period was 109.6 trillion won (62.3%) for 1-day repos, 32.5 trillion won (18.5%) for 7 to 10-day repos, and 25.8 trillion won (14.6%) for repos exceeding 10 days.

The average daily balance of trading securities (based on market price) was highest for government bonds at 118.6 trillion won (63.0%), followed by financial bonds at 35.2 trillion won (18.7%), special bonds at 15.5 trillion won (8.2%), and Monetary Stabilization Bonds at 8.7 trillion won (4.6%).

By transaction currency, the average daily balance was 155.4 trillion won (88.3%) in Korean won and 20.6 trillion won (11.7%) in foreign currency (converted to Korean won).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.