From the 17th, 'Baemin1 Plus' Introduced... Combining Hanjip and Altteul Delivery

This year, Baemin is expected to solidify its dominant position in the domestic delivery application (app) market. Although delivery demand decreased over the past year due to the COVID-19 endemic (periodic outbreaks of infectious diseases), Baemin has maintained its lead as the market leader without significant user loss. The strategy for this year is to strengthen the growth foundation by introducing a delivery service that lowers delivery fees for consumers while increasing convenience for restaurants starting from January. The second and third-ranked companies, Yogiyo and Coupang Eats, are also attempting to narrow the gap by differentiating themselves based on their respective platform competitiveness.

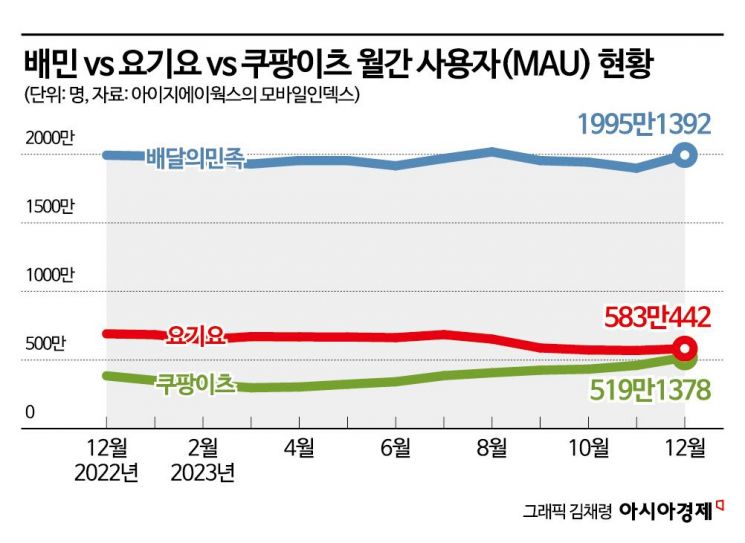

According to the mobile index compiled by data company IGAWorks on the 16th, last month the number of users (MAU) for the three major delivery apps?Baemin, Yogiyo, and Coupang Eats?were 19.95 million, 5.83 million, and 5.19 million respectively. Compared to the previous month, Baemin’s users increased by 5.1%, while Yogiyo and Coupang Eats grew by 2.4% and 12.8%, respectively. It was explained that all three companies showed an upward trend as the year-end delivery peak season approached.

Compared to December 2022, a year ago, Baemin’s users increased by 15,665, while Yogiyo lost 1.08 million users. Coupang Eats saw an increase of 1.35 million users. Overall, Baemin has maintained its user base with little fluctuation, Yogiyo has shown a sluggish trend, and Coupang Eats is showing clear growth but is expected to take more time to recover its user base that once exceeded 7 million. Coupang Eats had increased to 7 million users by the end of 2021 but experienced a sharp decline due to decreased delivery demand and reduced promotions.

Given the different market situations, each company’s strategy for this year inevitably differs. Baemin is focusing on efficiency. The representative example is the 'Baemin1Plus' service introduced from the 17th of this month. Baemin1Plus combines Baemin’s previous self-delivery services, 'One-Home Delivery' and 'Budget Delivery.' One-Home Delivery involves Baemin’s riders handling only one order per delivery, while Budget Delivery lowers delivery costs by optimally bundling deliveries based on routes. Previously, restaurant owners had to separately subscribe to One-Home Delivery and Budget Delivery, but now they can use both services at once by subscribing to Baemin1Plus. A Baemin official explained, “With one product, two delivery methods can be managed in an integrated way, and by analyzing customers’ ordering environments, the optimal delivery fee is automatically applied, enabling more efficient store operations.”

Yogiyo and Coupang Eats’ strategies are focused on expanding their user base. They need to narrow the gap with the number one while also competing closely with each other for second and third place. First, Yogiyo partnered with Kakao to expand its ordering channels. Since the end of November, orders can be easily placed through KakaoTalk. Yogiyo plans to continue pursuing various collaborations with different platforms.

Coupang Eats is actively leveraging its user expansion strategy based on the competitiveness of the Coupang Wow Membership. It offers a 10% discount at designated restaurants to Coupang Wow Membership subscribers, encouraging them to choose Coupang Eats for delivery services. Considering that the Wow Membership has over 11 million members, there is still significant potential to expand the user base. An industry insider said, “With the market structure settling into a 1-strong, 2-middle formation, this year will see continued service competition aimed at providing differentiated ordering experiences following the discount competition.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.