US SEC Simultaneously Approves 11 ETFs

Bitcoin Trading Volume Increases by 40%

Price Volatility Remains Limited

Ethereum Also Gives Up Gains

Investment Difficult in Korea for the Time Being

The U.S. Securities and Exchange Commission (SEC) approved the listing of a Bitcoin spot exchange-traded fund (ETF) product on the 10th (local time), with the trading volume on the first morning approaching 4 trillion won. However, in South Korea, financial authorities have prohibited securities firms from brokering ETFs due to violations of the current Capital Markets Act, making direct investment difficult.

Bitcoin Price Reflects Anticipation...Limited Upside

According to Bloomberg News, as of 1 p.m. on the first trading day after the approval of the Bitcoin spot ETF on the 11th (local time), the total trading volume reached $3 billion (3.95 trillion won). The ETF with the highest trading volume was the 'Grayscale Bitcoin Trust,' with a trading volume of about $1.7 billion. BlackRock Asset Management's 'iShares Bitcoin Trust (IBIT)' recorded over $880 million. As trading became active in ETFs, Bitcoin trading volume also increased by more than 40%.

The surge in trading volume is attributed to the SEC simultaneously approving 11 ETFs. It was also noted as unusual for more than 10 ETFs to be approved simultaneously. The commission had rejected more than 20 applications related to spot Bitcoin exchange-traded products (ETPs), including Grayscale Investments' application, from 2018 to March 2023. However, after the court ruled that the reasons for refusal were insufficient, the SEC made the first-ever approval decision for a Bitcoin spot ETF on the 10th (local time).

Being among the top in trading volume does not necessarily mean a large net inflow of funds. For example, the Grayscale Bitcoin Trust, which ranked first in trading volume, is estimated to have experienced significant net outflows due to its high annual fee of 1.5%. James Seyffart, a Bloomberg ETF expert, noted on X (formerly Twitter) that "half of the trading volume came from GBTC because many investors sold GBTC and bought other ETFs." According to Morningstar, the annual fees for Bitcoin spot ETFs range from 0.2% to 1.5%.

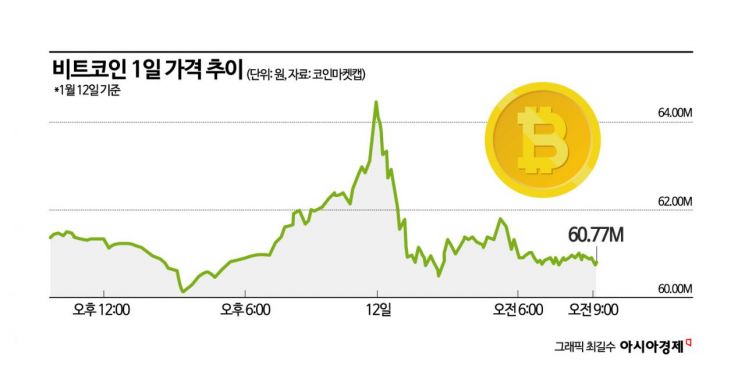

Despite the surge in trading volume, the price volatility of Bitcoin was limited. Bitcoin's price briefly surpassed 64 million won but has since given back most of its gains. The price, which reached an intraday high of 64.49 million won the previous day, dropped to 60.9 million won as of 8:46 a.m. on the same day. Ethereum, the second-largest virtual asset by trading volume and the leading altcoin (virtual assets excluding Bitcoin), also experienced a brief surge to the 3.4 million won range before giving back its gains. An industry insider commented, "Price fluctuations appear limited as expectations for ETF approval were already priced in."

Prohibition of Securities Firm Brokerage Due to Violation of Capital Markets Act in South Korea

In South Korea, Bitcoin spot ETF investment is expected to be difficult for the time being due to the prohibition of brokerage by securities firms under the Capital Markets Act. Financial authorities have conveyed an official interpretation to securities firms that brokering Bitcoin spot ETFs by domestic securities firms violates the law under current regulations. Following this decision, domestic securities firms are reported to have recently banned new purchases of the Canadian and German Bitcoin spot ETFs, such as the 'Purpose Bitcoin ETF,' which had been traded until now.

The Financial Services Commission stated, "Brokerage of overseas-listed Bitcoin spot ETFs by domestic securities firms may violate the government's existing stance on virtual assets and the Capital Markets Act. However, since regulations on virtual assets are being established, such as the 'Act on the Protection of Users of Virtual Assets' coming into effect in July this year, and considering overseas cases like in the U.S., further review will be conducted."

The Financial Supervisory Service also took note of increased price volatility across virtual assets following the SEC's approval of Bitcoin exchange-traded products (ETPs) and launched the Virtual Asset Supervision Bureau and Virtual Asset Investigation Bureau.

Unlike when the Bitcoin futures ETF was listed in December 2021, financial authorities have proactively taken regulatory measures, causing some confusion in the market. An industry insider said, "It is almost the first time that financial authorities have imposed sanctions separately during the process of selling overseas ETF products, which is unusual. Clear guidelines from the authorities are needed to reasonably explain the reasons to customers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)