Lower Loan Interest Rates Than Commercial Banks

Expect Refinancing Loans for Jeonse Deposits

KakaoBank Waives Early Repayment Penalties

K Bank Offers Fixed-Rate Products

With the launch of the online mortgage refinancing (switching mortgage loans) service, many customers are switching to internet banks that offer lower interest rates. This is because internet banks have lower funding costs than commercial banks, which inevitably leads to lower interest rates. This trend is expected to continue with the release of the jeonse deposit loan on the 31st of this month.

Internet bank KakaoBank temporarily suspended its mortgage refinancing service on the 9th but resumed it the next day. The reason was that the product quantity was limited, but demand surged excessively. The company explained that this was also to prevent consumers from having to wait due to document reviews when applications suddenly flood in. This achievement was made despite KakaoBank not partnering with any fintech (finance + technology) platforms such as Naver Pay, Toss, or Kakao Pay. On the other hand, another internet bank, K Bank, has partnered with most fintech platforms. The number of customers who viewed its apartment mortgage loan product increased more than threefold compared to usual, with more customers coming through platforms than through its own application (app).

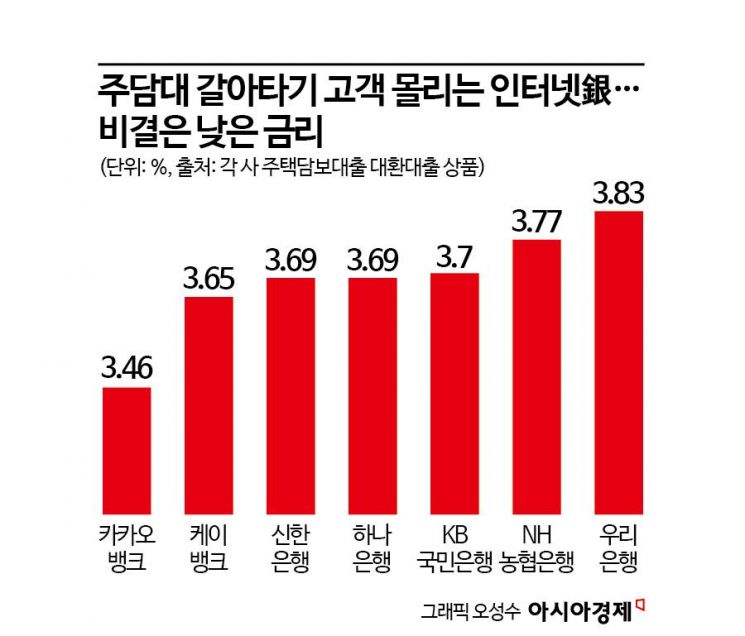

The strong performance of internet banks is due to their lower loan interest rates compared to commercial banks. As of the 11th, KakaoBank’s mortgage refinancing product offers a minimum interest rate of 3.46% (up to 1 billion KRW). This is lower than the 3.49% on the initial release on the 9th and 3.5% on the 10th. K Bank also offered 3.65%. The five major commercial banks have also launched similar products with interest rates in the 3% range. Shinhan Bank and Hana Bank both offer 3.69%, followed by KB Kookmin Bank (3.7%), NH Nonghyup Bank (3.77%), and Woori Bank (3.83%).

The reason internet banks can set lower interest rates is that their funding costs are lower than those of commercial banks. According to KakaoBank’s Q3 2023 financial results, the proportion of low-cost deposits (with interest rates around 0.1% per annum) was about 56.9%, higher than the banking sector average of 38.3%. The more deposits with low interest paid to customers, the larger the interest rate spread between deposits and loans, allowing the bank to earn more interest. Therefore, the higher the proportion of low-cost deposits, the greater the profitability. With higher profitability, internet banks can boldly lower loan interest rates to attract customers.

The nature of internet banks, which do not conduct offline sales, is also reflected. A representative from an internet bank said, “Compared to commercial banks, internet banks have fewer branches and employees and operate non-face-to-face sales, which reduces funding costs.”

Internet banks are optimistic about attracting consumers in the online jeonse deposit loan refinancing service launching on the 31st of this month. Like mortgage loans, the average interest rates for jeonse loans are lower than those of commercial banks. Based on the outstanding balance handled so far, the lowest average interest rate for jeonse loans (as of December last year) is offered by Toss Bank (3.92%), followed by KakaoBank (4.25%) and K Bank (4.49%). KB Kookmin Bank ranks fourth at 4.7%. KakaoBank is expected to promote the waiver of prepayment penalties applied to its mortgage refinancing products. This means that when switching from another bank to KakaoBank, the prepayment penalty is 100% waived. K Bank is the only internet bank offering a fixed-rate jeonse deposit loan product. Toss Bank is actively seeking to attract customers by considering partnerships with fintech platform companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)