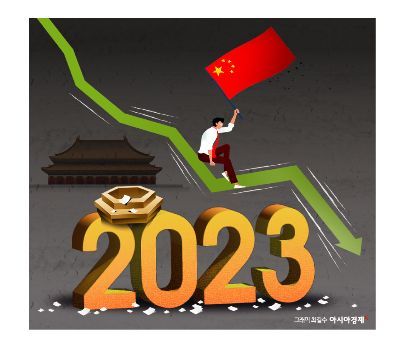

China's stock market, which continued its 'solo slump' last year, is still struggling at the beginning of this year. This is due to China's economic growth slowdown and deflation (falling prices amid economic recession) concerns failing to inject vitality into the stock market.

However, Chinese economic experts evaluated that since the Chinese stock market has fallen significantly so far, there is a high possibility of a mechanical rebound this year.

The CSI300 index, composed of the top 300 Chinese companies, closed at 3,277.13 on the 10th, down 0.47% from the previous day. The CSI300 index, which fell 11% last year and showed the lowest stock price since 2019, has dropped 4.5% so far this year. The Hong Kong Hang Seng Index was down 0.76% at 16,066.72 as of 3 p.m. that day. The Hang Seng Index fell more than 19% last year and over 5% this year.

It is no exaggeration to say that last year was the worst year for the Chinese economy. Liquidity crises continued among real estate developers such as Evergrande and Biguiyuan, and consumer sentiment weakened. It is analyzed that the stock prices reflect the expectation that this economic trend will not improve this year either.

On the same day (local time), Bloomberg conducted a survey of 23 local Chinese analysts and fund managers, and the evaluation came out that the Chinese stock market could be different this year. Bloomberg explained, "Chinese economic experts currently see more opportunities than risks when looking at the Chinese stock market indices."

In the expert survey, the CSI300 first-quarter forecast was predicted to be 3,500, which is about 6.5% higher than the current level. The Hang Seng Index is expected to rise 10% in the same period and 32% over the year, ending a four-year consecutive decline this year.

This is a different observation from the outlook for the Chinese economy this year. The International Monetary Fund (IMF) expects China's economic growth rate to slow to 4.5% this year from last year's forecast of 5.4%. This is due to the continuation of the real estate crisis and weak consumption trends this year.

However, it is explained that foreign investors aiming for bottom-fishing are expected to put upward pressure on the Chinese stock market. Foreign investment in mainland China-listed stocks peaked at 235 billion yuan in August last year but plummeted 87% to 30.7 billion yuan four months later. The significantly fallen Chinese stocks, combined with factors such as the global interest rate decline and increased risk asset preference, suggest a high possibility of foreign capital inflow.

Hayden Briscoe, Head of Asia Pacific Multi-Asset Portfolio Management at UBS Asset Management, said, "The Chinese stock market looks very cheap compared to other Asian stock markets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.