Available via Mobile Banking App

Platform Integration Begins with KakaoPay, etc.

Partnerships with Toss and Others to Increase in Future

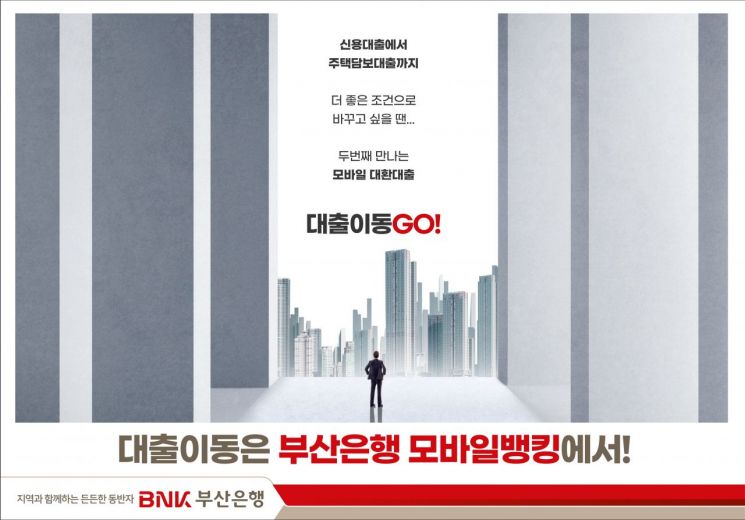

BNK Busan Bank announced on the 9th that it has expanded the ‘Loan Transfer GO!’ service, which allows refinancing applications for mortgage loans (jumdae) through its mobile banking application (app), to include mortgage loans. Refinancing of mortgage loans from other financial institutions is now possible without visiting a branch. The financial institutions eligible for refinancing include a total of 32 companies such as banks, savings banks, capital companies, and insurance companies.

If operating the mobile banking app is difficult, customers can visit the nearest Busan Bank branch to undergo refinancing loan screening. With customer consent, Busan Bank staff will directly verify and proceed with loan screening and repayment.

The bank has started partnerships with KakaoPay and NaverPay, and plans to expand partnerships with other platforms such as Toss in the future.

This service, which began in May last year as a Busan Bank loan transfer service for personal credit loans, exceeded 100 billion KRW in transaction volume within seven months of its launch.

Kim Yong-gyu, Head of Customer Marketing Division at Busan Bank, said, “With the advancement of the ‘Loan Transfer GO!’ service, customers can now easily switch mortgage loans from other financial institutions to Busan Bank. Busan Bank will continue to strengthen its customer-centered credit operation system and provide innovative digital financial products and services that meet the demands of the times.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)