'Special Act on Prevention of Insurance Fraud' Amendment Bill

Stalled at Judiciary Committee on 8th

Temporary National Assembly on 9th is the Last Chance

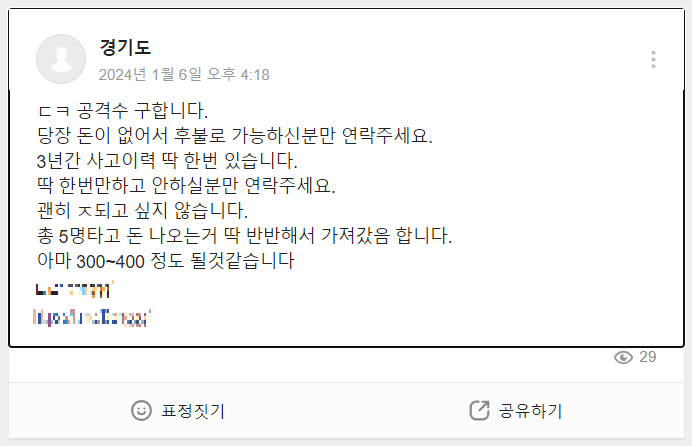

"Looking for a ㄷㅋ attacker."

This is a recent post on a social networking service (SNS) community. 'ㄷㅋ' is an abbreviation of 'Dwigung,' a criminal slang term for deliberately causing a car collision to claim insurance money. It is essentially an open advertisement recruiting insurance fraud gangs on the internet. The author tempted readers by saying, "There are five people in total, and I want to split the money evenly," adding, "It will probably be around 3 to 4 million won."

Even in the new year, posts of this type baiting with "high-paying part-time jobs" are rampant, but current laws do not have provisions to punish them. To prevent this, the amendment to the "Special Act on the Prevention of Insurance Fraud" was submitted and, after passing the National Assembly's Political Affairs Committee on the 8th, was brought to the Legislative and Judiciary Committee's plenary session agenda 40 days later but failed to pass. The reason given was the need for additional legal review regarding aggravated punishment.

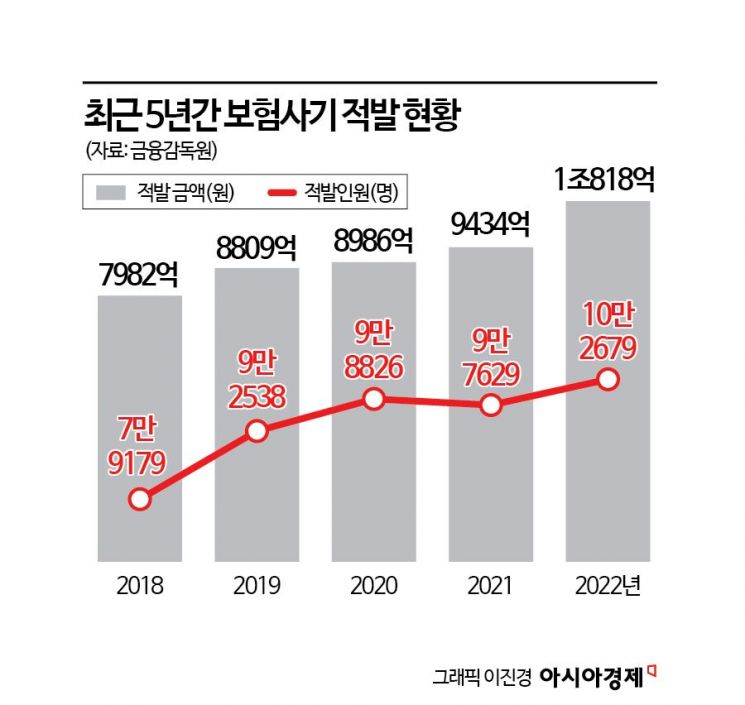

The Special Act on the Prevention of Insurance Fraud, enacted in 2016, has not been amended even once to date. During this time, the law's preventive effect has diminished, and insurance fraud has rather increased. According to the Financial Supervisory Service, the number of people caught for insurance fraud steadily increased from 79,179 in 2018 to surpass 102,679 in 2022. The amount detected rose from 798.2 billion won in 2018 to 1.0818 trillion won in 2022. In the first half of last year alone, 55,051 people and 623.3 billion won worth of insurance fraud were detected.

When the 2020 "Lee Eunhae Valley Incident" surfaced, public interest in insurance fraud grew, prompting the political sphere to consecutively propose amendments to the Special Act on the Prevention of Insurance Fraud. As of last year, 17 bills were proposed. Delayed by other pressing issues and unable to reach the standing committee, the Political Affairs Committee bundled 16 of the 17 bills into a single alternative proposal in July last year, which passed the committee in November. However, this time, the bill failed to clear the Legislative and Judiciary Committee, and it is expected to drift again without a definite timeline. This is because the last plenary session of the December extraordinary National Assembly, held on the afternoon of the 9th, is likely to mark the start of the ruling and opposition parties' full-scale election campaign phase.

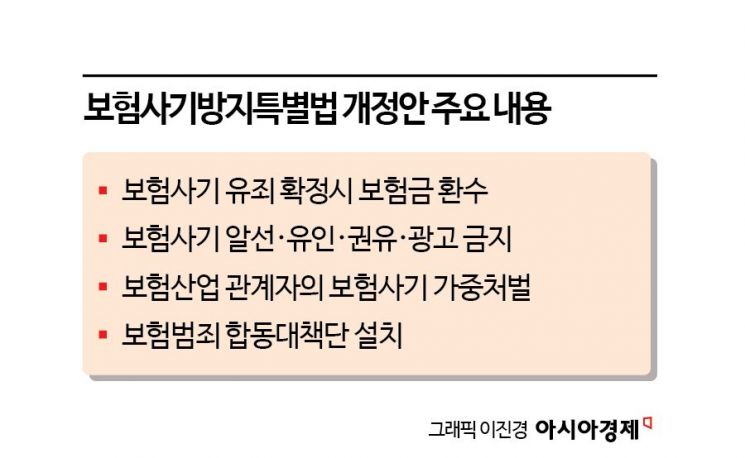

The amendment includes various measures to prevent insurance fraud, such as prohibiting solicitation, inducement, and advertisement of insurance fraud, imposing aggravated punishment on insurance industry personnel involved in fraud, returning unduly obtained insurance money, and establishing a joint task force on insurance crimes. Preventing insurance fraud also has the effect of lowering premiums for honest insurance payers. The office of Yoon Chang-hyun, a member of the People Power Party in the National Assembly's Political Affairs Committee, estimated that if the amount of insurance fraud decreases by 10% due to the amendment's passage, about 600 billion won in insurance premiums could be saved. An insurance industry official said, "With the 21st National Assembly nearing its end, it is regrettable that the bill's passage is being postponed repeatedly," adding, "If the bill is automatically discarded, insurance fraudsters are likely to become more brazen and commit more crimes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.