Comparison of 7 Platforms and 16 Apps

Jeonse Loan Implementation from the 31st

With the implementation of the mortgage refinancing platform service (refinancing home mortgage loans), competition among fintech (finance + technology) platforms to attract customers is fierce. They are actively competing to attract customers by highlighting their unique advantages such as partnerships with multiple financial institutions and convenience.

The Financial Services Commission announced that the refinancing service, which was previously limited to credit loans through an online one-stop refinancing infrastructure, will be expanded to include home mortgage loans starting from the 9th. For jeonse deposit loans, the service will be implemented from the 31st. Through this service, consumers can compare home mortgage loan interest rates from various financial institutions online. They can refinance their home mortgage loans to financial institutions with lower interest rates without visiting branches.

Consumers can check their existing loans and compare refinancing loan conditions through seven loan comparison platforms and 16 financial institution applications (apps). Borrowers who want to refinance their home mortgage loans can use the existing loan inquiry and new loan services on the platform every business day from 9 a.m. to 8 p.m. Once the borrower selects the product to switch to, they must apply for a new loan review through the financial institution’s app or branch. Required documents are verified through public MyData (personal credit information management) and web scraping methods, so no separate submission is necessary.

The refinancing target loans are home mortgage loans secured by apartments with a market price inquiry available, with a loan amount of up to 1 billion KRW. However, refinancing is only possible after six months have passed since the original loan was taken. Increase refinancing is not allowed, and the new loan limit is restricted to the remaining balance of the existing loan.

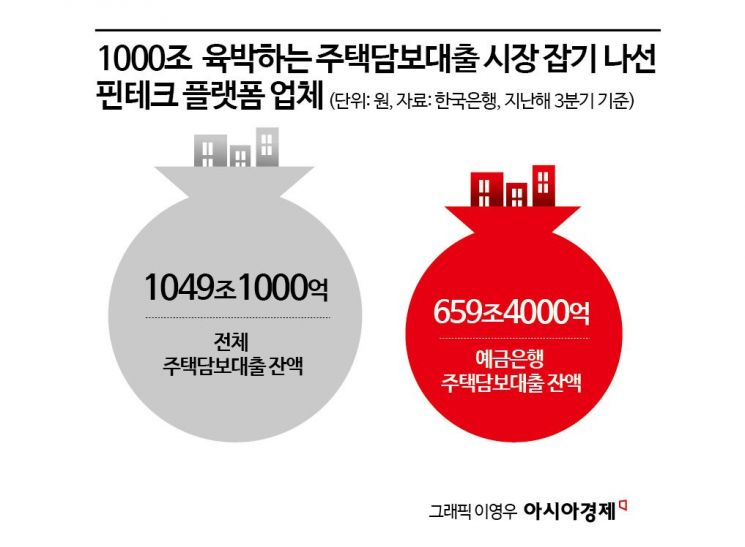

Fintech platform companies are actively seeking partnerships with financial institutions to attract customers in order to capture the entire home mortgage loan market, which is close to 1000 trillion KRW. According to data from the Bank of Korea, as of the third quarter of last year, the total outstanding home mortgage loans amounted to 1049.1 trillion KRW. Of this, the outstanding home mortgage loans at deposit banks were 659.4 trillion KRW. Kakao Pay partnered with the most financial institutions (11). Naver Pay partnered with six commercial banks, attracting the largest number of commercial banks (Shinhan, Woori, Hana, NH Nonghyup, IBK Industrial Bank, SC First Bank) to its platform.

Both companies cite ease of consumer access as their strength. Kakao Pay emphasizes KakaoTalk. A Kakao Pay representative said, “(Kakao Pay) not only offers a comfortable user interface (UI) and user experience (UX) but also allows direct access to the refinancing loan comparison platform through KakaoTalk.”

Naver Pay said that consumers can easily compare products through the ‘Our Home Service,’ which manages real estate they live in and own. Since house information and market prices are already registered, the information input step is simplified when directly executing home mortgage loan refinancing. Toss partnered with six companies including Shinhan, Hana, IBK, Busan Bank, K Bank, and Kyobo Life, stating, “Unlike most platforms that only allow integrated refinancing by combining two loans into one, Toss is designed to allow refinancing only the loan with the higher interest rate when holding two loans on one collateral.”

Some platforms offer loan interest rate discount coupons when customers receive refinancing loans within the platform. When consumers refinance their home mortgage loans through BankSalad, they can receive four initial 0.05% coupons, with a new 0.05% coupon issued daily. The ‘Enhance’ feature allows unlimited increases in the interest rate discount. Consumers can reduce their loan interest rate by the discount rate of the coupons they hold in addition to the base product interest rate. Customers who complete the final application after pre-registration receive a 0.3% basic interest rate discount coupon. Finda also offers a 50,000 KRW gift certificate to 100 customers who check their loan limit after pre-registering for the home mortgage loan refinancing service.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)