KCGI and Eolrain Achieved Remarkable Returns Last Year

Trusstone and FCP Attract Attention with Active Shareholder Activities

Ahead of the regular shareholder meeting season earlier this year, the shareholder activism and return performance of activist funds have been reexamined. Among them, the return performance of Align Partners and KCGI, whose cumulative investment scale exceeds 100 billion KRW, draws attention.

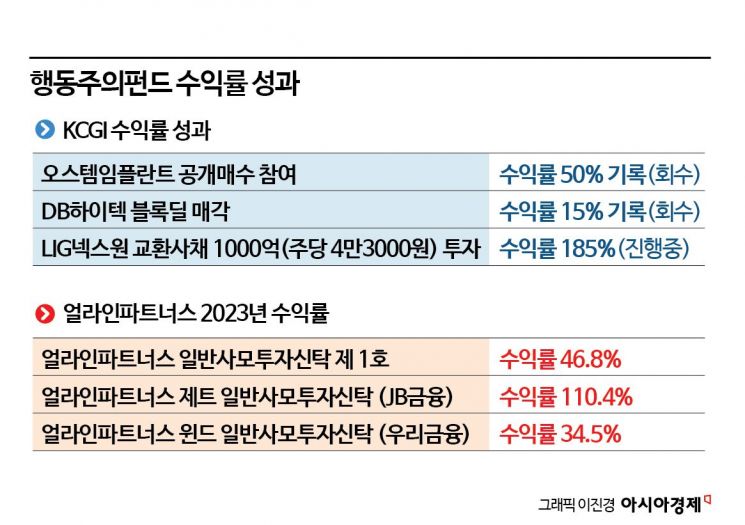

According to the investment banking (IB) industry on the 8th, KCGI recorded an internal rate of return (IRR) of over 200% last year through the sale of its stake in Osstem Implant. In the case of Osstem Implant, KCGI responded to a public tender offer for 1,038,256 shares (6.92%) at 190,000 KRW per share just three months after purchasing the shares, achieving a holding period return of 50% and an IRR of 220%.

They also earned more than 20 billion KRW in capital gains through the sale of DB HiTek shares. In December last year, they sold 2.5 million shares (5.63%) via a block deal after-hours for 165 billion KRW, recording a return of 15%. The price per share was 66,000 KRW, which was a 13% premium compared to the closing price of 58,600 KRW on the same day.

Kang Sung-bu, CEO of KCGI, said, "In the case of DB HiTek, we sold after most of our demands for governance improvements?such as conversion to a holding company, cancellation of the DB Metal merger, transparent management, a promise of over 30% shareholder returns, and vision presentation?were accepted," adding, "We left 1.5% this year because we are optimistic about the semiconductor market." He added, "We wanted to leave a precedent of amicable resolution."

Although an exit (capital recovery) has not yet been made, the place where KCGI expects the greatest return performance is LIG Nex1. KCGI acquired 1,897,658 shares (8.6% stake) of LIG Nex1 through the acquisition of 100 billion KRW worth of exchangeable bonds (EB) issued by LIG. The LIG Nex1 shares, purchased at 43,000 KRW per share, are currently priced at 123,200 KRW (based on the closing price on the 5th). A simple calculation shows a return of 185%, earning more than 150 billion KRW.

Another activist fund, Align Partners, recorded returns of approximately 30?110% (after fees and expenses) last year through three funds. Align Partners General Private Investment Trust No. 1 (SM) recorded a return of 46.8%, Align Partners Jet General Private Investment Trust (JB Financial) 110.4%, and Align Partners Wind General Private Investment Trust (Woori Financial) 34.5%.

Last year, Align sent open letters urging seven financial holding companies to introduce capital allocation policies and medium-term shareholder return policies. In the securities industry, a 'bank stock rally' continued amid expectations of shareholder returns. Bank stocks surged about 15% throughout January.

This year, whether Align Partners will make another attempt to appoint an outside director at JB Financial Group is a matter of interest inside and outside the financial sector. Align Partners holds a 14.04% stake in JB Financial, making it the second-largest shareholder after Samyangsa (14.61%). At last year's general meeting of shareholders, Align opposed the appointment of outside director Sung Je-hwan and appealed for the appointment of candidate Kim Ki-seok. Although they lost the vote, it is reported that they have not given up on appointing an outside director who would advocate for stronger shareholder returns.

Other funds' active shareholder activities are also expected ahead of the regular shareholder meeting season. Last year, Truston Asset Management (Taekwang Industrial, BYC, Korea Alcohol, LF), Flashlight Capital Partners and Anda Asset Management (KT&G), and Value Partners Asset Management (KISCO Holdings) actively engaged.

This year, Flashlight Capital Partners (FCP) is intensifying its offensive against KT&G, demanding improvements in the appointment process for the president candidate.

KCGI Asset Management, which has been demanding governance improvements from Hyundai Elevator, has partially achieved its goals. KCGI Asset Management recently evaluated the resignation of Hyundai Group Chairwoman Hyun Jeong-eun from the registered director and board chair positions as "the first step toward normalizing the board," while also demanding improvements in management structure, normalization of corporate value, and the complete cancellation of treasury shares.

Although Truston Asset Management lost the vote battle with Taekwang Industrial last year, it welcomed Taekwang Industrial's recent announcement to operate an ESG (Environmental, Social, Governance) committee within the board as part of strengthening ESG management. Last month, it launched an exchange-traded fund (ETF) that focuses on stocks expected to expand shareholder value through activist activities.

Since shareholder proposals under the Commercial Act must be submitted in writing at least six weeks before the shareholder meeting date, the movements of activist funds are expected to become even busier in the future.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.