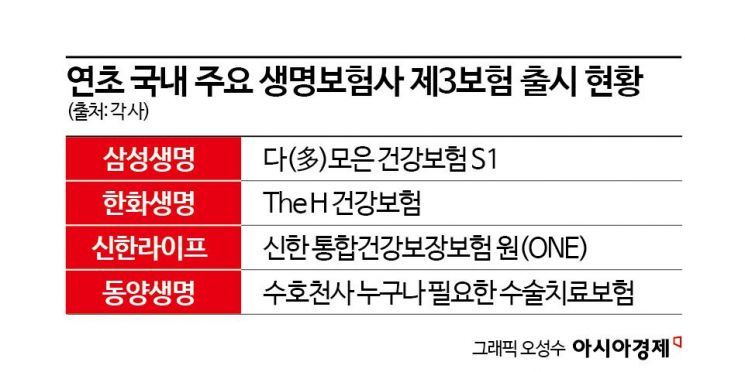

Samsung, Hanwha, Shinhan, Dongyang and Other Major Insurers Launch Third Insurance Products

Price Competitiveness Secured by Reflecting New Reference Rates and Experience Life Tables

Since the beginning of the year, life insurance companies have been launching 'third insurance' products one after another. The third insurance market, where non-life insurance companies hold a 75% market share, is expected to be a fiercely contested battleground between life and non-life insurers this year. Life insurers, who have been at a disadvantage in terms of price competitiveness, now have grounds to reduce premiums by more than 50% starting from April due to the revised reference rates and the incorporation of the experience mortality table, threatening non-life insurers from the start of the year.

According to the life insurance industry on the 4th, Samsung Life Insurance launched 'Da(Many)moeun Health Insurance S1' on the 2nd. It offers 144 special riders, one of the highest numbers among Samsung Life products. Hanwha Life also introduced 'The H Health Insurance' on the same day, strengthening coverage for major diseases such as cancer, brain, and heart conditions while cutting premiums to about half. Shinhan Life launched 'Shinhan Integrated Health Protection Insurance ONE' on the same day, an integrated health insurance product that allows customers to assemble around 100 special riders based on individual coverage needs such as diagnosis, hospitalization, and surgery costs. Dongyang Life released 'Guardian Angel Surgery Treatment Insurance for Everyone' the day before, a product that covers basic surgeries and new medical surgeries.

All these insurance products fall under third insurance (health, cancer, children's insurance, etc.) that can be handled by both life and non-life insurers. The reason life insurers have jumped into third insurance marketing from the start of the Gapjin year is that the '10th Reference Rate Revision' delivered by the Korea Insurance Development Institute to each life insurer at the end of last year acted as a catalyst. The reference rate is the industry average insurance rate calculated by the Korea Insurance Development Institute based on insurers' experience statistics (disease incidence rates, subscriber attributes, etc.). Insurers base their pricing on this reference rate when creating new insurance products.

The latest reference rate revision includes four new incidence rates for life insurers: three brain-related (cerebral hemorrhage, cerebral infarction, stroke) and one heart-related (acute myocardial infarction). Until now, life insurers, whose main products were whole life and variable insurance, relied on national statistics or their own data due to a lack of brain and heart insurance statistics rather than the reference rate. However, the newly calculated brain and heart disease incidence rates in this revision turned out to be more than half lower than national statistics. An industry insider explained, "If disease incidence rates decrease, the likelihood of insurers paying claims to policyholders also decreases, which benefits insurers," adding, "Life insurers can lower premiums accordingly and secure price competitiveness in the third insurance market." Although the revised reference rate will be applied to products from the second quarter, Hanwha Life has preemptively reflected it in 'The H Health Insurance.'

The application of the 10th experience mortality table from the second quarter is also an opportunity for life insurers. The experience mortality table is a statistical table that collects probabilities of disease, accident, death, etc., received from insurers, segmented by age, gender, and other factors. The Korea Insurance Development Institute revises it every 3 to 5 years, and this revision comes five years after 2019. Since the first experience mortality table was implemented in 1989, average life expectancy has increased annually. In the first table, average life expectancy was 65.65 years for men and 75.65 years for women, but by the 9th table, it had increased to 83.5 years and 88.5 years, respectively. As life expectancy increases, mortality rates decrease, making it likely that whole life insurance premiums will decrease. During the 9th experience mortality table revision, major life insurers competed to reduce whole life insurance premiums by nearly 10%. However, due to increased life expectancy, pension insurance premiums may rise or pension amounts may decrease. A representative of a major life insurer said, "We are currently setting appropriate rates for insurance products overall by reflecting the new reference rates and experience mortality tables," and predicted, "With price competitiveness gained in third insurance, many small and medium-sized life insurers besides the major companies will join the price reduction trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)