Construction Company PF Guarantees of 9.5 Trillion Won in 'Risk and Caution' Stage

Risk if Pre-Sale Rate Below 75% Even After Groundbreaking

Taeyoung and Others Focused on Commercial and Regional Areas

'Non-started' rather than 'started', 'commercial real estate' rather than 'apartments', and 'provincial areas' rather than the metropolitan area. The construction industry is growing increasingly anxious following Taeyoung Construction's application for a corporate restructuring workout. To gauge the risks of real estate project finance (PF), it is pointed out that one must consider not only the scale of construction companies' PF guarantees but also factors that determine the level of risk.

On the 2nd, Korea Ratings assessed that construction companies showing a concentration of PF guarantees in non-started projects, quasi-residential facilities such as commercial real estate and officetels, and provincial areas are unstable. Even if construction has started, a sales rate below 75% is considered risky.

Half of Contract Construction PF Guarantees Are Risky or Cautionary

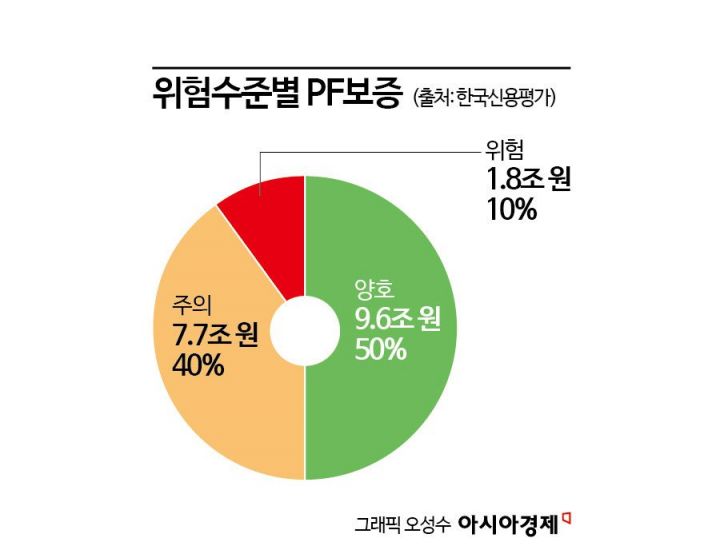

The scale of construction companies' PF guarantees stands at 27.7 trillion KRW (based on Korea Ratings' rated construction companies as of June last year). PF guarantees refer to the construction company guaranteeing and repaying the developer's loan in case of developer default or similar reasons. PF guarantees are divided into contract projects (19.1 trillion KRW) and maintenance projects (8.6 trillion KRW).

The main concern lies in contract projects. Korea Ratings classified 9.5 trillion KRW, half of the 19.1 trillion KRW, as 'risk and caution' level. This is due to the scale related to non-started projects, commercial real estate, and provincial construction volumes. In the case of Taeyoung Construction, the ratio of risk and caution PF guarantees to equity capital reached 183.7%. Lotte Construction followed with 146.3%.

Looking at the detailed composition of Taeyoung Construction's contract project PF guarantees, 70% (700 billion KRW) of the non-started volume (1 trillion KRW) consists of quasi-residential and commercial real estate in the metropolitan area and apartments in provincial areas. Similarly, 76% (3.2 trillion KRW) of Lotte Construction's non-started volume (4.2 trillion KRW) is concentrated here. Lotte Construction stated, "We reduced the PF guarantee scale by 1.6 trillion KRW in 2023 compared to 2022, and as of the third quarter last year, we hold 2 trillion KRW in cash equivalents," adding, "Although the PF guarantee scale is large and the proportion of commercial real estate is high, it is not at a dangerous level."

Provincial and Commercial Real Estate Trapped in a Quagmire

What is the background behind 'non-started', 'commercial real estate', and 'provincial areas' becoming PF triggers? Korea Ratings analyzed, "About 70% of construction companies' PF guarantees are related to non-started projects," and "Among non-started projects, quasi-residential facilities and others, which have relatively high sales downturn levels, account for 48%." Furthermore, "By region, the metropolitan area accounts for 66%, and provincial areas 34%, but excluding Hyundai Construction's non-started volume, the provincial share rises to 51%," it stated.

Although real estate indicators improved last year, this was limited to the metropolitan area, while provincial areas remained stagnant. Korea Ratings noted, "Except for Sejong and Daejeon, housing sale prices in provincial areas showed a low increase rate of around 1-2%." The decrease in unsold units was also due to construction companies' conservative sales strategies. Last year (January to August), provincial sales volumes dropped to about 40% compared to the same period the previous year.

Rising construction costs, mainly materials and labor, led to deteriorating profitability, further worsening the provincial housing market. This eliminated the room for price reductions. Korea Ratings explained, "Construction companies with a high proportion of provincial projects are expected to see delayed improvements in sales performance," adding, "Companies with lower credit ratings and construction capability rankings tend to have a higher proportion of provincial sites."

For construction companies with an AA credit rating, planned projects were concentrated in Seoul (24.8%) and Incheon/Gyeonggi (37.6%), with a relatively small provincial share (38.2%). In contrast, construction companies with a BBB credit rating had planned projects heavily skewed towards provincial areas (68.1%), with relatively small shares in Seoul (5.3%) and Incheon/Gyeonggi (26.6%).

The quasi-residential and commercial real estate markets are also experiencing sluggishness. According to KB Real Estate officetel statistics, over the past year (November 2022 to November 2023), the officetel sales price index fell by 1.30% in Seoul, 7.35% in Gyeonggi, and 3.58% in the five major metropolitan cities. Korea Ratings analyzed, "Prices of residential lodging facilities have declined, and with a surge in unsold units, risks in collecting interim and final payments have expanded," adding, "The market has stagnated due to supply-demand imbalances in knowledge business centers, and logistics centers are facing oversupply and delays in completion, leading lenders to demand construction companies assume PF debt under responsibility completion agreements."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.