All Members Signed Exclusive Contracts on the 6th

Positive Reviews from Securities Firms but Stock Price Remains Weak

Individual Activities and Profit-Taking Sales Cited as Factors

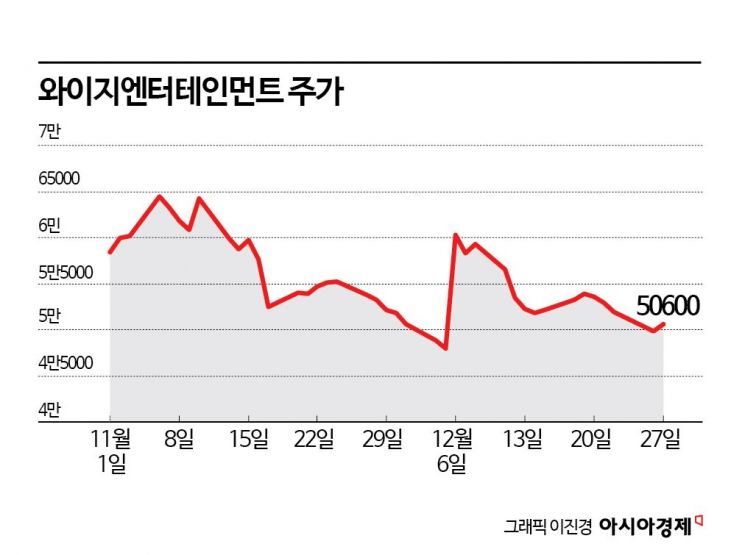

Despite positive reviews from the securities industry, YG Entertainment's stock price remains sluggish. On the 6th, after signing exclusive contracts with the four members of the world-renowned girl group 'BLACKPINK,' the securities industry praised the move, saying it resolved uncertainties and that only growth lies ahead. Individual investors rushed to buy YG Entertainment shares, but the returns have been disappointing. Amid a flood of profit-taking sales, news emerged that Jennie, one of the BLACKPINK members, is establishing a separate company for her solo activities, causing the stock price to give up all its gains.

According to the financial investment industry on the 28th, individuals have net purchased YG Entertainment shares worth 42.7 billion KRW so far this month until the previous day. The average purchase price per share was 56,200 KRW, and based on the closing price of 50,600 KRW on the previous day, this reflects an unrealized loss rate of 10%.

Institutional investors showed a net selling dominance of 24.5 billion KRW this month, with an average selling price of 53,100 KRW. Foreign investors recorded net sales of 17.9 billion KRW, with an average selling price of 55,700 KRW.

Looking at the December trading records, foreigners and institutions appear to have traded better than individuals. On the 6th, when the news of the exclusive contract with BLACKPINK was announced, YG Entertainment's stock price surged 29%. The stock, which had fallen to 47,900 KRW the day before, recovered to the 60,000 KRW level in just one day.

There had been many forecasts that failing to renew the contract with BLACKPINK could negatively impact performance. Concerns about the contract renewal grew, leading to a contraction in investment sentiment. YG Entertainment's stock price retreated until just before the contract announcement after reaching a peak of 97,000 KRW on May 31. With the celebrity drug scandal erupting, the stock price halved in six months. After the contract announcement, individuals bought YG Entertainment shares, expecting a strong rebound. Securities firms in Yeouido published positive reports the day after the contract was signed.

Andoyoung, a researcher at Korea Investment & Securities, said, "The full renewal of contracts resolved the uncertainty, which was a discount factor," and predicted, "YG Entertainment will continue to generate massive indirect sales without damaging BLACKPINK's intellectual property (IP) value."

Namsoo Lee, a researcher at Kiwoom Securities, also analyzed, "The continuation of full-group activities supports the most important artist activities, such as album releases and world tours," and added, "This addresses the performance slowdown concerns that had been pointed out."

Amid optimistic forecasts, foreigners and institutions took the opportunity to reorganize their portfolios. They reduced their holdings amid the surge in YG Entertainment's trading volume and stock price rebound. They may have sold to realize profits from the short-term price surge. Although individuals filled the gap left by foreigners and institutions, the stock price fell back to the level before the contract announcement.

Individuals, who expected the rebound trend to continue, kept averaging down their purchase price by continuing to buy more shares. In this situation, on the 24th, Jennie of BLACKPINK announced via social media that she had established 'ODD ATELIER,' causing the stock price to fluctuate once again. With Jennie establishing an individual label, BLACKPINK members plan to operate in a 'together yet separate' manner.

However, the general outlook is that YG Entertainment's stock price will trend upward once the BLACKPINK-related volatility subsides. Hwajung Lee, a researcher at NH Investment & Securities, analyzed, "Individual contracts are expected to be flexible," and added, "For personal activities requiring BLACKPINK 'titles,' such as major advertisements and solo albums, collaboration with YG Entertainment is possible." She further noted, "If the popularity of Baby Monster and Treasure increases, it could act as a catalyst for stock price growth," and added, "Baby Monster's debut song is achieving remarkable results worldwide in terms of streaming."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)