Domestic Game Stocks Plunge Due to Chinese Regulatory Measures

Sales Decline and Weak Stock Recovery Raise Pessimistic Outlook

Some Expect Limited Impact from 'Pan-Ho Issuance' Restrictions

Stocks related to online and mobile games are experiencing a rollercoaster ride due to China's announcement of game regulations. The securities industry is showing mixed forecasts for gaming stocks.

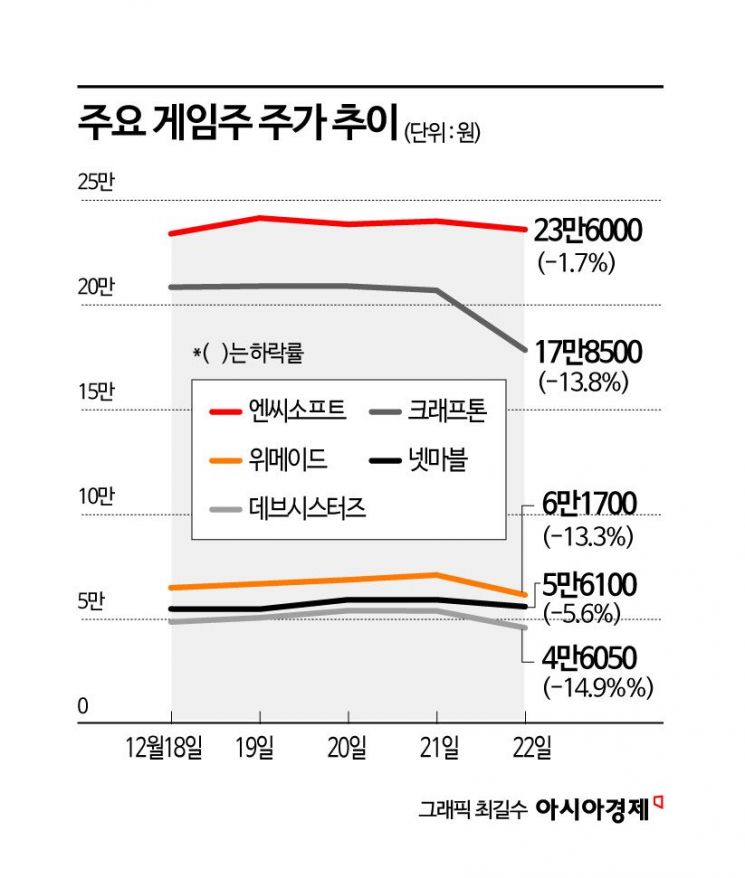

According to the Korea Exchange, Wemade, the developer of 'Mir4,' closed at 61,700 KRW on the 22nd, down 13.3%. During the day, it fell more than 15%. Devsisters, the maker of 'Cookie Run,' also dropped 14.9%, while Krafton (-13.8%), Netmarble (-5.6%), and NCSoft (-1.7%) showed weakness.

The sharp decline in gaming stocks on that day was due to China's online game regulations. The National Press and Publication Administration (NPPA) of China released a draft of the 'Online Game Management Measures,' announcing sweeping regulatory measures. The main points include ▲prohibition of rewards for multiple consecutive top-ups ▲ban on expensive transactions for auction or speculation activities ▲imposition of top-up limits, among others.

The purpose of the regulations is to limit excessive gaming and overspending. The Chinese government has been regulating the online content industry in recent years, citing risks such as youth game addiction. In 2021, it even compared online games to opium and implemented a regulation allowing only three hours of play per week.

After announcing these regulatory measures, shares of Chinese gaming companies Tencent and NetEase fell by 12-16%. In response, the Chinese government calmed the angry market by stating that it is currently collecting opinions on the online game management measures and aims to promote the development of the gaming industry. The finalized regulations are expected to be released by January next year.

However, the domestic securities industry is showing a skeptical response. In particular, there is analysis that the impact will be greater on MMORPG (Massively Multiplayer Online Role-Playing Game) developers, where top-spending users account for most of the revenue, due to the aspect of limiting individual top-up limits.

Yoon Ye-ji, a researcher at Hi Investment & Securities, said, “Although details such as the method of setting top-up limits per game and the application cycle of the top-up limits are undecided, a conservative approach is necessary for games sensitive to this clause,” adding, “NCSoft’s ‘Blade & Soul 2’ and Wemade’s ‘Mir M,’ which are expected to be released in the first half of next year after receiving Chinese licenses this time, will have the direction of these regulations play an important role in revenue estimates.”

Kim Ha-jung, a researcher at Daol Investment & Securities, said, “During the dark period of Chinese game regulations in 2021, the performance of Chinese-related game companies such as Krafton significantly declined, and even games that had already received licenses performed poorly,” adding, “Considering the change in the trend of easing Chinese game regulations that continued this year, a full recovery of stock prices will not be easy in the future.”

On the other hand, there are opinions that concerns can be alleviated as the Chinese government resumed issuing 40 types of game licenses along with this regulatory proposal. Ahn Jae-min, a researcher at NH Investment & Securities, said, “Since additional licenses have been issued, companies preparing to launch games in China in 2024 are positive,” and predicted, “Wemade, Netmarble, Devsisters, NCSoft, and others will show a favorable trend when the game release schedules become concrete.”

Lim Hee-seok, a researcher at Mirae Asset Securities, analyzed, “In the case of Krafton’s ‘Peacekeeper Elite,’ the average revenue per user (ARPU) is low, so the regulatory impact is limited,” adding, “Wemade holds the Mir intellectual property (IP), which has top recognition and a loyal user base in China, so it has high potential for success.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)