Some Insurers Set Aside Trillions in Surrender Value Reserves

Potential Side Effects of Short-Term Profit Boosts

May Undermine Objectivity and Comparability of Insurer Performance

Some insurance companies are drawing attention by accumulating large reserves for surrender refunds, which are funds to be returned to customers when they cancel their contracts. This is interpreted as a result of aggressively increasing new contracts to raise the new profitability indicator, Contract Service Margin (CSM). There are even criticisms that this is a side effect of inflating short-term performance under the newly changed accounting standards.

According to the industry on the 22nd, some insurers are setting aside surrender refund reserves in the trillions of won. Surrender refunds are amounts that must be returned to customers when they cancel their insurance contracts. From this year, the new accounting standard IFRS17 was introduced, which evaluates insurance liabilities at fair value rather than cost, making the previously set surrender refunds potentially insufficient. If a large number of subscribers cancel their insurance at once, the refund payments may not be fulfilled. To prepare for this, financial authorities have required insurers to accumulate part of their retained earnings within capital as separate surrender refund reserves, and this amount cannot be used for dividends.

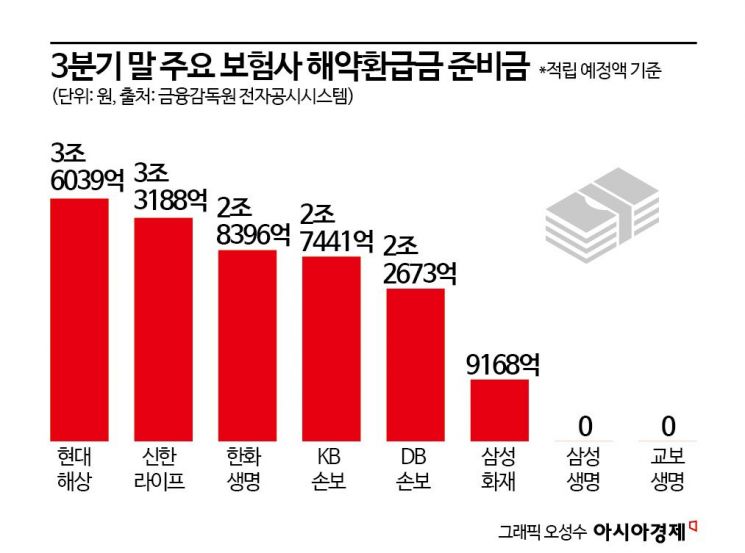

The company that has accumulated the most surrender refund reserves is Hyundai Marine & Fire Insurance. As of the end of the third quarter, it decided to set aside 3.6039 trillion won. Shinhan Life (3.3188 trillion won), Hanwha Life (2.8396 trillion won), KB Insurance (2.7441 trillion won), and DB Insurance (2.2673 trillion won) also announced that they would prepare reserves exceeding 2 trillion won. In contrast, Samsung Life and Kyobo Life have no surrender refund reserves.

The problem is that the increase in surrender refund reserves may be a side effect of inflating the profitability indicator CSM. CSM is calculated by subtracting surrender refunds, operating expenses, and reserves for volatility (Risk Adjustment, RA) from the premiums received by the insurer. The occurrence of surrender refund reserves means that the surrender refunds are insufficient, which could imply that surrender refunds and operating expenses were underestimated to increase CSM.

In fact, major insurers have made expanding CSM their top priority since the introduction of IFRS17. They changed their sales strategies to focus on protection-type insurance favorable to CSM and worked hard. Competition intensified as they increased new contracts favorable to CSM, such as short-term payment whole life insurance and flu insurance. The atmosphere was such that even quarterly net losses were tolerated as long as CSM increased. Concerned about excessive CSM inflation, financial authorities also stepped in. The Financial Supervisory Service issued separate guidelines to prevent overly optimistic accounting assumptions in products like indemnity medical insurance and no/low surrender value insurance, aiming at CSM increases.

The accounting industry is also expressing skepticism. It is difficult to accept the insurance liabilities and CSM of companies that have excessively accumulated surrender refund reserves at face value. An insurance accounting expert said, "If new contracts increase significantly, surrender refund reserves can also increase, but from the management's perspective, even if a large amount of surrender refund reserves is accumulated, they may want to recognize short-term profits by selling many new contracts," adding, "This can be interpreted as indicating that the currently accumulated CSM is somewhat overestimated, which could ultimately undermine the objectivity and comparability of the insurance industry's performance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)