Starting Hong Kong Corporation... 20th Anniversary of Global Expansion

Total 14 M&A Deals, 8 Overseas Acquisitions

Mirae Asset Securities, Recent Acquisition of Local Indian Corporation

Mirae Asset Group, which took its first step into overseas markets by establishing an asset management company in Hong Kong in 2003, is accelerating market expansion on the occasion of its 20th anniversary of global advancement. Recently, it has been focusing the group’s merger and acquisition (M&A) capabilities on overseas markets, including acquiring a local securities firm in India for the first time in Korea. Chairman Park Hyun-joo is directly leading overseas operations as the group’s Global Strategist Officer (GSO).

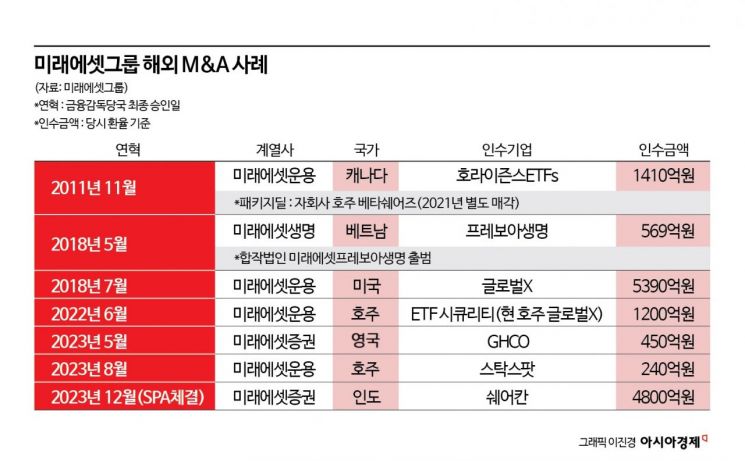

According to Mirae Asset Group on the 27th, out of the total 14 M&As conducted since the group’s launch in 1997, 8 cases (57.1%) were overseas acquisitions. All five M&As by affiliates in the past five years were completed abroad. The overseas acquisition cases by affiliates include five by Mirae Asset Global Investments, two by Mirae Asset Securities, and one by Mirae Asset Life Insurance. Essentially, the group is pouring all its M&A capabilities into overseas markets. Chairman Park’s intention is to find growth engines in overseas markets. This is why he has been serving as the group’s GSO since 2018.

About 40% of Mirae Asset Global Investments’ AUM is overseas... Presence in 18 regions worldwide

Mirae Asset Group marked its 20th anniversary of global expansion this year. In particular, Mirae Asset Global Investments, which has led most of the overseas acquisitions, has expanded its global network by entering 18 regions worldwide, including Korea, Hong Kong, the United States, Canada, Australia, and Japan. As of the end of last month, the scale of overseas assets under management (AUM) was approximately KRW 120 trillion, accounting for about 40% of the total AUM of KRW 300 trillion of Mirae Asset Global Investments, including domestic assets. According to ETFGI, a global exchange-traded fund (ETF) research firm, Mirae Asset Global Investments ranked 12th among global asset managers in terms of net asset size as of the end of June.

The first overseas entry began with the establishment of Mirae Asset Global Investments’ Hong Kong branch on December 17, 2003. In 2005, it launched the 'Mirae Asset Asia Pacific Star Fund,' managed directly by local professional portfolio managers in Hong Kong, and in 2011, it entered the Hong Kong ETF market for the first time in Korea. Despite negative forecasts about Korean financial companies entering overseas markets at the time, Chairman Park boldly challenged the overseas market, saying, “Even if I fail, the experience will remain in the Korean capital market.” Thanks to this perseverance, the Hong Kong branch has grown to become the 6th largest asset manager in Hong Kong. As of the end of last month, its total AUM was about KRW 2 trillion, and it currently manages 35 ETFs. In October, it cross-listed the 'Global X Hong Kong Hang Seng TECH ETF' on the Hong Kong, Shanghai, and Shenzhen exchanges, becoming the first Korean asset manager to enter the Chinese mainland ETF market.

The acquisition of the large Canadian asset manager 'Horizons ETFs' in 2011 became a turning point for targeting the North American market. Through this deal, Mirae Asset also acquired the Australian asset manager 'BetaShares,' a subsidiary of Horizons ETFs. BetaShares, which grew over more than ten years, was sold to a U.S.-based private equity firm in 2021, generating a profit of several hundred billion won for Mirae Asset.

In 2018, Mirae Asset acquired the U.S. asset manager 'Global X.' Global X has played a foothold role in global territorial expansion by listing ETFs on exchanges in various countries. During the acquisition process of the Australian asset manager 'Securities' last year, Mirae Asset Global ETFs Holdings in Hong Kong and Global X in the U.S. invested 55% and 45%, respectively, marking the first case of acquiring an overseas asset manager solely with profits earned abroad. Currently, Securities operates under the name 'Global X Australia.' In August, Mirae Asset acquired 'Stockspot,' an Australian robo-advisor specialized asset manager, to develop financial products incorporating artificial intelligence (AI)-based services.

Mirae Asset Securities acquires UK’s GHCO and India’s Sharekhan this year

Mirae Asset Securities, a core affiliate of Mirae Asset Group, boasts the largest global network among domestic securities firms. It currently has 10 overseas local corporations and 3 offices. Notably, on the 12th, it signed a stock purchase agreement (SPA) to acquire the Indian local securities firm 'Sharekhan Limited' for KRW 480 billion. Mirae Asset Securities entered the Indian capital market in 2018 as the first domestic securities firm and acquired a local company within five years. Established in 2000, Sharekhan is ranked around 10th in the local industry. Mirae Asset plans to make Sharekhan one of the top five securities firms locally within five years and focus on aggressively targeting the Indian financial market, which is gaining attention as the 'Next China.'

Earlier, in May, Mirae Asset Securities acquired GHCO, a European ETF market-making specialist company, through its London branch. Established in 2005, GHCO provides 'on-exchange liquidity provision' services that maintain the stock price of specific ETF issues at a certain level through its proprietary system. This allowed Mirae Asset Securities to enter the European ETF market, the second largest in the world after the U.S. Through these efforts, Mirae Asset Securities recorded a pre-tax net profit of KRW 52.8 billion from overseas subsidiaries in the third quarter of this year, a 19.2% increase from the previous quarter and an 83.9% increase compared to the same period last year. Additionally, Mirae Asset Life Insurance acquired shares of 'Prevoir Vietnam Life' in Vietnam in May 2018 and launched the integrated corporation Mirae Asset Prevoir Life. This was an achievement following the entry of Mirae Asset Global Investments and Mirae Asset Securities into Vietnam in 2006-2007, the first among domestic asset managers and securities firms.

Meanwhile, Chairman Park Hyun-joo will be awarded the 'International CEO of the Year' at the annual conference of the Academy of International Business (AIB) in July next year in recognition of her achievements in overseas expansion. AIB, which has more than 3,400 members from about 90 countries worldwide, has been awarding the International CEO of the Year to business leaders who have significantly enhanced their company’s reputation and performance on the international stage.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)