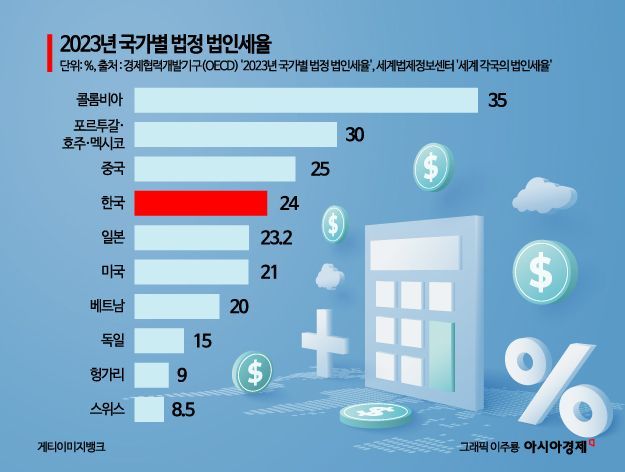

South Korea's Top Corporate Tax Rate 24% vs. U.S. 21%

Business Sector Anticipates Further Corporate Tax Cuts

Among OECD countries, Colombia has the highest corporate tax rate at 35%. Although South Korea's corporate tax rate decreased by 1 percentage point last year, its top rate remains relatively high at 24% compared to other major OECD countries including the United States and Germany.

According to the World Legal Information Center and the 2023 OECD statutory corporate tax rate statistics compiled on the 25th, Colombia's top corporate tax rate is 35%, the highest in the world. Countries with high top rates also include Portugal, Australia, Mexico (30%), New Zealand (28%), and Chile (27%). On the other hand, Switzerland (8.5%), Hungary (9%), and Ireland (12.5%) are representative countries with low corporate tax rates.

The United States has a top corporate tax rate of 21%, which is applied uniformly regardless of taxable income amount. However, in addition to the federal corporate tax rate, state governments impose their own corporate taxes, so rates vary slightly by state. For example, six states?Texas, Washington, Nevada, Ohio, Wyoming, and South Dakota?do not impose state corporate taxes. Meanwhile, the corporate tax rates in the other 44 states and Washington D.C. range from 2.5% (North Carolina) to 11.5% (New Jersey).

Germany imposes a corporate tax of 15% on taxable income. However, additional taxes such as trade tax levied by state governments and a solidarity surcharge to support the former East Germany mean that the total tax burden amounts to about 30% of taxable income. Recently, the German government decided to introduce the Growth Opportunities Act, which includes tax cuts to overcome the economic recession and ease the burden on small and medium-sized enterprises. If the law takes effect, corporate tax reductions totaling approximately 7 billion euros (about 9.9 trillion KRW) annually will be implemented in Germany until 2028.

In Asia, Japan applies a corporate tax rate of 23.20% to ordinary corporations (small and medium-sized corporations under the Corporate Tax Act). However, for corporations with capital of 100 million yen or less, the tax rate varies based on annual corporate income. If annual corporate income is 8 million yen or less, a 15% rate applies except for certain excluded businesses; if annual corporate income exceeds 8 million yen, the 23.20% corporate tax rate applies.

In Vietnam, the top corporate tax rate is 20%. Companies operating in legally designated sectors, engaging in new investments, or conducting social activities can receive benefits such as preferential tax rates, exemptions, and reductions for a certain period. This includes cases where Korean companies establish local subsidiaries in Vietnam and receive tax reduction benefits. Companies engaged in oil, gas, and rare resource exploration and mining are subject to corporate tax rates ranging from 32% to 50%.

South Korea's current top corporate tax rate is 24%.

According to Article 55 of the Corporate Tax Act, revised and enforced from January 1 this year, corporate tax rates have been reduced by 1% point across taxable income brackets, applying rates from a minimum of 9% to a maximum of 24%. The tax rates are applied by taxable income brackets as follows: under 2 billion KRW (9%), 2 billion to 20 billion KRW (19%), 20 billion to 300 billion KRW (21%), and over 300 billion KRW (24%). Last year, the government initially proposed a tax law amendment to lower the top corporate tax rate to 22%, but this was decided otherwise during the National Assembly discussions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.