LS Materials Listing Boosts Affiliate Recognition

Gaon Cable Enhances Financial Stability with Increased Capital

LS Eco Energy Stock Doubles on New Business Expectations

LS Group affiliates are gaining attention in the domestic stock market. Since its listing on the 12th, LS Materials has been hitting record highs in its stock price day after day. The stock price of Gaon Cable, which is raising funds to repay debt, has also been rising continuously, increasing the likelihood of a successful rights offering. The market capitalization of LS Cable Asia, which is set to change its name to LS Eco Energy, has doubled in just two months.

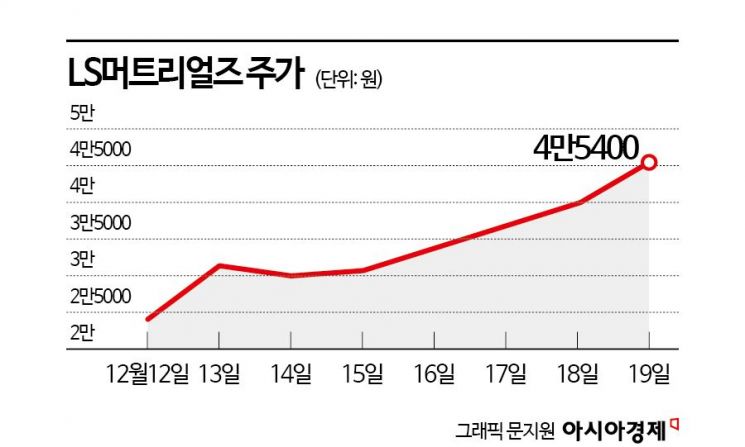

According to the Korea Exchange on the 20th, LS Materials' stock price rose 657% compared to its initial public offering (IPO) price within just six trading days after listing. It closed at 24,000 KRW on the first day of trading, up from the IPO price of 6,000 KRW. The stock hit the daily upper limit again the next day, rapidly increasing its market capitalization. The market cap surpassed 3 trillion KRW after rising nearly 14% the previous day.

Since LS Materials' listing, individual investors have led the stock price increase with a net purchase of 338.1 billion KRW. The average purchase price is 33,100 KRW, resulting in an estimated return of 37% based on the current stock price.

LS Materials is a manufacturer of high-output energy storage devices called "ultracapacitors (UC)." UCs are used in wind turbine generators, uninterruptible power supplies (UPS) in semiconductor factories, factory automation, and automated guided vehicles (AGVs). They are noted for their fast charging capability and long lifespan, making them a promising alternative to lithium-ion batteries (LIB).

Jongseon Park, a researcher at Eugene Investment & Securities, said, "The global ultracapacitor market is expected to grow at an average annual rate of 24.9% from 2020 to 2026," adding, "LS Materials will continue stable performance growth based on the high trust of major domestic and international customers."

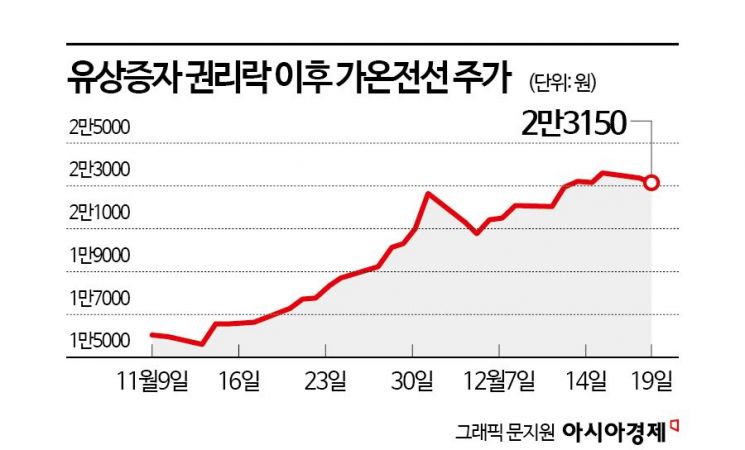

With LS Materials' listing on the KOSDAQ market, interest in LS Group affiliates has increased. Thanks to this, Gaon Cable's stock price, which had fallen due to the rights offering issue, has recovered. Gaon Cable's stock price rose 44.6% one month after the rights offering ex-rights date. The new share issuance price was set at 13,730 KRW, higher than the first issuance price of 11,270 KRW. The public offering size increased from 11.3 billion KRW to 13.7 billion KRW. All the funds raised will be used to repay debt.

Gaon Cable's debt ratio stood at 150.5% as of the end of the third quarter, up 2.27 percentage points from the end of last year. This was due to increased working capital burdens caused by rising raw material prices. By repaying more than 2 billion KRW in debt than planned, financial soundness is expected to improve.

Gaon Cable conducted a subscription for existing shareholders over two days starting on the 18th. Considering that Gaon Cable's stock price remained around 23,000 KRW during the subscription, the subscription rate is expected to have been high. The board of directors of LS Cable, the largest shareholder, resolved to participate in the subscription for more than 100% of the allocated new shares.

Gaon Cable recorded sales of 980.1 billion KRW and operating profit of 34.4 billion KRW through the third quarter of this year. The operating profit surpassed last year's 24.1 billion KRW in just three quarters.

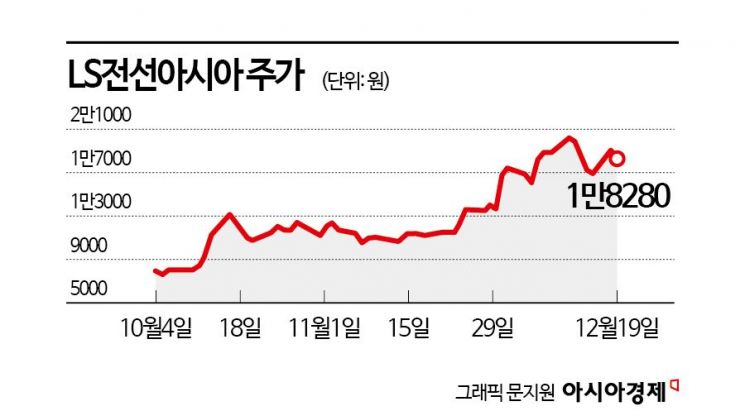

LS Cable Asia attracted more attention in the stock market than LS Materials and Gaon Cable. Its stock price rose more than 120% in the past two months. On the 12th, it held an extraordinary general meeting of shareholders and approved a proposal to change its name to LS Eco Energy. LS Cable Asia decided to change its name as it plans to pursue a rare earth business. It is expanding its scope from the existing power and communication cable business to submarine cables and rare earths. It plans to supply neodymium and other rare earths refined overseas to domestic and international general trading companies and permanent magnet manufacturers.

Amid growing expectations for group affiliates, the outlook for LS, the holding company, is also bright. Jisan Kim, a researcher at Kiwoom Securities, said, "The performance of the cable division is the most important factor in LS's corporate value," adding, "The cable division will continue its record-breaking performance streak this year and next year." He also added, "The contribution of high-value-added submarine cables to profits will increase, and subsidiaries such as LS Cable Asia, LS Materials, and Gaon Cable will also show simultaneous favorable performance by expanding synergy effects."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)