Bank of Korea Hong Kong Resident Report

H Shares Plunge 59% While A Shares Fall 16%

Mainland Investors and Foreigners Diverge on China Outlook

Foreigners' Negative Outlook Increases Downward Pressure on H Shares

Large Losses Expected for Next Year's Maturing ELS

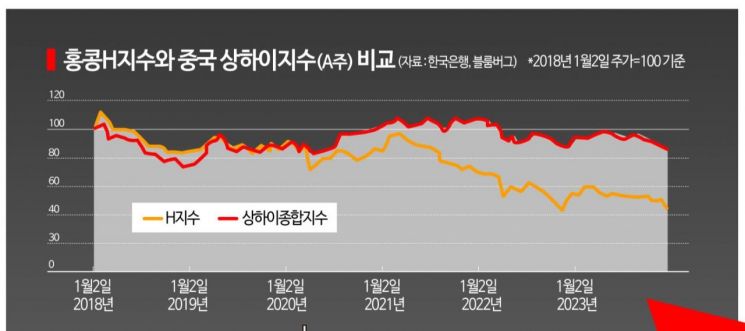

As the Hong Kong H-Share Index (HSCEI) plummets, large-scale losses are expected in equity-linked securities (ELS) based on this underlying asset, while the mainland China Shanghai Index (A-shares) shows relatively smaller declines, drawing attention. Analysts attribute this to mainland Chinese investors, who primarily trade A-shares, having a relatively more optimistic outlook on China's economic prospects, whereas foreign investors, who mainly trade H-shares, still view China's economic outlook negatively.

'Foreign' H-Share Index Plummets... 'Domestic' A-Shares Decline Less

The Chinese stock market is broadly divided into A-shares listed on the mainland and H-shares listed in Hong Kong. A-shares are stocks exclusively for domestic investors listed on the Shanghai and Shenzhen stock exchanges, while H-shares are stocks of mainland Chinese companies listed in Hong Kong. The H-Share Index is calculated based on the market capitalization of the 50 largest companies by market cap and trading volume among H-shares. A-shares are traded in yuan, whereas H-shares are traded in Hong Kong dollars and other currencies. Essentially, A-shares are for domestic investors, and H-shares are for foreign investors.

Although the same stocks are listed and traded under the names A-shares and H-shares, their values differ. According to a report from the Bank of Korea's Hong Kong representative office, the H-Share Index has dropped about 59% from January 26, 2018, before the COVID-19 pandemic, to June 11 this year, while the Chinese A-shares (Shanghai Index) have fallen only 16%, showing a significant difference. The benchmark for ELS (equity-linked securities) sold in Korea, which are facing concerns over large-scale losses, is based on the sharply declining Hong Kong H-Share Index.

The sharper decline in the H-Share Index is mainly attributed to the collapse in stock prices of China's mega real estate companies such as Evergrande and Country Garden, which are listed only in Hong Kong, due to the downturn in China's real estate market. Since their peak in 2021, Evergrande's stock price has dropped 98.6%, and Country Garden's has fallen 92.9%. Additionally, the poor performance of mega big-tech companies like Tencent and Alibaba, also listed only in Hong Kong, due to regulatory crackdowns by Chinese authorities, has contributed to the decline in the H-Share Index.

Chinese President Xi Jinping arrived at San Francisco International Airport in California, USA, on the 14th of last month (local time). [Image source=Yonhap News]

Chinese President Xi Jinping arrived at San Francisco International Airport in California, USA, on the 14th of last month (local time). [Image source=Yonhap News]

"China Will Improve" vs "Uncertainty Remains"

However, the Bank of Korea explained that differing assessments of China's economic outlook between domestic and foreign perspectives also contribute to this disparity. Foreign investors, who are major players in the Hong Kong stock market, perceive greater uncertainty about the sustainability of China's economic growth compared to domestic investors, leading them to reduce their exposure, which has further pressured the H-Share Index downward.

According to the Bank of Korea's Hong Kong representative office report, foreign investors account for about 40-50% of trading volume in the fully liberalized Hong Kong capital market, whereas in the mainland China market, they represent only about 6%. Mainland individual investors, who make up the majority of Chinese A-shares, have maintained steady investment in domestic stocks with optimistic expectations for government stimulus policies and new industry development, which is believed to have moderated the decline in A-shares.

In fact, there is strong internal expectation within China for economic recovery next year. Tang Jianwei, Director of the Development Research Department at China Communications Bank, mentioned at the '9th Anniversary Conference of the Seoul Won-Yuan Direct Trading Market' held on June 11 at The Plaza Hotel in Jung-gu, Seoul, that the Chinese government is actively promoting redevelopment projects in urban dilapidated areas. He explained, "Next year, the Chinese real estate market could see zero growth from a neutral perspective or a slight rebound from an optimistic viewpoint."

Especially, Dr. Tang predicted that the recovery speed of China's economy next year will accelerate as the manufacturing sector bottoms out and rebounds. He emphasized, "Next year will be the first year that China's economy completely recovers from the impact of COVID-19. The Chinese government is expected to set the economic growth target around 5%. If China achieves 5% growth again next year following this year, it will be qualitatively better as it is achieved without a base effect."

"Risk Management Comes First in Chinese Stock Investment"

On the other hand, concerns about China's economy remain high outside China. The International Monetary Fund (IMF) forecasts China's growth rate to decline from 5.2% this year to 4.5% next year, and the Organisation for Economic Co-operation and Development (OECD) projects a decrease from 5.2% to 4.7%. Jeon Jong-gyu, a researcher at Samsung Securities, pointed out, "The economic work conference in December, which was a key policy event, remained at the consensus level of the financial market, and concerns about weak economic indicators persist. Risk management should be prioritized in both the mainland China and Hong Kong stock markets."

Examining the AH premium, calculated from the price difference of 81 companies issuing both mainland China A-shares and Hong Kong H-shares, it recently rose above 140. Considering it was around 128 in January 2018, this is a significant increase. The AH premium is the ratio of Chinese stock prices to Hong Kong stock prices for the same companies listed on both Chinese and Hong Kong exchanges. An index of 140 means that Chinese A-shares are 40% more expensive than Hong Kong H-shares, indicating a large divergence in economic outlooks between domestic and foreign perspectives.

The problem is that unless the negative external views surrounding China's real estate market and other factors are resolved, it will be difficult for the H-Share Index to rebound. In that case, large-scale losses in ELS products maturing next year will be unavoidable. The Bank of Korea stated, "The likelihood of a short-term recovery in China's real estate market is low, and recent Chinese government policies to foster advanced industries are not directly related to the Hong Kong stock market. Therefore, it is expected that the H-Share Index will not easily recover dramatically to previous levels."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.