US Treasury Department Unveils Detailed Plan for IRA Advanced Manufacturing Tax Credit

On the 14th (local time), the U.S. Department of the Treasury announced provisional guidance on the Advanced Manufacturing Production Credit (AMPC) under the Inflation Reduction Act (IRA). AMPC is a system that provides tax credits for products manufactured and sold using advanced manufacturing technologies within the United States. It was created to incentivize investment in advanced manufacturing facilities in the U.S.

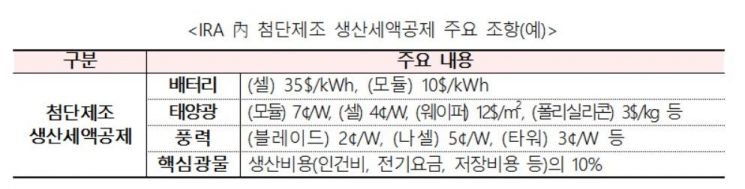

According to the detailed guidelines released that day, the tax credit applies to products completed and sold after December 31, 2022. This tax credit provision will be effective from 2023 to 2032, and eligible items include battery components, solar and wind power parts, and critical minerals. However, the tax credit amounts for batteries, solar, and wind will be gradually reduced starting in 2030.

For batteries, tax credits of $35 and $10 per kilowatt-hour (kWh) are applied to cells and modules, respectively. Solar modules and cells receive 7 cents and 4 cents per watt (W), respectively, while wafers qualify for $12 per cubic meter (㎥), and polysilicon receives $3 per kilogram (kg) in tax credits. For wind power, blades and nacelles are eligible for 2 cents and 5 cents per watt, respectively, and towers receive 3 cents per watt in tax credits. Critical minerals can claim tax credits equal to 10% of production costs, including labor, electricity, and storage expenses.

An official from the Ministry of Trade, Industry and Energy explained, "The newly announced advanced manufacturing production tax credit includes detailed definitions of eligible items and applicable conditions, resolving uncertainties regarding whether companies producing advanced manufacturing items in the U.S. can benefit from the tax credits and the scale of such credits. In particular, we expect significant benefits for our battery companies and solar and wind-related firms that have established production facilities in the U.S. to enter the North American market."

Meanwhile, the U.S. Treasury posted this guidance on the 15th and will hold a 60-day public comment period. A public hearing is also scheduled for February 22 next year. The Ministry official added, "The government has been consulting with the U.S. government to reflect the opinions of our industry regarding the IRA, and will continue to strengthen communication with the industry and maintain negotiations with the U.S. to maximize benefits for our companies and minimize burdens."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)