NH Investment and Shinhan Investment as Underwriters... Two SPCs Split Acquisition Equally

Possibility of Use for Strengthening Vice Chairman Jeong Daehyun's Control

Sampyo Group's key affiliate, Sampyo Industrial, has issued 150 billion KRW worth of Redeemable Preferred Shares (RPS). While early redeeming previously issued RPS, the company increased the issuance scale. It is expected to be used for purposes such as raising funds during the restructuring of the group's governance centered on Vice Chairman Jeong Dae-hyun, who is at the pinnacle of the group's succession structure.

According to the investment banking (IB) industry, Sampyo Industrial recently issued RPS worth 150 billion KRW with NH Investment & Securities and Shinhan Investment Corp. as lead managers. The issued shares total 3,879,980 shares at 38,660 KRW per share. Of these, half, 1,939,990 shares, were acquired by SGIBSP Je Samcha, a special purpose company (SPC), and the other half by Cube SP. The two SPCs issued securitized bonds using the RPS as underlying assets (a type of collateral) to raise funds for acquiring the RPS.

In July this year, Sampyo Group restructured its governance by merging Sampyo, which had served as the holding company, into its subsidiary Sampyo Industrial through a reverse merger. The merger ratio was 1.8742887 to 1 between Sampyo and Sampyo Industrial, with Sampyo being the dissolving company and Sampyo Industrial remaining as the surviving company. As a result, Sampyo Industrial, at the top of the group’s governance structure, is understood to have taken on the role of the holding company.

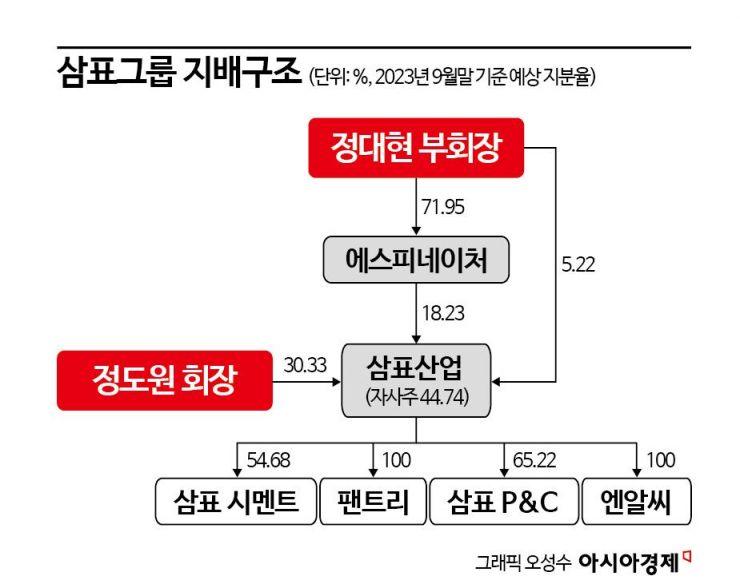

Prior to this, Sampyo Industrial conducted a paid-in capital increase worth 60.05 billion KRW by allocating shares to a third party, Espinature. The issued shares were 1.95 million common shares at a price of 30,771 KRW per share. Through this capital increase, Espinature’s stake in Sampyo Industrial rose from 1.74% to 17.21%, about tenfold. Vice Chairman Jeong Dae-hyun holds 71.95% of Espinature’s shares, which is interpreted as increasing his control over Sampyo Industrial through Espinature.

The biggest change resulting from the merger and capital increase is the significant expansion of Vice Chairman Jeong Dae-hyun’s control over the group. Previously, Jeong’s holdings in Sampyo (the former holding company) consisted of 11.34% directly held and 19.43% held through Espinature, totaling about 30%. Additionally, Espinature’s stake in Sampyo Industrial was negligible at 1.74%. Chairman Jeong Do-won held 65.99% of Sampyo shares, giving him substantially greater actual control over the group than Vice Chairman Jeong.

However, with the restructuring of the governance through the merger and capital increase, Vice Chairman Jeong’s stake in Sampyo Industrial increased to 5.22%. Espinature’s stake in Sampyo Industrial also surged from the 1% range to 18.23%. Meanwhile, Chairman Jeong Do-won’s stake in Sampyo Industrial decreased to 30.33%. Although the combined stake of Vice Chairman Jeong and Espinature in Sampyo Industrial is 23.45%, which is not considered high control, when factoring in 44.74% of treasury shares, the effective control rises to the 68% range.

At the same time, the ownership structure linking affiliates such as 'Espinature → Sampyo → Sampyo Industrial → Sampyo Cement' was simplified by one step to 'Espinature → Sampyo Industrial → Sampyo Cement.' Sampyo Industrial holds affiliates including its core affiliate Sampyo Cement, as well as Pentrack, Sampyo P&C, and NR&C. Espinature, Vice Chairman Jeong’s personal company, also owns affiliates such as SPSNA, SP Environment, Hongmyeong Industry, and Best Engineering.

With Sampyo Industrial issuing a large-scale RPS, there are expectations that the RPS will be used to expand Vice Chairman Jeong’s control. An IB industry insider said, "The previously issued RPS included an agreement that allowed investors to transfer their RPS to persons or corporations designated by Sampyo Industrial," adding, "By issuing RPS to secure funds, it can be used for governance restructuring through changes in RPS ownership."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)