Simple Investment Relationship Daiso Sangyo

Second Son Demands Management Participation After Succession

Japanese Side's Shares Liquidated After 22 Years

Erasing the Stigma of 'Japanese-affiliated Company'

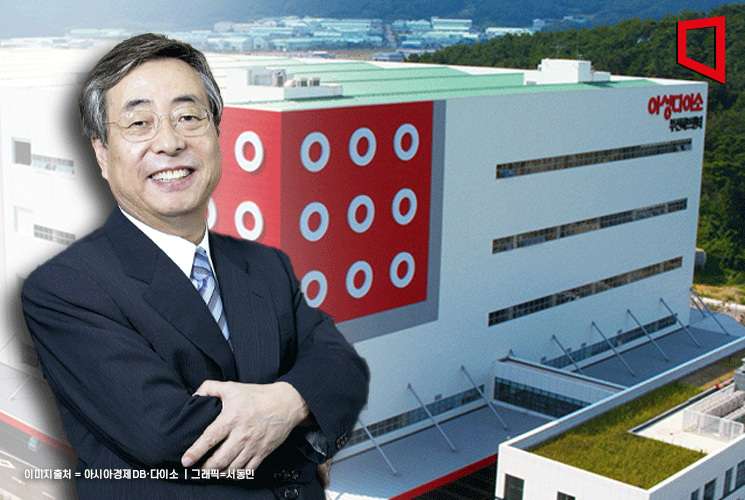

Chairman Park of Aseong Daiso has fulfilled his long-cherished wish. By liquidating the Japanese stake, he has completely erased the stigma of "Daiso being a Japanese-affiliated company." Until now, Chairman Park had emphasized that Daiso was a purely native Korean company, but his claim was met with skepticism due to Japanese investment and management participation.

On the afternoon of the 12th, Aseong Daiso announced, "To become a native Korean people's store again, we have decided to purchase all shares of Japan's Daiso Sangyo (大創産業, Daiso Sangyo)." With this decision, the shareholding ratio of Aseong HMP, where Chairman Park is the largest shareholder, will increase to 84.23%. The remaining shares are held by Chairman Park's second daughter Park Young-joo at 13.9% and eldest daughter Park Soo-yeon at 1.87%, making Aseong Daiso's shareholding structure 100% owned by the Park family.

Aseong Daiso started in May 1997 when Chairman Park, a former salaryman, opened a household goods store called "Asco Even Plaza" in Cheonho-dong, Gangdong-gu, Seoul. Later, in 2001, Chairman Park received an investment of 400 million yen (about 3.8 billion KRW) from Daiso Sangyo, a business partner, and changed the store name to Daiso, the Japanese pronunciation of Daechang. In return for the investment, he gave Daiso Sangyo a 34.21% stake.

Daiso Sangyo remained a passive investor as the second-largest shareholder, but in 2018, when founder Yano Hirotake stepped down from management and his second son Yano Seiji was promoted to president, their stance changed completely. They began asserting their shareholder rights by demanding management participation and increased dividends. Eventually, in March last year, Aseong Daiso yielded board seats and auditor positions to Daiso Sangyo personnel at the shareholders' meeting.

Whenever there was a boycott of Japanese products, Aseong Daiso defended itself against accusations of being a "Japanese-affiliated company" by stating that "apart from equity investment, there are no royalty payments, personnel exchanges, or management participation with Daiso Sangyo." Chairman Park also repeatedly emphasized in media interviews and his autobiography that Daiso was a purely native Korean company he founded. However, with Daiso Sangyo's active management participation last year, Chairman Park's claims seemed to lose credibility.

Industry insiders largely expected that it would not be easy for Aseong Daiso to proceed with equity liquidation against Daiso Sangyo, which was expanding its role within the company. However, Chairman Park reportedly made a bold decision to purchase the shares despite the heavy financial burden, paying more than 100 times the initial investment from Daiso Sangyo. It is reported that Aseong Daiso invested about 500 billion KRW to acquire Daiso Sangyo's shares this time.

Earlier, Chairman Park said in his autobiography Manage with 1,000 Won, "What is clear is that Aseong Daiso is a purely native Korean company that I founded and have led for 30 years. We have steadily grown step by step over more than 30 years. It is a native company built by our own hands, so when will we be free from the misunderstanding and burden of being called a Japanese company...?" That day has come. It has been 22 years since receiving investment from Japan.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.