Acquisition of 34% Stake in Japan Daiso Sanko

"Asung Daiso Owns the Trademark, Name to be Retained"

Asung HMP (HMP), the largest shareholder of Asung Daiso, a uniform-priced household goods store, has purchased all the shares held by Daiso Sangyo (Daechang Industry), the second-largest shareholder from Japan. By acquiring all the Japanese shares, the company is determined to transform into a native national enterprise.

On the 12th, Asung Daiso stated, "We purchased all the shares to become a native national store in Korea," adding, "Since we hold the trademark rights for Daiso domestically, there will be no change in the company name." The purchase price of the shares is reported to be 500 billion KRW, but the company declined to disclose the exact amount. Daiso Sangyo's initial investment was 3.8 billion KRW, so based on the 500 billion KRW figure, it is estimated that they made a profit exceeding 130 times their original investment.

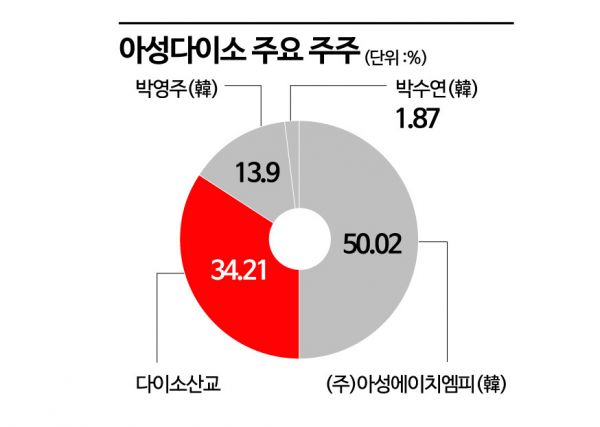

Before the share acquisition, the shareholding structure of Asung Daiso showed that Asung HMP, led by Chairman Park Jeong-bu, held 50.02%, and Daiso Sangyo held 34.21%. The remainder was reportedly held by parties related to Chairman Park. With this acquisition, Asung HMP's stake increased to 84.23%, enabling Chairman Park and the Asung Group to own 100% of Asung Daiso's shares.

Asung Daiso has not clearly stated the reasons for deciding on the share acquisition. However, it is presumed that the Asung Group intended to prevent Daiso Sangyo's expanding role in advance, as Daiso Sangyo showed intentions to participate in management by demanding increased dividends at the shareholders' meeting in March this year. At that shareholders' meeting, Daiso Sangyo, as the second-largest shareholder, asserted their share rights and requested management participation, appointing two inside directors and one auditor from their own people. They also reportedly insisted that dividends should increase proportionally with sales growth.

Asung Daiso began when Park Jeong-bu, a former salaryman and current CEO of Asung Daiso, opened a household goods store called "Asco Even Plaza" in Cheonho-dong, Gangdong-gu, Seoul, in May 1997. The Asung Group partnered with Daiso Sangyo when they started supplying products to the 100-yen shop "Daiso" operated by Daiso Sangyo. At that time, Daiso Sangyo requested exclusive supply rights, and Chairman Park demanded an investment of 400 million yen (approximately 3.8 billion KRW), in exchange for which he gave a 34% stake. The store name was also changed to Daiso at that time.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.