As the European Electric Vehicle and Battery Market Declines, Korean Companies 'Wobble'

The European electric vehicle (EV) and battery market is declining, narrowing the position of domestic battery companies. As the EV industry turns to negative growth and China's market share expansion based on mid-to-low-priced products accelerates, our companies are taking a hit.

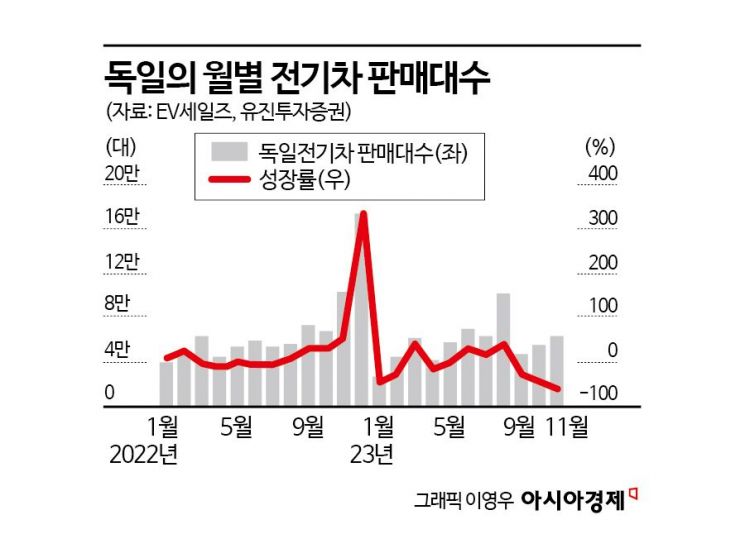

According to data from the European Automobile Manufacturers Association (ACEA), cumulative EV sales in Germany up to November this year reached 627,000 units, a 5% decrease compared to the previous year. In particular, November sales were only 63,000 units, a sharp 39% drop compared to the same period last year. ACEA forecasts that December is also likely to see negative growth, projecting a 10% decrease in EV sales this year compared to last year.

This marks the first visible negative growth since 2016. New EV registrations in Germany grew rapidly by 32.2% last year, 83.3% in 2021, and 206.8% in 2020. This contraction in the EV market is attributed to subsidy reductions. The German government reduced subsidies for EV buyers starting January this year and stopped subsidies for plug-in hybrid vehicles.

Additionally, from September 1 this year, government subsidies are provided only to individual EV buyers, excluding company, foundation, corporate, and association vehicles from subsidy eligibility. The German government's EV subsidies for corporate buyers were abolished at the end of August, and from this month, subsidies for EVs priced between 40,000 and 65,000 euros (approximately 56.74 million to 92.21 million KRW) have also been eliminated.

Germany accounted for 32% of the entire European EV market as of last year. Germany's sluggishness implies a slowdown in EV sales across Europe. Norway, the EV kingdom, is also experiencing negative growth this year. Cumulative sales up to November reached 103,000 units, a 12% decrease compared to 118,000 units last year.

The negative growth in Europe, one of the world's top three EV markets, poses a 'risk' to the battery industry. The other two major markets, North America and China, have become bloc-oriented due to domestic industry expansion and supply chain restructuring strategies. Although Europe is partially undergoing bloc formation, most global companies, including those from Korea, the U.S., China, and Japan, can enter without significant restrictions. For this reason, Europe is considered the fiercest battleground for the EV and battery markets.

China is targeting the European market with NCM (Nickel-Cobalt-Manganese) batteries rather than LFP (Lithium Iron Phosphate) batteries. NCM batteries are a strength of Korean companies.

According to data from the Korea Institute for International Economic Policy (KIEP), the market share of the three domestic battery companies (LG Energy Solution, SK On, Samsung SDI) in Europe was about 57% from January to July this year. In 2021, it was over 70%. This is interpreted as an effect of the Chinese share rising to around 40%. Japan's share has plummeted from 36% in 2019 to around 2% recently.

Chinese companies are targeting the market with 'mid-nickel batteries' such as NCM523 (Nickel:Cobalt:Manganese ratio of 5:2:3) and NCM622 (Nickel 6:Cobalt 2:Manganese 2). Our companies mostly emphasize 'high-nickel batteries' like NCM811, with nickel content over 80%. High-nickel batteries have excellent energy density but are expensive. As the EV market expands, the adoption of mid-to-low-priced batteries has increased, boosting China's market share in Europe.

Chinese companies like CATL have also improved price competitiveness through vertical integration of the supply chain. CATL is evaluated to have created a virtuous cycle by investing cost reductions in upstream sectors into research and development (R&D). Notably, CATL ranked second this year in EV battery usage with a 26.6% market share (70.3 GWh), closely trailing LG Energy Solution, which holds a 26.7% share (70.5 GWh).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.