36 cases in 2020, 39 cases in 2021, 44 cases in 2022, 39 cases in 2023

Impact of revising delisting regulations as part of efforts to rationalize the expulsion system

Concerns over harming market soundness due to failure of sorting function

The number of delisted companies this year has decreased. The number of delistings, which had been on the rise since COVID-19, has turned downward, which is attributed to the government's rationalization of the exit system. However, concerns have also been raised in the securities industry that if the delisting system fails to properly distinguish between good and bad companies, the soundness of the market could deteriorate.

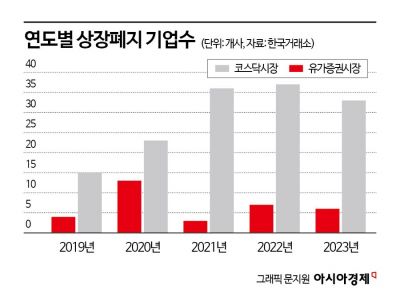

According to the Korea Exchange on the 12th, the number of delistings this year was 39, down from 44 last year. The number had been increasing continuously since the COVID-19 pandemic but the upward trend has been halted this year. The number of delistings increased from 19 in 2019 to 36 in 2020, 39 in 2021, and 44 in 2022. By market, delistings on the KOSDAQ market decreased from 37 last year to 33 this year, and on the KOSPI market, from 7 to 6.

By reason for delisting, on the KOSDAQ market, special purpose acquisition companies (SPACs) continued to account for the majority of delistings this year as well as last year. The number of SPAC-related delistings on the KOSDAQ market this year was 19, up from 13 last year. This is because SPAC mergers were actively conducted this year. Cases of delisting due to SPAC extinction following mergers increased from 4 last year to 13 this year.

In contrast, delistings due to failure to submit preliminary listing examination applications decreased from 9 last year to 6 this year. SPACs have a lifespan of three years, and if they do not apply for preliminary listing examination six months before the expiration of their lifespan, they are designated as management-listed companies. If the reasons for management-listed designation are not resolved within one month after designation, the company proceeds to delisting.

Delistings due to incorporation as a subsidiary of another company or absorption-type mergers decreased from 5 last year to 2 this year. Delistings due to voluntary delisting requests also decreased from 3 last year to 1 this year. Delistings due to transfer to the KOSPI market increased from 1 last year to 3 this year.

In particular, delistings due to issues such as audit opinion rejections or going concern problems decreased. Delistings due to audit opinion rejections dropped from 9 last year to 6 this year. Delistings related to corporate continuity and management transparency decreased from 5 last year to 2 this year. There were no delistings due to bankruptcy this year, compared to one last year.

The decrease in delistings due to business deterioration or insolvency issues appears to be influenced by the government's rationalization plan for the exit system. At the end of last year, the Korea Exchange reorganized the requirements and procedures related to maintaining listings as part of the national agenda, "Promotion Plan for Rationalizing the Exit System to Reduce Corporate Burden and Protect Investors." Accordingly, formal financial delisting reasons were converted into substantive delisting review reasons, and opportunities to appeal delisting reasons were expanded. The KOSPI market's requirement for stock price falling below 20% of par value and the KOSDAQ market's four consecutive years of operating losses leading to management-listed designation and five consecutive years of operating losses leading to substantive review were each removed. Additionally, the KOSDAQ market changed the application criteria for management-listed designation and delisting due to capital erosion from semiannual to annual basis.

A Korea Exchange official said, "While delistings due to issues such as audit opinion rejections or mergers are unrelated to the rationalization plan for the exit system, the decrease in delistings related to corporate management conditions appears to be influenced by the rationalization plan."

However, concerns have been raised that the decrease in delistings due to the easing of delisting requirements could lower market quality. A securities industry official pointed out, "The core of the delisting system is to maintain market soundness and protect investors. If the delisting system's function to distinguish between good and bad companies does not work properly, rotten apples and sound apples will coexist in the market, which can lead to investor losses and degrade the overall quality of the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.