Scheduled for KOSDAQ listing in February next year... Total public offering size 27.6 billion to 33 billion KRW

New factory groundbreaking in Auburn, USA, investment in next-generation battery cell pad manufacturing facilities

Inics plans to concentrate the funds secured through its KOSDAQ listing on its U.S. subsidiary. Amid global companies investing in new and expanded automobile and battery plants in the U.S. under the Inflation Reduction Act (IRA), Inics aims to expand sales by keeping pace with this trend.

According to the Financial Supervisory Service's electronic disclosure system, Inics will issue 3 million new shares for its initial public offering (IPO). The expected price range is 9,200 to 11,000 KRW per share, with a total offering size of 27.6 to 33 billion KRW. Demand forecasting will take place from January 11 to 17 next year, followed by a general subscription from January 23 to 24. The listing is scheduled for February. Samsung Securities is the lead underwriter.

Inics was established in 1984. It manufactures automotive parts such as battery cell pads and fire-resistant partitions, which are key components of secondary batteries. The battery cell pad prevents collisions between battery cells and vibrations during driving, thereby extending battery life and preventing fires. The company is confident in its technology. In its securities registration statement, the company explained, "The fire-resistant partition is a product that Inics has been developing and proposing to clients since 2022, and this year, it began mass production and supply for the first time in the industry." It added, "Currently, there are no competitors in the fire-resistant partition market, and Inics holds 100% market share."

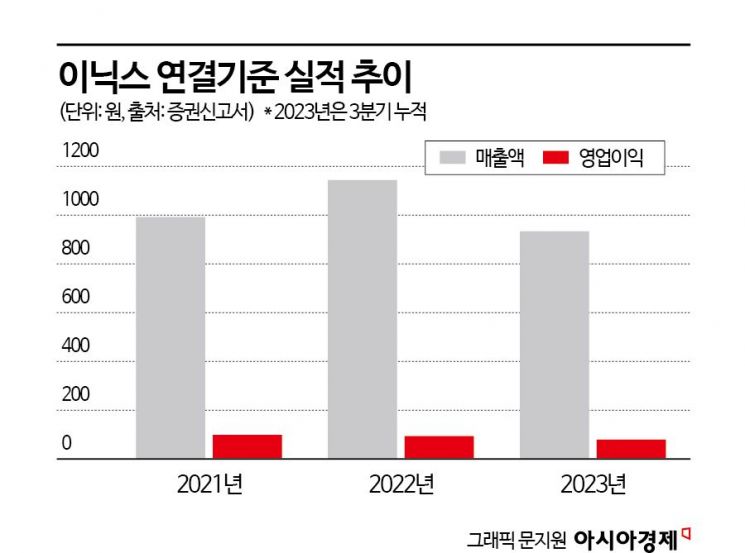

Performance has been steadily increasing. Consolidated sales rose from 99.2 billion KRW in 2021 to 114.3 billion KRW last year. Operating profit slightly decreased from 9.6 billion KRW to 9.4 billion KRW during the same period. As of the third quarter this year, cumulative sales reached 93.4 billion KRW with an operating profit of 7.9 billion KRW, representing increases of 11.36% and 10.26%, respectively, compared to the same period last year.

Samsung Securities calculated Inics' expected offering price using the price-to-earnings ratio (PER). Comparable companies included Shinheung SEC, Sangsin EDP, Younghwa Tech, Aluco, and Taiflex, all manufacturers of secondary battery parts for electric vehicles. The average PER of these companies is 12.01 times. Applying this, the per-share valuation was 14,090 KRW, and a discount rate of 21.93% to 34.17% was applied to propose the expected offering price range.

Inics plans to raise 27.6 billion KRW based on the lowest end of the expected offering price. Of this, 5 billion KRW will be allocated to facility funds and 22.4 billion KRW to operating funds. Facility funds will be used for constructing the second plant in Busan and introducing machinery and equipment for next-generation battery cell pads (TBA).

The majority of the remaining funds will be invested in U.S. expansion. Currently, Inics owns a 100% subsidiary, INICS Battery Solutions Corp., in the U.S. The U.S. production base is planned to be established in Auburn, Alabama. Inics will invest over 20 billion KRW in the U.S., including 14.5 billion KRW for building the first U.S. plant and 3.6 billion KRW for manufacturing equipment for next-generation battery cell pads.

In the securities registration statement, the company explained, "Following the recent U.S. IRA legislation, investments in electric vehicle production facilities and battery production facilities in the U.S. are actively underway." It added, "Inics is establishing a corporation in the U.S. and preparing to start construction of a new plant in line with the growth of the upstream market and its clients."

Inics has strong growth potential even after listing. The order backlog, which accounts for the largest portion of performance, has been increasing annually. The order backlog was 167.4 billion KRW in 2021, rising to 238.3 billion KRW last year. As of the end of November, it reached 344.4 billion KRW.

However, the recent slowdown in the electric vehicle market poses a threat. Recently, automakers have been delaying or revising their electric vehicle transition plans. Additionally, plans for battery joint ventures have been withdrawn. This could lead to a decrease in electric vehicle demand or slower growth than expected.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.