Magnificent 7 Contributed 75% to S&P 500 Rise This Year

Earnings Growth Expected to Slow from Q4

"Must Prove with Results... Current Stock Prices Are Too High"

The seven U.S. tech companies known as the "Magnificent 7" have contributed over 70% to the rise of the S&P 500 this year. As forecasts suggest that next year’s U.S. stock market rally depends on the profit scale of AI companies, concerns about investing in tech stocks are also emerging.

On the 10th (local time), Bloomberg reported that the market capitalization of the Magnificent 7?Apple, Microsoft (MS), Amazon, Alphabet, Nvidia, Tesla, and Meta?has increased by $5 trillion so far this year.

The S&P 500 index has risen 19.9% this year, with the Magnificent 7 contributing 75% of that increase. As the stock prices of these seven companies surged, their share of the S&P 500 expanded to 30%.

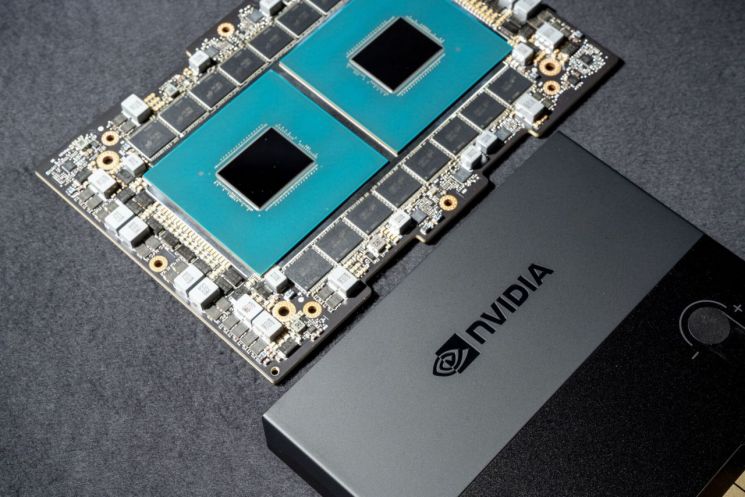

Strong earnings improvements supported the stock price gains. The seven companies achieved record-high profits of $99 billion in the third quarter this year. Although profits decreased by 2.9% year-over-year in the first quarter, they expanded with growth rates of 32% in the second quarter and 52.7% in the third quarter. Nvidia led the profit growth. Due to the ChatGPT craze and the surge in demand for AI semiconductors, Nvidia is expected to generate $28 billion in annual profits this year, more than six times last year’s $4.4 billion.

The problem is that, except for Nvidia, the other companies in the Magnificent 7 are not experiencing steep profit growth. The profit growth rate of the seven tech companies is expected to slow down from the peak of 52.7% in the third quarter to 46.2% in the fourth quarter, 31.9% in the first quarter of next year, 20.9% in the second quarter, and 10.7% in the third quarter.

There is also an assessment that their stock prices are overvalued. The price-to-earnings ratio (PER) of these companies is currently 32 times. A higher PER indicates overvaluation. Although this is lower than the 36 times in July, it remains high compared to 21 times at the beginning of the year.

Mark Lehman, CEO of JMP Securities, said, "The moment is approaching when companies claiming AI-related profits need to show (results)," adding, "Revenue must come from companies that are actually improving their earnings."

There is growing caution about some investors being overly optimistic about the U.S. Federal Reserve’s pivot (monetary policy direction change) in the first quarter of next year and betting on stock price increases.

Phil Segner, senior research analyst and portfolio manager at the U.S. investment firm Royholt Group, warned, "Even if stock prices don’t fall, it’s unclear how much they can rise if valuations are too high," and added, "At some point, people need to recognize the risks of such stocks (like those in the Magnificent 7) in their portfolios."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)