The proportion of transactions involving older apartments in the Seoul metropolitan area is on the rise. As it has become difficult to secure financing due to high interest rates and a reduction in policy-based financial support, buyers are turning their attention from newly built apartments to older ones, which are more affordable.

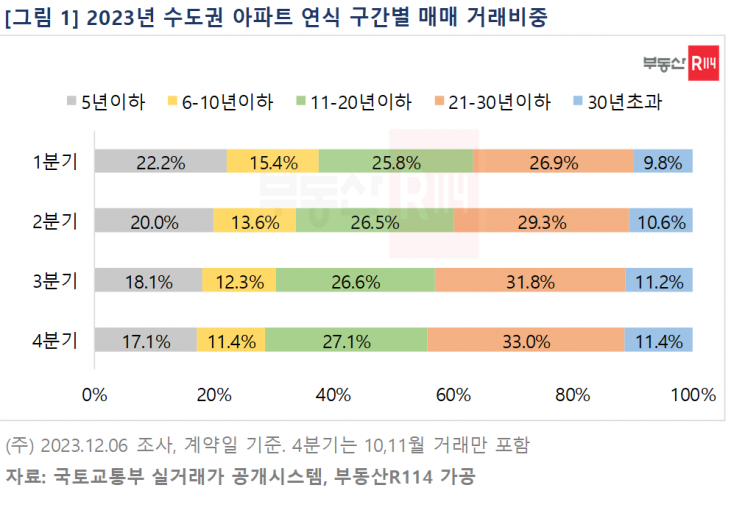

On the 11th, Real Estate R114 analyzed apartment sales transactions in the Seoul metropolitan area in 2023 by building age using data from the Ministry of Land, Infrastructure and Transport's actual transaction prices. The analysis showed that the transaction share of apartments completed within the last 10 years decreased, while the share of apartments older than 10 years increased across all age groups. In particular, the transaction share of apartments aged 21 to 30 years rose the most, from 26.9% in the first quarter to 33.0% in the fourth quarter, an increase of 6.1 percentage points. Conversely, the transaction share of apartments aged 5 years or less dropped by 5.1 percentage points, from 22.2% in the first quarter to 17.1% in the fourth quarter.

Despite lower residential preference compared to new apartments, the main reason for the increased transaction share of older apartments is their relatively affordable price. As the housing market recovers and prices of new apartments rise sharply, buyers have shifted toward older apartments or postponed purchases. In fact, the average sale price per 3.3㎡ of apartments aged 21 to 30 years transacted this year was 21.67 million KRW, which is less burdensome compared to 29.89 million KRW for apartments aged 5 years or less.

Meanwhile, the transaction price of apartments older than 30 years was the highest at 32.97 million KRW, which can be attributed to many apartments either awaiting or currently undergoing reconstruction. Since the beginning of this year, over 80 transactions have occurred in high-priced complexes such as Seo-won Daechi 2 Complex in Gaepo-dong, Gangnam-gu, Eunma in Daechi-dong, and Olympic Family Town in Munjeong-dong, Songpa-gu.

Additionally, the reduction of policy mortgages such as high-interest rates and special home loans (teukrye bogumjari loan) is expected to act as a barrier for buyers entering the new apartment market, as a high level of cash liquidity is required. Although transactions have recently declined sharply, housing supply indicators such as permits and construction starts are all falling simultaneously, which may lead owners of newly built apartments, whose scarcity has increased, to maintain elevated asking prices. On the other hand, in mid- to low-priced apartment areas with many older apartments purchased through aggressive borrowing ('youngkkeun'), there is a possibility of an increase in urgent sales due to rising interest burdens.

Yeokyunghee, Senior Researcher at Real Estate R114, said, “Given the concerns about further price declines amid economic slowdown, buyers are focusing on listings where price negotiations are easier. Therefore, the transaction share of older apartments is expected to remain high for some time.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.