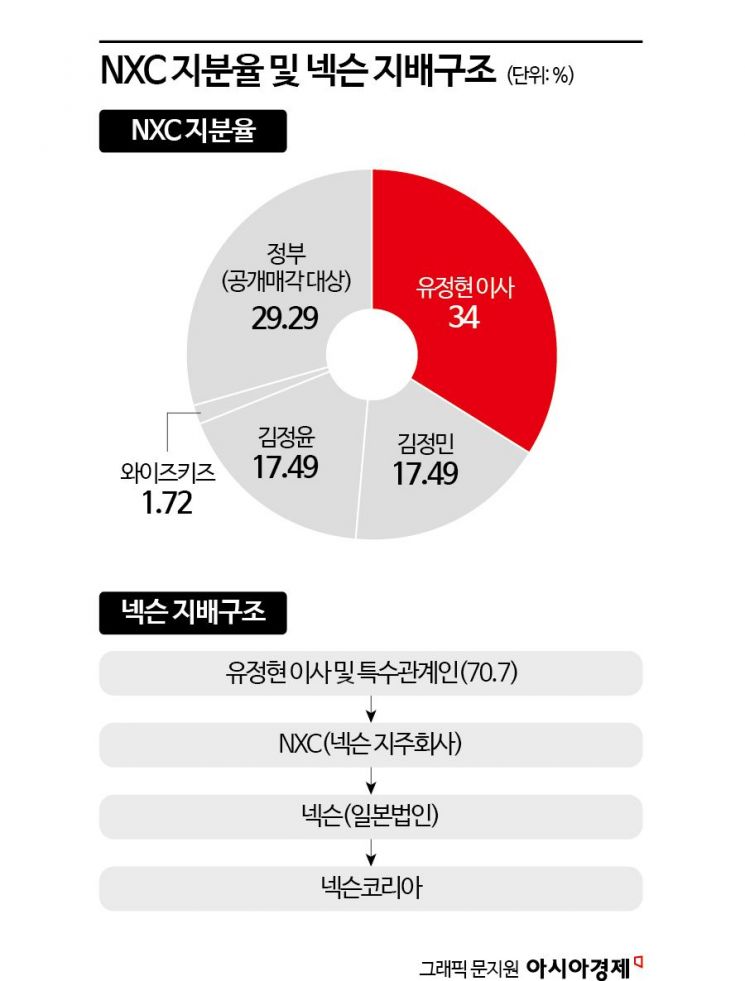

The holding company of game developer Nexon, NXC, is set to publicly sell shares worth 4.7 trillion KRW. Acquiring these shares would instantly make the buyer the second-largest shareholder of NXC. China and Saudi Arabia are mentioned as potential buyers. However, since the shares come without management or voting rights, the sale process is expected to be challenging.

The Ministry of Economy and Finance will sell 29.3% (852,000 shares) of NXC shares inherited by the family of Nexon founder Kim Jung-ju, who passed away last year, as inheritance tax payment to the state, on the 18th. Acquiring these shares would make the buyer the second-largest shareholder of NXC. Currently, NXC’s approximately 70% stake is held by Kim’s wife Yoo Jeong-hyun, who is a director at NXC, their two daughters, and family companies.

The government prioritizes the bulk sale of shares valued at 4.7149 trillion KRW. This is because splitting the shares into smaller lots would likely reduce their value. The bidding will take place from the 18th to 19th, and if no successful bid is made in the first round, a second round will be held on the 25th to 26th.

Chinese Tencent and Saudi Sovereign Wealth Fund Eye the Shares

Potential buyers include Tencent, China’s largest game company, and Saudi Arabia’s sovereign wealth fund, the Public Investment Fund (PIF).

Tencent has a close relationship with Nexon, handling the Chinese publishing of Nexon’s flagship game "Dungeon & Fighter." Tencent also holds stakes in several domestic game companies, showing strong interest in ‘K-games.’ Tencent is the second-largest shareholder of Krafton with a 13.73% stake and holds 17.52% of Netmarble shares. Recently, it also acquired a 4.3% stake in Shift Up, which was sold by Wemade.

Middle Eastern capital may also participate in acquiring NXC shares. Saudi Arabia is actively investing in the Korean game industry under the banner of economic diversification. In particular, PIF has been steadily purchasing Nexon shares listed on the Tokyo Stock Exchange. It currently holds a 10.23% stake in Nexon Japan, making it the second-largest shareholder. Last year, PIF invested approximately 1.09 trillion KRW in NCSoft, acquiring a 9.3% stake.

Domestically, there appears to be little interest in acquiring NXC shares. The high price of around 5 trillion KRW and the lack of management rights are significant obstacles. Additionally, the current difficult domestic and international economic conditions pose challenges.

In 2019, NXC attempted to sell 98.64% of its shares, including management rights. At that time, MBK Partners, Kohlberg Kravis Roberts (KKR), Bain Capital, as well as Kakao and Netmarble participated in the main bidding. However, the sale was canceled when founder Kim suddenly withdrew the public sale.

Shares Without Management or Voting Rights... Declining Appeal

The process of selling NXC shares does not look easy. Even if all the shares are acquired, the buyer would only become the second-largest shareholder without management rights. As a non-listed company, there are no voting rights either. Since Nexon Korea and Nexon Japan, subsidiaries of NXC, are already listed domestically and in Japan respectively, recovering investment through NXC’s listing is also difficult.

The family of founder Kim has a clear intention to maintain management rights. After Kim’s death, attention was focused on raising a large inheritance tax fund of about 6 trillion KRW. It was widely expected that the family would sell shares to pay the inheritance tax and transfer management rights. However, in March, NXC registered Yoo Jeong-hyun, an auditor at NXC, as an inside director and designated her as the same person (head) of the company.

Yoo is not directly involved in management. However, she co-founded Nexon with Kim in 1994 and has overseen the company’s operations, understanding the overall management flow. Recently, she was newly appointed as the CEO of Nexon Korea following the Nexon Japan appointment, which is seen as reflecting her influence. Founder Kim emphasized global expansion as a core competitive strength during his lifetime. Lee Jung-heon, newly appointed CEO of Nexon Korea and former CEO of Nexon Japan, successfully led global achievements. Yoo is interpreted as continuing Kim’s management philosophy while initiating a generational change in management.

Meanwhile, NXC may attempt to repurchase shares by acquiring treasury stock. If no valid bids are made more than twice, the issuing company can dispose of the shares through a private contract. However, no matter how much the value of the shares paid as inheritance tax falls due to failed bids, the government can only buy the shares at or above the initially appraised value of 4.7 trillion KRW. Since these shares were originally put up because it was difficult to bear the huge inheritance tax, it is expected to be difficult to repurchase them.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)