Daol Investment & Securities and Hi Investment & Securities Credit Rating Outlook Downgraded

"Small and mid-sized firms bear domestic real estate PF loss burden, large firms bear overseas real estate loss burden"

The risk of real estate project financing (PF) defaults is threatening the creditworthiness of securities firms. Credit rating agencies are increasingly concerned about potential downgrades, viewing the credit outlook for securities firms negatively.

According to NICE Credit Rating on the 7th, downward pressure on the credit ratings of securities firms is expected to increase next year. NICE Credit Rating forecasted a stable credit rating outlook for four major financial sectors?banks, life insurance, non-life insurance, and credit cards. In contrast, the outlook for securities, capital, real estate trust, and savings banks sectors was negative.

Specifically, regarding the credit rating outlook for the securities sector next year, the industry environment is expected to deteriorate compared to this year. Lee Hyuk-jun, head of financial evaluation at NICE Credit Rating, explained, "The potential risks related to real estate PF are significant, and as profitability and asset soundness decline, companies with worsening performance will face increased downward pressure on their credit ratings."

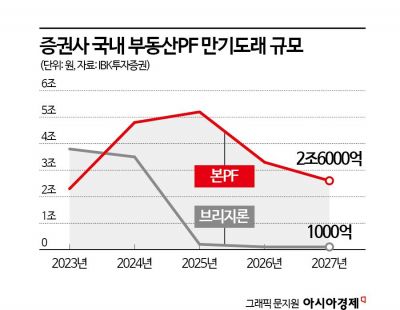

The real estate PF risk is expected to continue to squeeze securities firms next year, as meaningful risk reduction in terms of scale and content has not been achieved. Lee Hyuk-jun noted, "Most bridge loans are being extended rather than recovered, and the main PF is not decreasing in absolute terms due to concerns about unsold units or delayed sales. Securities, capital, and savings banks, which have concentrated exposure to the riskiest bridge loans, face significant concerns about performance deterioration next year."

Real estate PF carries higher default risk when the proportions of bridge loans, mezzanine and subordinated loans, non-metropolitan areas, and non-residential properties are large. In the securities sector, these proportions have not significantly improved compared to the end of last year. The share of bridge loans increased from 26% at the end of last year to 27% as of the end of September this year. Mezzanine and subordinated loans decreased slightly from 49% to 44%, non-metropolitan area loans from 45% to 44%, and non-residential property loans from 41% to 37%. Lee said, "If high interest rates persist, we expect 30-50% of bridge loans to result in final losses. Financial companies with large shares of mezzanine, non-metropolitan, and non-residential bridge loans are likely to see performance deterioration and increased downward pressure on their credit ratings."

The corporate finance (IB) division of securities firms is expected to remain highly sensitive to the real estate finance market. Kim Ye-eun, a researcher at Korea Credit Rating, explained, "With overall investment sentiment deteriorating, the IB, investment, and real estate finance markets are all contracting. The profitability and asset soundness of securities firms' IB divisions will be highly sensitive to the real estate finance market. While the possibility of securing new deals is limited, the burden of deteriorating soundness of existing deals is accumulating." She added, "For small and medium-sized firms, losses related to domestic real estate PF will be a burden, while for large firms, losses from overseas real estate investments will significantly impact profits and financial structure."

Recently, the rating outlooks for small and medium-sized securities firms with significant real estate PF concerns have been downgraded consecutively. At the end of last month, Korea Ratings lowered the corporate credit rating (ICR) and unsecured bond rating outlook for Daol Investment & Securities from 'stable' to 'negative' and downgraded the unsecured bond rating outlook for Hi Investment & Securities from 'positive' to 'stable.' Jung Hyo-seop, a researcher at Korea Ratings, explained, "The change in Hi Investment & Securities' rating outlook reflects deteriorating profitability due to a slowdown in IB division performance and increased loan loss provisions, increased burden in managing the soundness of PF exposure amid the real estate market downturn, and although capital adequacy is sound, the management burden is inherent." Kim Sun-joo, another researcher at Korea Ratings, said regarding Daol Investment & Securities' outlook change, "It reflects a sharp decline in IB income and increased loan loss provisions leading to significantly worsened operating performance and recurring profitability, a downward trend in capital adequacy indicators, inherent soundness burdens related to real estate PF, and the need to monitor liquidity response capabilities."

Overseas real estate is also expected to negatively impact securities firms' performance. Woo Do-hyung, a researcher at IBK Investment & Securities, said, "Most overseas real estate exposure is held by large securities firms, with a large proportion in commercial real estate in the U.S. and Europe. As real estate price indices in the U.S. and Europe continue to decline, concerns about related losses are expanding. The maturity amount of overseas commercial real estate for securities firms next year is about 3.7 trillion KRW, making it inevitable to recognize losses related to overseas alternative investments next year as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman with 50 Million Won Debt Clutches a Stolen Dior Bag and Jumps... A Monster Is Born [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)