Financial Supervisory Service Issues Financial Consumer Alert

#One day, Mr. A received a phone call informing him of a 'special debt reduction.' Believing the debt collector's promise that if he repaid 14 million won, which is half of his total debt of 28 million won, by the 30th, his debt would be settled, Mr. A made the payment. Later, when Mr. A requested a certificate of full repayment, the collector demanded additional payment, giving the hard-to-believe reason that 'approval for full repayment is difficult because you have a job.' Mr. A, who had repaid the debt excessively trusting the promise of reduction, found himself in a difficult situation.

Always Obtain 'Reduction Documents' When Receiving Debt Reduction

According to the Financial Supervisory Service (FSS) on the 6th, cases of victims like Mr. A, where debt reduction was promised and repayment was pressured but then the attitude changed and the debt was pursued, are increasing. Besides cases like Mr. A’s, there have been instances where creditors verbally promised to settle the debt if only part of the amount was repaid, then revoked the reduction agreement and continued to collect the reduced amount through debt collectors.

There have also been confirmed cases of debt collection on loan company claims arising from unfair loan contracts. The FSS has issued a financial consumer alert to prevent financial consumer damage caused by illegal debt collection.

First, it is important to remember that 'debt collectors,' who are not creditors, do not have the authority to reduce debts. If a debt collector mentions debt reduction to a debtor without the creditor’s decision, this constitutes 'illegal debt collection.' If such an incident occurs, related evidence such as recordings should be secured and reported to the FSS.

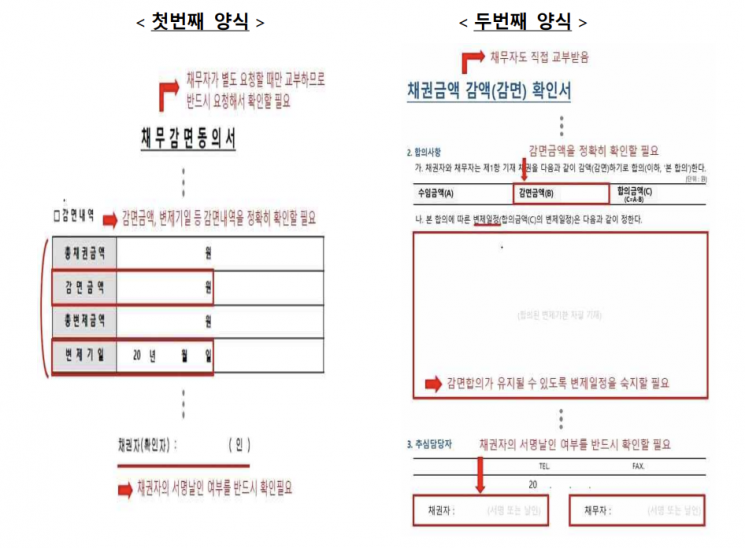

Also, when proceeding with debt reduction, it is essential to receive 'reduction documents' from the debt collector and carefully verify key details such as the reduced amount, repayment schedule, and reduction conditions. If debt reduction matters are confirmed only verbally, one may not receive proper relief if unfair treatment occurs later.

Report Debt Collection if Interest Rate Exceeds 20% or Loan is Collected Immediately Upon Default

The FSS advised that even if the 'loan agreement' with a loan company does not specify the interest rate, if the actual interest rate exceeds the legal maximum limit (20%) under the Interest Rate Restriction Act, consumers should request the suspension of debt collection and report to the FSS if necessary.

Additionally, according to the standard loan transaction terms, 'the loss of the benefit of the term' occurs only if the delinquency period continues for two months or more, and the debtor must be notified in advance. If the entire loan amount is collected immediately upon default, consumers should request the suspension of debt collection and report the loan company to the FSS, the agency explained.

Loans to minors without the consent of a legal representative can be 'canceled.' Consumers should express their intention to cancel to the creditor loan company via certified mail and request the suspension of debt collection from the debt collector.

An FSS official stated, "We will actively encourage financial consumers to file complaints or reports regarding illegal collection of unfair loan claims, and during inspections of debt collection companies, we plan to focus on these issues."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.