LG Group Chairman Koo Kwang-mo borrowed 167 billion KRW from Korea Securities Finance in November using shares of LG Corporation as collateral to pay inheritance tax. With this, Chairman Koo completed the installment payments of inheritance tax over six times in five years. The total amount he paid in inheritance tax exceeds 700 billion KRW. In this process, he had to borrow a significant amount of money. This year alone, loans secured by shares exceeded 300 billion KRW. Since the interest rate on stock-collateralized loans is around 5-6% per annum, he faces an annual interest burden of hundreds of billions of KRW.

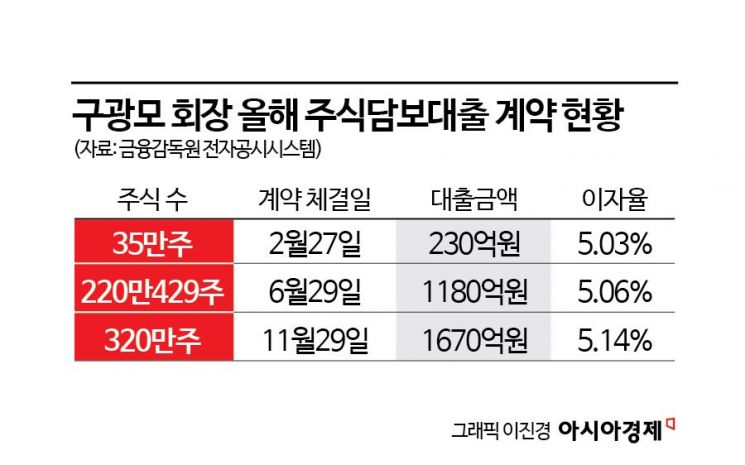

LG announced that Chairman Koo executed a stock-collateralized loan of 167 billion KRW from Korea Securities Finance at an interest rate of 5.14% per annum through the Financial Supervisory Service's electronic disclosure system earlier this month. The contract period is one year, from November 29 this year to November 29 next year.

The reason for borrowing money with shares as collateral at the end of November was to pay the last remaining sixth installment of the inheritance tax under the installment payment system. Chairman Koo paid over 700 billion KRW in inheritance tax related to the assets he inherited from the late former Chairman Koo Bon-moo, who passed away in 2018. He utilized the installment payment system, which allows taxpayers to divide the payment into six installments. The installment payment system permits taxpayers to provide securities as collateral and pay the tax in installments if the inheritance tax amount exceeds 20 million KRW. Under current law, the inheritance tax rate for major shareholders of large corporations is 60%.

Earlier this year, in February and June, Chairman Koo also took out stock-collateralized loans of 23 billion KRW and 118 billion KRW, respectively, from Korea Securities Finance. The interest rates were 5.03% and 5.06% per annum, with one-year contracts. The total amount borrowed this year using shares as collateral is 308 billion KRW.

The sixth installment of inheritance tax that Chairman Koo had to pay by the end of last month was reportedly around 120 billion KRW, but the reason he raised loans exceeding 300 billion KRW this year was due to the interest burden and the need to repay existing loan maturities. The maturity of the stock-collateralized loan contracted in 2019 was at the end of last month. Even a simple calculation of the interest on loans raised this year shows an annual interest payment of 15.7 billion KRW.

Chairman Koo did not initially borrow against shares to pay inheritance tax. Upon the inheritance decision in 2018, he sold his 7.5% stake in Pantos to fund the first installment of the inheritance tax. However, due to the astronomical amount of inheritance tax, funds were insufficient. Starting with a 38 billion KRW stock-collateralized loan from Korea Securities Finance in November 2019, he actively utilized his shares as resources for inheritance tax payments.

Subsequently, Chairman Koo sold all his shares in LX Holdings in 2021 to secure additional funds. Moreover, after borrowing 18 billion KRW in February last year, he borrowed 162 billion KRW at interest rates of 5.2% and 5.8% from Daishin Securities and Korea Securities Finance, respectively, at the end of November last year, just before the fifth installment tax payment. Currently, about half of the LG Corporation shares held by Chairman Koo are pledged as collateral.

An industry insider said, "Even though Chairman Koo completed all inheritance tax payments with the sixth installment at the end of last month, how he will repay the borrowed money remains an issue. If he cannot secure additional funds by the time the loan maturities come next year, stock-collateralized loans may continue into next year as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)