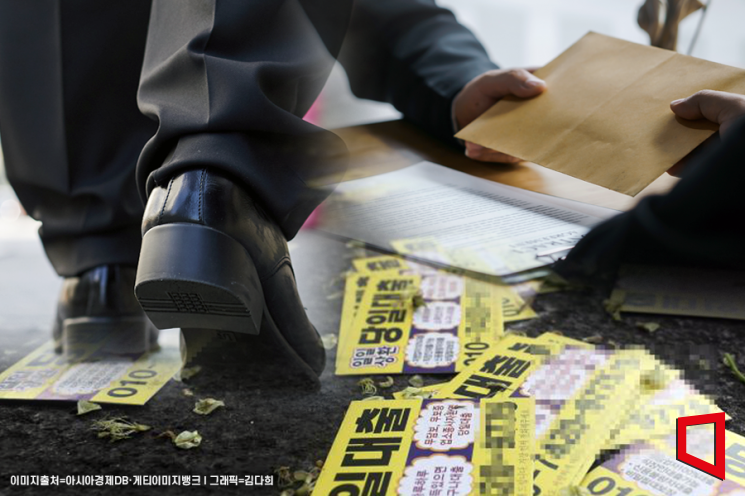

Rapid Increase in High-Interest Loan Damage Targeting Youth and Young Adults

Seoul Fair Trade Comprehensive Counseling Center Actively Encourages Reporting

As the year-end and New Year holidays and winter vacation approach, cases of approaching teenagers and young adults with promises of "easy and quick loans" to induce high-interest small loans are increasing, requiring caution.

Most Loan Business Consultations Involve 'High-Interest Loan' Damage

According to Seoul City on the 6th, an analysis of 253 loan business-related consultation cases received by the 'Fair Trade Comprehensive Counseling Center' from January to October this year showed that 142 cases involved consultations on high-interest small loans, accounting for more than half. Illegal debt collection was also reported in 31 cases, indicating that nearly 70% of the consultations were related to damages caused by high-interest loans.

Middle school student A received a message from B through social networking services (SNS) during a game, offering to proxy purchase a 30,000 won item. When A said she had no money, B said she could repay 60,000 won in two days. Eventually, A agreed to the proxy payment based on this.

Two days later, B threatened that if the promised 60,000 won was not deposited, a late fee of 2,000 won per hour would be charged, and personal information would be leaked to her parents and on SNS. Then, B connected A to illegal lender C, from whom A borrowed 60,000 won and repaid it.

Four days later, C demanded repayment of 90,000 won including interest and late fees. When converted to an annual interest rate, the interest amounted to a staggering 4,562%.

Online Loan Results in 10,800% Interest Rate

D, a university student in his 20s, experienced trouble after inquiring about a loan on an online loan brokerage platform due to his addiction to online gambling. The company lent him 300,000 won in cash on the condition that he repay 500,000 won in a week. They also took the names and phone numbers of 10 acquaintances saved on D’s mobile phone.

However, when D failed to repay on time, the company pressured him with illegal collection, and he had to repay 3 million won after a month. The interest rate in this case reached 10,800%.

Such cases frequently involve approaching teenagers by offering to proxy purchase game items and idol goods, then demanding high-interest fees under the pretext of hourly late fees, and threatening to leak photos or personal information if repayment is not made.

Additionally, many cases involve lending small amounts around 300,000 won for short terms of less than seven days through online loan brokerage platforms, and when the repayment date is missed, inducing additional loans that increase interest to more than ten times the principal.

The Seoul Fair Trade Comprehensive Counseling Center provides relief support for victims of such illegal loan business damages. As of last month, the center has handled 37 relief cases amounting to 178 million won.

Based on the financial transaction details of the consultees, if the interest rate is calculated and the loan principal and interest have been overpaid, support is provided through methods such as 'return of unjust enrichment' or 'waiver of remaining debt.' For damages caused by illegal collection, support is provided to receive 'free representation by debtor agents and litigation lawyers.'

Kim Kyung-mi, the Seoul City Fair Economy Officer, said, "Recently, 'illegal small loan damages' targeting teenagers and young adults who frequently use SNS and messengers are increasing, so caution is required," and urged victims to actively report such cases.

High-Interest Small Loans and Nude Photo Blackmail

In July, a group that created an illegal loan business organization in Busan was caught by the police for lending small loans and applying an annual interest rate of over 4,000%, gaining unfair profits.

The group, including E, is suspected of lending a total of 1.07 billion won in 2,555 transactions to 492 victims from December 2021 to April this year, applying an annual interest rate of over 4,000%, and earning unfair profits worth about 580 million won.

If the loan was not properly repaid, they pressured victims with insults and threats, and are also suspected of distributing victims’ nude photos to family or acquaintances.

According to the police, most victims were socially vulnerable groups such as university students and young adults who found normal financial loans difficult due to COVID-19 and economic recession, and teenagers who dropped out of high school.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)