Sam-il PwC Management Research Institute Publishes '2024 Economic Outlook' Report

Global Economy Shows 'Sluggish Growth'... Domestic Economy Experiences Worsening Sentiment

Next year, South Korea's economic indicators are expected to improve, but the overall economic sentiment is predicted to remain challenging. While the global economy is likely to continue sluggish growth at a level similar to this year, accumulated risk factors will act as downside risks, making risk management a crucial focus for the year.

Samil PwC Management Research Institute released the "2024 Economic Outlook" report on the 5th, containing these forecasts and analyses. The key themes summarized in the report for next year's economy are "accumulating risks" and "seeking a low-level equilibrium."

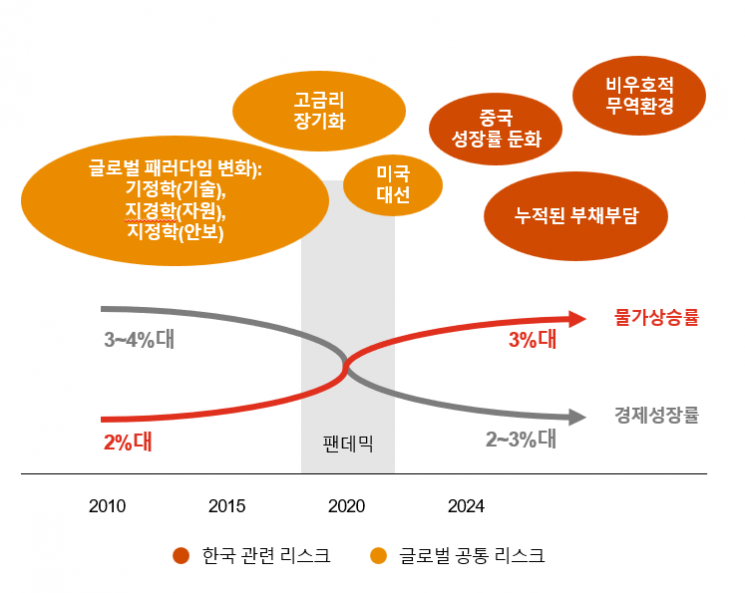

According to the report, the global economy next year is expected to maintain sluggish growth similar to this year. After being shaken by the pandemic and the Russia-Ukraine war over the past four years, the global economy is anticipated to find a new equilibrium next year. However, this new equilibrium is expected to be at a worsened level compared to the pre-pandemic period, meaning inflation will remain high while growth rates stay low.

The institute identified the major variables influencing the global economy next year as △ side effects of high interest rates △ mismatch between monetary policy and market expectations △ a divided world △ real estate risks in China's economy and consumption risks in the U.S. economy △ and the U.S. presidential election.

Meanwhile, South Korea's domestic economy next year is expected to be driven by increased global trade and a recovery in the semiconductor industry, boosting exports and facility investments. However, consumption, which reflects economic sentiment, and the construction sector, indicating economic vitality, are expected to remain sluggish, resulting in a challenging economic sentiment despite improvements in economic indicators.

The institute pointed out four variables for South Korea's economy next year: △ side effects of accumulated debts such as household debt and real estate project financing (PF) △ the dilemma of monetary policy (difficulty in either lowering or raising interest rates) △ the gap between economic indicators and economic sentiment △ and the adaptation speed to global derisking strategies aimed at reducing dependence on China in key industries.

Choi Jaeyoung, head of the Management Research Institute, stated, “As the trend of changes in the global economic paradigm, which has been unfavorable to the Korean economy, strengthens next year, it is necessary to lower expectations regarding the normalization speed of inflation, growth, and interest rate levels,” adding, “The factors acting as variables in domestic and international economies are expected to pose more risks than opportunities.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.