Soaring Gold Prices Despite Powell's Hawkish Remarks... US Government Debt Surge Drives Momentum

Past Three Super Rallies Fueled by Prolonged Dollar Weakness

"Overvalued Compared to Real Interest Rates... Long-Term Rally Unlikely," Experts Say

International gold prices have reached an all-time high for the first time in 3 years and 4 months, raising expectations for a 'super rally.' Even after surpassing $2,000 per ounce, the rally has continued with prices breaking through $2,100, drawing attention to whether a new record of $2,500 will be set. Market experts expect the gold price rally to continue for the time being.

On the 1st (local time) at the New York Commodity Exchange (COMEX), gold futures prices rose 1.58% from the previous trading day to $2,089.70 per troy ounce (approximately 31.1g). This surpassed the previous all-time high of $2,069.40 (intraday $2,089.20) recorded in August 2020. On the 4th, prices surged to an intraday high of $2,152.30, setting a new record again (adjusting to $2,036.30 on the 5th).

The rise is attributed to expectations of interest rate cuts by the U.S. Federal Reserve (Fed), a weakening dollar, and falling U.S. bond yields. Additionally, renewed conflict between Israel and Hamas has contributed to instability in the Middle East, which also pushed gold prices higher. Increased gold purchases by central banks in China, India, and other countries have also been a factor in the price increase.

Gold prices have shown sharp volatility this year. After bottoming out at $1,817.10 per ounce at the end of February, prices rose to $2,055.30 by mid-April but then fell to $1,831.80 on October 5. Following the impact of the Israel-Palestine war, the upward trend resumed, surpassing $2,000 per ounce on October 30. After some adjustments, prices have stabilized in the $2,000 range. A decisive factor was the announcement on the 14th of last month that the U.S. October consumer price inflation rate was 3.2%, lower than market expectations, easing concerns about interest rate hikes.

Although Fed Chair Jerome Powell recently stated that discussions about the timing of interest rate cuts are premature, this was not significantly different from previous remarks and was insufficient to curb the soaring gold prices. In a talk at Spellman College in the U.S., Powell said, "If it is deemed appropriate to shift monetary policy to a tighter stance, we are prepared to do so." However, the market reacted sensitively to signals that U.S. interest rate hikes were ending.

U.S. Government Debt Surge Fuels Rally

Regarding the gold price rally surpassing $2,000 per ounce, some expect the super rally to continue, potentially reaching $2,500 or even $3,000. Will the super rally continue? It is necessary to examine the background of past rallies.

Since 1960, there have been four super rallies in gold prices, including the current one. These were during the U.S. suspension of gold convertibility in the 1970s, the Plaza Accord in 1985, the dot-com bubble and China boom in the 2000s, and the rally from 2019 to the present. Except for the current rally, the common factor in the previous three was an extreme weakening of the U.S. dollar. While economic factors cannot be ignored, prolonged extreme dollar weakness acted as a catalyst for gold price super rallies.

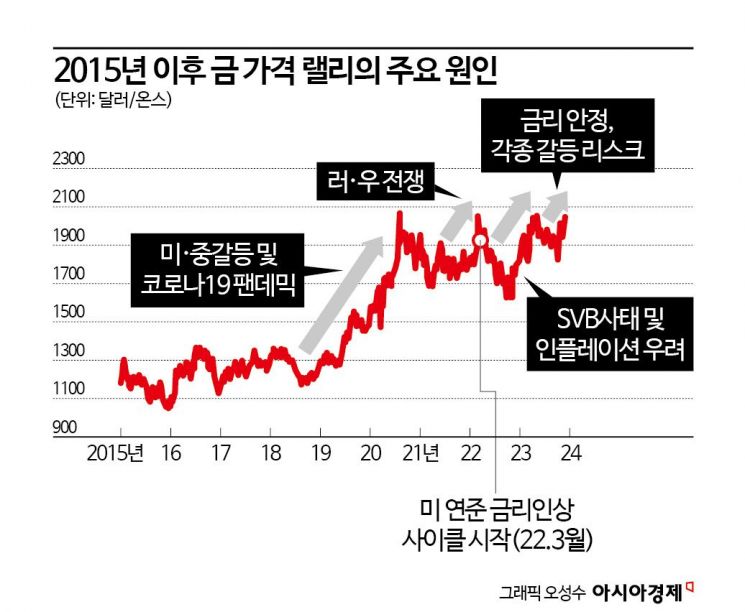

From this perspective, experts find the current rally somewhat unusual because gold prices have risen despite a strong dollar trend. Park Sang-hyun, a researcher at Hi Investment & Securities, said, "From a medium-term perspective, gold price rallies since 2015 have been influenced by safe-haven demand, liquidity expansion, and inflation. These include the 2019-2020 rally during U.S.-China tensions and COVID-19 (liquidity expansion), the first half of 2022 rally due to the Russia-Ukraine war and inflation concerns, and the late 2022 to early 2023 rally based on the Silicon Valley Bank (SVB) crisis (liquidity expansion) and hyperinflation fears. However, the recent gold price rally is difficult to explain with past variables."

Most experts point to factors such as stable interest rates and dollar value, geopolitical instability, increased gold purchases by central banks in China, Singapore, and Poland, and, importantly, the astronomically increased U.S. government debt, which traditionally fuels gold price strength.

Researcher Park also noted, "The driving forces behind this rally are unprecedented liquidity unleashed since COVID-19, inflation hedge demand due to high inflation experienced for decades, and safe-haven demand amid various conflict risks. However, since gold, the dollar, and Bitcoin are all showing strength simultaneously, this explanation has limitations. The rapid increase in U.S. government debt, which emerged as part of overcoming crises like COVID-19, economic stimulus, and industrial paradigm shifts, is one of the important factors." He also pointed out that the new Cold War atmosphere and hegemonic risks triggered by conflicts between the U.S. and China, and the U.S. and Russia, have contributed to the gold price rally.

Gold Rally Expected to Continue for the Time Being

Accordingly, the consensus is that the gold rally will continue for the time being. Researcher Park predicted, "Expectations of a weaker dollar, delayed resolution of various geopolitical risks, expansion of U.S. government debt amid U.S. recession risks, and China's selling of U.S. Treasury bonds coupled with dollar purchases will support gold price strength."

O Jae-young, a researcher at KB Securities, also said, "Although high interest rates are expected to be maintained for a considerable period, the anticipated interest rate cuts in the second half of next year suggest a trend of rising gold prices."

Choi Jin-young, a researcher at Daishin Securities, forecasted next year's gold price to average $2,000 per ounce (ranging from $1,850 to $2,150), emphasizing, "The Fed's interest rate hike cycle is ending, and the timing of policy rate cuts is approaching, which is an attractive direction for gold investment."

However, some opinions suggest that while a short-term rally is expected, the long-term outlook remains uncertain. This is based on the judgment that geopolitical risks are calming and inflation concerns are easing. Researcher Park said, "While the short-term outlook is bullish, it is uncertain whether gold prices, which have surpassed historical highs, will continue the super rally. Additional rallies in gold prices are difficult to interpret as positive signals for the global economy, so the gold rally needs to subside for economic momentum to strengthen significantly."

Baek Young-chan, a researcher at Sangsangin Securities, stated, "The lack of a reversal in safe-haven preference despite easing geopolitical uncertainties suggests the possibility of a downturn in gold prices. Above all, gold prices are overvalued relative to real interest rates, making it difficult for the super rally to continue."

Shim Soo-bin, a researcher at Kiwoom Securities, explained, "Ahead of the December Federal Open Market Committee (FOMC) meeting, precious metal prices are expected to be sensitive to related news. There remains some room for the Fed's interest rate cut expectations to weaken. In that case, precious metal prices, which have risen based on interest rate cut expectations, may undergo some correction, so attention should be paid to the trends in the dollar and bond yields."

Views among global market experts also vary. Henggun Hou, Head of Market Strategy at UOB, said, "Expectations that both the U.S. dollar (value) and interest rates will fall next year will be the driving force behind rising gold prices," forecasting gold prices to reach $2,200 per ounce by the end of next year. Nikki Shields, Head of Metals Strategy at MKS Pamp, also predicted gold prices to fluctuate between $2,100 and $2,200. Bart Melek, Head of Commodity Strategy at TD Securities, forecasted an average gold price of $2,100 in the second quarter of next year. JP Morgan predicted gold prices will surpass $2,300 per ounce by mid-next year, stating, "With slowing U.S. GDP growth, expectations for Fed interest rate cuts will strengthen, and a 1 percentage point rate cut in the second half of next year will push gold prices into new territory."

However, some do not guarantee a super rally in the long term. Carsten Menke, an analyst at Julius Baer, pointed out, "With an economic environment without recession and interest rates above average, the likelihood of investors returning to gold as a safe haven in the near future is low."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)