Domestic Securities Firms' Research Centers' KOSPI Outlook for Next Year

Different Judgments on the Impact of Interest Rate Cuts... Diverging Forecasts Including High-Low-High, High-Low-Low, and N-Shaped Trends

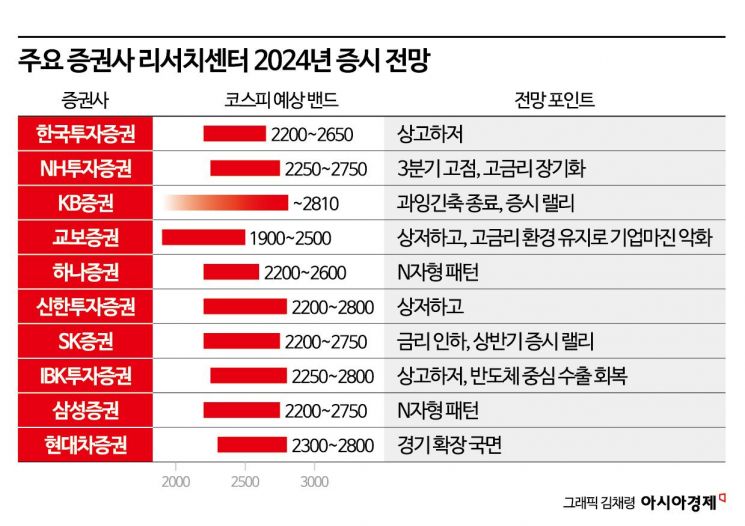

KOSPI bottom range 1900~2300 points. Domestic securities firms' research centers generally predicted that next year's market would be better than this year, but opinions diverged regarding the index's lower bound (bottom). The fluctuation range between the bottom and top (peak) was large, and some conservatively suggested the possibility of breaking below the 2000 level. However, semiconductor was commonly cited as a promising sector.

Kim Hyung-ryeol, head of Kyobo Securities Research Center, said, "The 2024 KOSPI band is suggested to be 1900~2500 because a fluctuation range of 600 points is not meaningful for index prediction," adding, "If we consider the meaning of the upper and lower bands, the threat of breaking below the 2000 level is latent in the stock market." He continued, "This reflects the opinion of Kyobo Securities bond analysts that the 3-year government bond yield will average 3.43% in 2024, and I agree that the high interest rate environment will be maintained for some time. In that case, not only will the valuation burden on the stock market increase, but corporate profit margins will deteriorate, and currently unconfirmed financial risks may materialize."

Among securities firms that presented KOSPI expected bands, Kyobo Securities had the lowest lower bound. Next, DB Financial Investment set the lower bound low at 2150. Korea Investment & Securities, along with Hana Securities, Shinhan Investment Corp., SK Securities, and Samsung Securities, expected the KOSPI bottom around the 2200 level, NH Investment & Securities at 2250, and Hyundai Motor Securities at 2300.

Lee Jae-sun, head of the investment strategy team at Hyundai Motor Securities, who presented the most optimistic lower bound, explained, "The sensitivity of the U.S. Federal Reserve's (Fed) monetary policy is expected to be lower than this year, and if the end of the rate hike cycle is near, the important factor in the market is the cycle," adding, "2024 is likely to be a year when the coincident economic index bottoms out and the leading economic index rebounds, entering an economic expansion phase."

Major securities firms' research centers generally forecasted next year's KOSPI peak to be between 2600 and 2800, with an average around 2700. The highest forecast was from DB Financial Investment, which expected the KOSPI upper bound at 2950. Next was KB Securities, which projected up to 2810. They generally anticipated a better investment environment than this year, expecting the KOSPI to have an upside potential of 3~15%.

Kang Hyun-gi, head of DB Financial Investment Research Center, analyzed, "The real disposable income in the U.S., which affects Korea's export economy, is surprisingly solid," adding, "From the second half of next year, the fundamentals of the domestic stock market could strongly recover." Lee Eun-taek, head of KB Securities stock strategy team, diagnosed, "Macro uncertainties will be removed, and the economy will resume a slow rebound."

High top and low bottom vs High bottom and low top

Views on market trends also diverged. Korea Investment & Securities, KB Securities, Shinhan Investment Corp., and IBK Investment & Securities predicted a better first half. This was based on expectations that the U.S. interest rate hike cycle would end early. Even if the rate hike cycle ends in the second half, they expected the domestic market to be positively influenced as market interest rates would move first.

Kim Dae-jun, head of Korea Investment & Securities investment strategy team, said, "The first half of next year is expected to rise, and the second half to show a sideways trend," adding, "Monetary and fiscal policies are expected to support the investment environment, but in the second half, the lack of upward momentum may cause the index to move sideways, requiring trading focused on individual stocks." Byun Jun-ho, research fellow at IBK Investment & Securities investment analysis department, said, "There is valuation appeal in the stock market due to semiconductor-centered export recovery and expectations of rate cuts," but noted, "However, in the second half, the U.S. economic recession risk is a variable." Kang Jae-hyun, researcher at SK Securities, said, "We expect a stock market rally in the first half, reflecting relatively good economic conditions and expectations of rate cuts in valuation increases," adding, "However, in the second half, risks of recession in developed countries and consequent fiscal crisis are expected to burden the stock market."

Kyobo Securities and NH Investment & Securities, which see corporate earnings improvement delayed in a high interest rate environment, forecasted the stock market to rise in the second half. NH Investment & Securities expected the KOSPI to start at a low index level in Q1 and reach a peak in Q3. Kim Byung-yeon, head of NH Investment & Securities investment strategy team, analyzed, "Next year is a U.S. presidential election year, and analyzing stock price trends in U.S. presidential election years since 1972 shows that September is usually the peak," adding, "Risk factors include U.S. credit rating downgrade, deterioration of U.S.-China relations, Chinese real estate risk, and Korean credit risk, but the likelihood of spread is low."

Kim Yong-gu, head of Samsung Securities global investment strategy team, forecasted an N-shaped index fluctuation with ranges of 2200~2600 in Q1, 2350~2750 in Q2, 2250~2650 in Q3, and 2300~2700 in Q4, but said, "The possibility of the domestic stock market reaching the highest point next year is low." He pointed out many negative factors such as delayed U.S. economic slowdown, Fed's high-rate freeze response, sporadic credit and financial instability, and expanded political and geopolitical risks around the November U.S. presidential election.

Hana Securities also forecasted an N-shaped index pattern assuming the Fed starts cutting the base rate in June next year. They expected the KOSPI to decline from late Q2 to mid-Q3. Lee Jae-man, head of Hana Securities global investment analysis team, explained, "Since 2001, whenever the Fed started cutting the base rate, except in 2008, the KOSPI fell by an average of 11~13%," adding, "Because rate cuts begin around the start of economic recessions, the initial phase of rate cuts suffers from recession shocks."

Semiconductors stand out as a sector with strong base effect on profits

Semiconductors were unanimously cited as a promising sector. Kim Byung-yeon, head of NH Investment & Securities investment strategy team, said, "Stock investment strategy lies where U.S. companies invest," adding, "Korean exports will be favorable in IT advanced industries related to large U.S. blue-chip companies, i.e., semiconductors, within a modified globalization excluding China." Lee Jae-sun, head of Hyundai Motor Securities investment strategy team, also said, "The sector with a prominent profit base effect is undoubtedly semiconductors," adding, "If demand recovery from China, semiconductor demand from emerging countries, and advanced countries' expectations for generative artificial intelligence (AI) continue, the profit influence of semiconductors will become even stronger." Kim Dae-jun, head of Korea Investment & Securities investment strategy team, said, "Semiconductor net profit is expected to increase significantly from KRW 2.6 trillion in 2023 to KRW 34.4 trillion in 2024," adding, "Although returning to the 2022 profit level is difficult, profit estimates are increasing, so there is no problem in increasing semiconductor weighting." He also noted that sectors with high net profit growth rates such as display, utilities, shipbuilding, chemicals, hardware, and healthcare should be watched.

DB Financial Investment recommended semiconductor, steel, and pure chemicals as strategic stocks. SK Securities preferred AI and semiconductors, which can structurally grow independently, rather than themes benefiting from government fiscal spending expansion. Lee Woong-chan, researcher at Hi Investment & Securities, said, "In the first half of next year, the stock market is expected to be stagnant for semiconductor and secondary battery stocks due to economic concerns, while stocks sensitive to liquidity recovery will show strength," adding, "In the second half, semiconductor and secondary battery stocks are expected to strengthen again with economic recovery expectations and election benefits, raising the possibility of the index rising again."

Dividend stocks and cyclical stocks were also viewed as promising. Samsung Securities advised investing mainly in growth stocks such as semiconductors and secondary batteries in the first half, and focusing on dividend stocks like banks, insurance, and telecommunications in the second half when uncertainty increases due to the U.S. presidential election. KB Securities recommended dividend stocks and insurance stocks, warning to prepare for a situation where interest rates are broadly elevated if U.S. government spending continues. Hyundai Motor Securities expected the manufacturing industry, which had been sluggish, to recover and advised seeking investment opportunities in cyclical sectors such as chemicals, steel, and transportation. NH Investment & Securities diagnosed that considering next year's U.S. presidential election, large-scale investment, and Korea's aging trend, sectors with high 'time efficiency' (performance relative to time) will rise. They viewed technology companies (internet, IT solutions, pharmaceuticals, bio) and companies providing leisure proportional to saved time (entertainment, gaming, cosmetics, apparel) as promising.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.