Base Interest Rate Held Steady at 3.5% for 7 Consecutive Times

Export Recovery Slower Than Expected

Concerns Deepen Over Weak Consumption and Investment

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Direction Decision Meeting of the Monetary Policy Committee held on the 30th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Direction Decision Meeting of the Monetary Policy Committee held on the 30th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

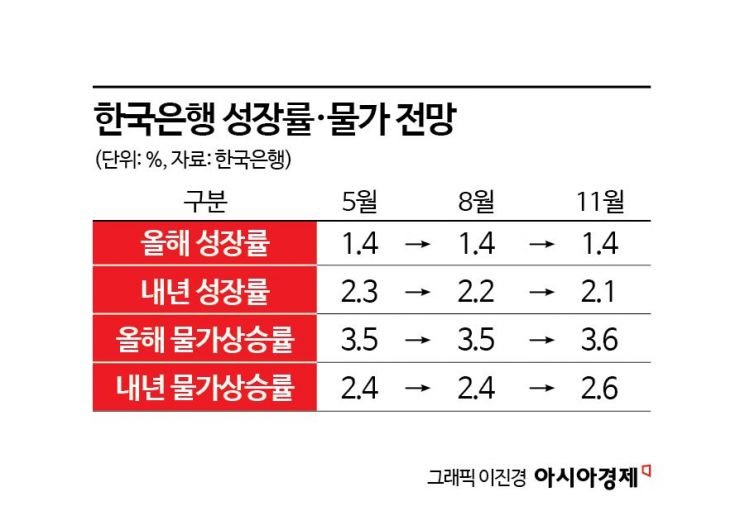

On the 30th, the Bank of Korea lowered its economic growth forecast for next year to 2.1%, signaling a global economic slowdown. This is a 0.1 percentage point decrease from the 2.2% forecast released in August, reflecting downside risks to the economy due to slower-than-expected export recovery and sluggish consumption amid high interest rates. As concerns over economic slowdown grew, the Bank of Korea kept the base interest rate unchanged at 3.50% for the seventh consecutive time.

On the other hand, the consumer price inflation forecast for next year was revised upward from 2.4% to 2.6%. With the Bank of Korea lowering the growth forecast while raising the inflation forecast, a 'stagflation' scenario?characterized by economic stagnation alongside rising prices?is expected to persist.

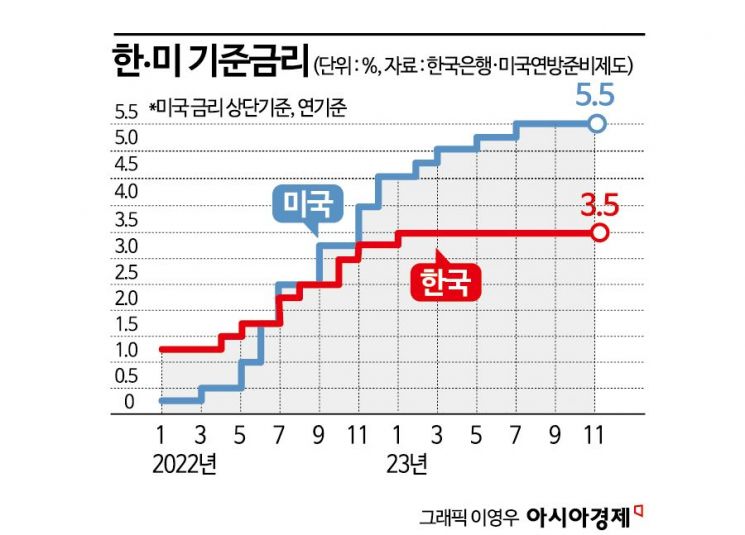

The Monetary Policy Board of the Bank of Korea held a meeting on monetary policy direction starting at 9 a.m. that day and decided to maintain the base interest rate at the current 3.50%. The board had consecutively held the rate steady in meetings in February, April, May, July, August, and October, and by keeping the rate unchanged in this final meeting of the year, it extended the freeze to seven consecutive times. Although the consumer price inflation rate in October exceeded expectations at 3.8%, and the timing for reaching the inflation target (2%) is expected to be delayed?factors that could justify a rate hike?the sluggish export recovery due to the economic downturn in China and the significantly increased financial interest burden made further rate hikes burdensome.

In particular, the perception that the U.S. Federal Reserve's (Fed) rate hikes have effectively ended has eased concerns about the widening interest rate gap between Korea and the U.S., supporting the Bank of Korea's decision to hold rates steady. Christopher Waller, a prominent hawk on the Fed, recently expressed confidence that the current policy is in a "good place" to slow growth and bring inflation back to the 2% target. As the possibility of the Fed ending its rate hikes gains traction, market expectations for rate cuts next year are rising. Since the interest rate gap with the U.S. has widened to a record high of up to 2 percentage points, further widening could lead to instability in financial and foreign exchange markets, so the end of U.S. rate hikes reduces the burden on Korea's monetary policy decisions.

Joo Won, head of economic research at Hyundai Research Institute, said, "At the December Federal Open Market Committee (FOMC) meeting, the Fed is expected to hold rates steady due to recent price stabilization and concerns over real economic recession, and rate cuts are expected to begin next year as the global economic slowdown intensifies." He added, "Due to domestic financial market instability caused by high interest rates, the possibility of a Fed pivot (monetary policy shift), and weak domestic economic recovery, Korea is unlikely to raise rates further." Although the high inflation in the high 3% range and the increase in household debt remain burdens, recent easing of the won-dollar exchange rate and international oil prices suggests that monetary policy decisions will place greater emphasis on economic slowdown and financial stability.

Even if Semiconductors Recover Next Year... Concerns Over Weak Domestic Demand and Exports

In its revised economic outlook released that day, the Bank of Korea maintained this year's economic growth forecast at 1.4% but lowered next year's growth forecast to 2.1%. Previously, in August, the Bank had kept this year's growth forecast at 1.4%, the same as in May, but lowered next year's forecast from 2.3% to 2.2%. Now, in just over three months, it has further lowered the forecast for next year. Considering that the OECD raised South Korea's growth forecast for next year from 2.1% to 2.3% the day before, the Bank of Korea's outlook indicates a more pessimistic view of the Korean economy next year. Compared to the Ministry of Economy and Finance (2.4%) and the International Monetary Fund (IMF, 2.2%), the Bank's forecast is relatively low.

The Bank of Korea's downward revision of next year's economic growth forecast reflects the significant uncertainties surrounding the economy. Although the semiconductor sector is gradually recovering from its worst phase, the tightening effects over the past two years are now fully impacting consumption, leading to a weakening domestic demand, which is the biggest concern. Additionally, forecasts that the U.S. and Chinese economies?both critical to Korea?may underperform next year are interpreted as reasons for the Bank's conservative growth outlook.

First, the semiconductor sector, a key export item for Korea, is expected to show signs of recovery next year. According to the Korea Customs Service, exports from the beginning of this month through the 20th reached $33.79 billion, a 2.2% increase compared to the same period last year, largely influenced by the recovery in semiconductor trade volumes, the largest export item. The rebound in prices for memory products such as DRAM and NAND flash indicates that semiconductor exports have bottomed out and are reviving. The Bank of Korea's November Business Survey Index (BSI), released the day before, also showed a significant improvement in manufacturing sentiment centered on semiconductors, electronics, video, and communication equipment.

However, excluding semiconductor exports, many risk factors remain. In particular, consumption, which had compensated for semiconductor weakness through pent-up demand following the COVID-19 pandemic, has recently deteriorated. Inflation remains high in the 3% range, and the full effect of high interest rates has dampened consumer sentiment. The non-manufacturing business sentiment this month fell to its worst level in 1 year and 11 months since December 2020. The Korea Development Institute (KDI) and the Korea Institute for Industrial Economics and Trade recently forecast relatively low growth rates of 2.2% and 2%, respectively, citing weak private consumption as a key factor.

Concerns also abound that the sluggish housing market and massive household debt will weigh down next year's growth. Although the real estate market showed signs of price rebounds centered on Seoul earlier this year, it has recently stalled due to the impact of high interest rates. Experts predict that while semiconductor and other facility investments may slightly increase, construction investment will decline due to rising unsold housing units. Since Korea has a large amount of household debt related to real estate, such as mortgage loans, a sluggish housing market negatively affects consumption. As of the end of September, household credit balances reached 1,875.6 trillion won, and if the high interest rate environment continues into next year, the increased household interest burden will inevitably hit consumption and domestic demand. The continued rise in interest burdens on households and businesses, along with financial market instability such as real estate project financing (PF) defaults, further complicates monetary policy challenges.

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Direction Decision Meeting of the Monetary Policy Committee held on the 30th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Direction Decision Meeting of the Monetary Policy Committee held on the 30th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

China's Economic Recovery Remains Key to Korea's Growth Next Year

Amid contrasting trends in semiconductors and domestic demand, the degree of China's economic recovery is expected to be a major variable for Korea's growth next year. China experienced significant slowdowns in both exports and domestic demand this year due to financial difficulties faced by major real estate developers such as Evergrande and Country Garden. However, recent continuous stimulus measures by the authorities have somewhat improved the situation. China's economic growth rates were 4.5% in Q1, 6.3% in Q2, and 4.9% in Q3, approaching the initial annual growth target of 5%. Accordingly, organizations like the OECD and IMF have recently slightly raised their growth forecasts for China next year.

However, the OECD and IMF still expect China's growth rate next year to be in the low 4% range, lower than this year, suggesting limited positive spillover effects from China's recovery. Professor Heo Jun-young of Sogang University's Department of Economics said, "Since China recorded 3% growth last year, even if it achieves the 5% target this year, it is not an impressive figure." He added, "Even if China's economy rebounds next year, unlike in the past, China's domestic demand has significantly increased, so the benefits to the Korean economy may be limited."

The U.S. economy, which has divided opinions regarding its outlook, is also a key variable. If the U.S. economy continues to grow next year without a hard landing, exports to the U.S., especially automobiles which performed well this year, could continue to increase. Conversely, if the opposite occurs, Korea's exports will inevitably be hit. While Goldman Sachs and UBS forecast a soft landing for the U.S. next year, some market participants predict a hard landing, reflecting divergent views. Professor Heo said, "Given Korea's dependence on external factors, a sudden downturn in the U.S. economy would be frightening. If it only slows moderately, the Bank of Korea would have no strong reason to significantly lower its growth forecast next year."

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee meeting held on the 30th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee meeting held on the 30th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

Potential Growth Rate Decline Forecast... Concerns Extend Beyond Next Year

The Bank of Korea projects the economic growth rate for 2025 at 2.3%. This implies that the Korean economy will find it difficult to regain past growth momentum. With aging and low birth rates intensifying and no clear new growth engines identified, a decline in potential growth rate is inevitable. Bank of Korea Governor Lee Chang-yong previously stated that Korea's neutral interest rate would decline after the high inflation period passes. Recently, Agustin Carstens, General Manager of the Bank for International Settlements (BIS), agreed with Governor Lee's view, forecasting declines in Korea's potential growth rate and neutral interest rate. Professor Heo Jin-wook of Incheon National University's Department of Economics explained, "Next year, growth is expected to return to the 2% potential growth path as exports improve, but most agree that the potential growth rate will decline rapidly going forward."

The Bank of Korea raised its consumer price inflation forecast for next year from 2.4% to 2.6%. Last month, the Monetary Policy Board indicated the possibility of upward revision in inflation forecasts due to the ripple effects of international oil prices and exchange rates, as well as the Israel-Hamas conflict, which increased upside risks to inflation and delayed the timing for inflation to converge to the target. The inflation rate for the year after next is projected at 2.1%.

With the Bank lowering next year's growth forecast and raising the inflation forecast, attention is focused on the implications for future monetary policy. The prolonged Ukraine conflict, Middle East war variables, global economic slowdown, and China's economic downturn are slowing export recovery and weakening growth momentum. The tightening monetary policy to counter high inflation is leading to a contraction in investment and consumption, which is worrisome. Professor Seok Byung-hoon of Ewha Womans University's Department of Economics said, "The recovery speed of Korea's key export item, semiconductors, is slower than expected, delaying export recovery. With weak exports and consumption, and the government unable to boost spending due to tax revenue shortfalls, a worst-case scenario of growth in the 1% range next year is not impossible."

The delayed timing for inflation to converge to the target (2%) as forecast by the Bank of Korea is also a variable. Korea's consumer price inflation rate in October was 3.8%, exceeding expectations and reigniting inflation concerns. Although the government, which had promoted the 'October price stabilization theory,' has belatedly begun price management, the slowdown is not rapid, and the timing for inflation convergence is expected to be delayed beyond initial expectations. A delayed achievement of the inflation target will inevitably postpone Korea's interest rate cut timing.

Final Interest Rate Reached, Rate Cuts Expected in Q3 Next Year

As perceptions spread that the base interest rates in the U.S. and Korea have effectively reached their peak, market attention is turning toward rate cuts. Kwon Hyo-sung, an economist at Bloomberg Korea, said, "Due to the slower-than-expected pace of inflation deceleration, the Bank of Korea has revised its expected timing for rate cuts from Q2 to Q3 next year," adding, "With the U.S. economy remaining more resilient than expected, no rate cuts are expected until mid-next year." Professor Yoo Hye-mi of Hanyang University's College of Economics and Finance said, "Since the U.S. inflation is slowing faster than Korea's and considering the interest rate gap between Korea and the U.S., it will be difficult for Korea to cut rates before the U.S. If the U.S. cuts rates around the end of Q2 next year, the Bank of Korea is expected to follow with cuts in Q3."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)