[LG Energy Solution 2.0]

Numbers Created in 3 Years Since Establishment

Average Annual Growth of 40%↑... Sales in the 30 Trillion Won Range

500 Trillion Won Order Backlog & 12 Global Factories

LG Energy Solution members are showcasing cylindrical batteries at the Ochang plant. (Photo by LG Energy Solution)

LG Energy Solution members are showcasing cylindrical batteries at the Ochang plant. (Photo by LG Energy Solution)

LG Energy Solution, which is celebrating its 3rd anniversary, has shown a compound annual growth rate (CAGR) of over 40% based on sales. This growth rate surpasses that of any domestic or international company to date. Last year, it successfully completed its IPO (Initial Public Offering) and secured the 2nd largest market capitalization in the domestic stock market, following Samsung Electronics.

As the 'big brother' of the battery industry, which is considered the next growth engine of our economy, LG Energy Solution is moving faster than any global company in the competition for global supply chains. We looked at the past three years of LG Energy Solution, which is preparing for its second phase by recently changing leadership, through numbers.

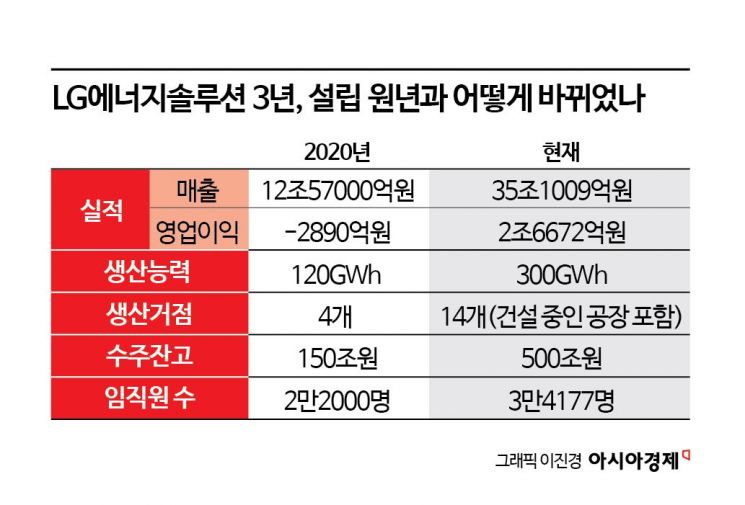

The fastest change is, of course, in performance. LG Energy Solution, which was spun off from LG Chem's battery business division on December 1, 2020, recorded KRW 12.57 trillion in sales and an operating loss of KRW 289 billion in its founding year, 2020.

The following year, sales reached KRW 17.852 trillion with an operating profit of KRW 768 billion, and in 2022, sales rose to KRW 25.599 trillion with an operating profit of KRW 1.214 trillion. This year, cumulative sales through the third quarter reached KRW 25.744 trillion, and operating profit was KRW 1.825 trillion, surpassing last year's performance. It is expected to record KRW 35.1009 trillion in sales and KRW 2.6672 trillion in operating profit this year (according to securities industry consensus), exceeding the initial goal of 'KRW 30 trillion in sales by 2023.'

Until last year, the compound annual growth rate was 43.1%. The initial target at the time of establishment was around 33%. It is rare worldwide for a manufacturing company, even one spun off as a physical division, to show such high growth exceeding 40% annually. This also surpasses the 'hypergrowth' definition of a 40% CAGR proposed by former Billpcom CEO Alexandre Izosimov in the 2008 Harvard Business Review.

TSMC, the world's leading semiconductor foundry, has shown about 21% growth over the past three years. Netflix, a leading online video service (OTT) company, had an average growth rate of about 25% over the past five years. Electric vehicle manufacturer Tesla exceeded a 60% CAGR, and Apple showed a 53% CAGR over five years after launching the iPhone in 2008.

Professor Lee Hogun of Daeduk College's Department of Automotive Engineering said, "Although Chinese battery companies are aggressively expanding their global market share recently, I believe LG Energy Solution's battery production volume and sales will continue to grow due to its superior technological capabilities."

Production capacity has also improved dramatically. Battery production capacity, which was around 120GWh in 2020, increased to about 300GWh this year. LG Energy Solution plans to have a total annual battery production capacity of 540GWh by 2025. Considering that the battery capacity required to produce one high-performance electric vehicle is 80kWh, 540GWh corresponds to the production of 6.75 million electric vehicles.

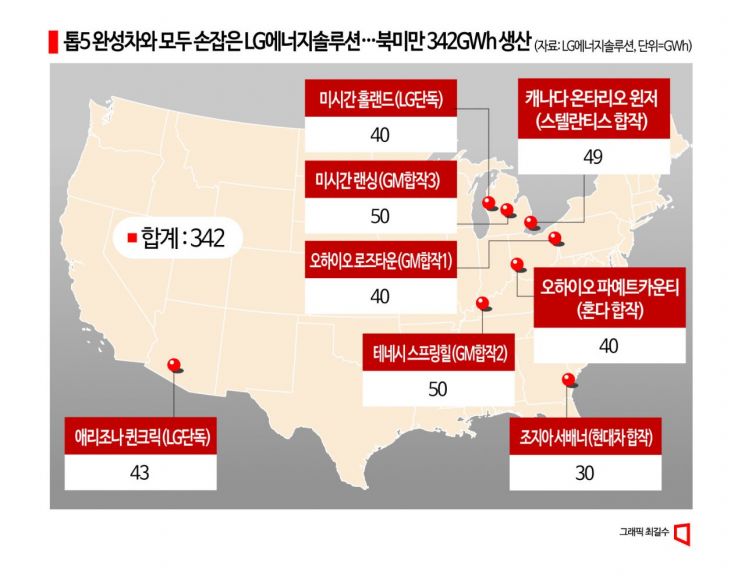

In 2020, LG Energy Solution operated four production bases including Ochang in Korea, Michigan in the U.S., Nanjing in China, and Wrocław in Poland, but now the number has increased to 14. The order backlog, which was around KRW 150 trillion in 2020, has grown to KRW 500 trillion as of the end of October. Although the order backlog was about KRW 440 trillion by the end of June, it increased by KRW 60 trillion in early October due to contracts with companies such as Toyota in Japan.

This year, capital expenditures (CAPEX) are expected to exceed KRW 10 trillion. LG Energy Solution invested KRW 4.2 trillion in facilities in the first half alone, a 55% increase compared to the same period last year. The number of employees increased from about 22,000 in 2020 (7,000 domestic and 15,000 overseas) to 34,177. Of these, 10,442 (30.5%) are domestic employees, and 23,735 (69.4%) are overseas employees.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)